Insight Focus

- Global honey market is unregulated, with no real definition of the product.

- Low priced, sub-standard honey is being imported into the US

- US bee keepers hit by climate change, low-cost imports.

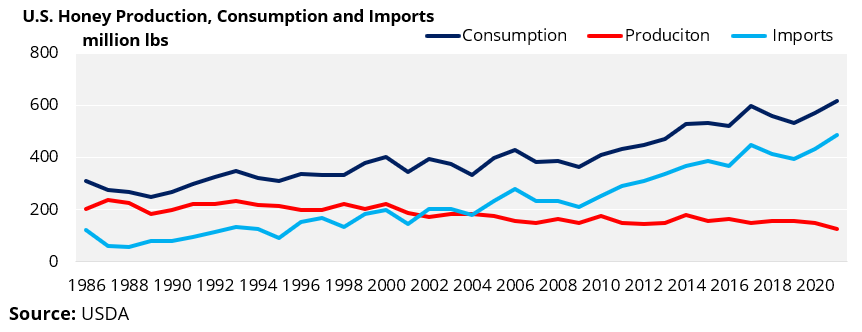

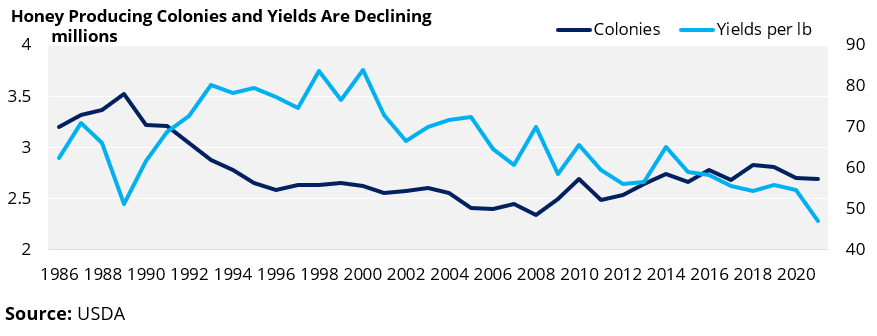

Most honey imports into the US are to meet the gap caused by falling domestic production. US production has fallen because producers have struggled to keep their bees alive due to extreme heat and had to compete with lower-priced imports.

Asian honey exports have more than doubled over the last decade but the number of hives has increased by only 6%. This had led to the suspicion of widespread honey fraud which means that the “honey” is diluted with syrups. This product is cheaper than 100% raw honey.

US Imports Hit Record High in 2021

In 2021, imports hit a record high. Industrial use accounts for half the of the honey consumed in the US, while households account for the other half. Most of the imported honey is used by industrial consumers.

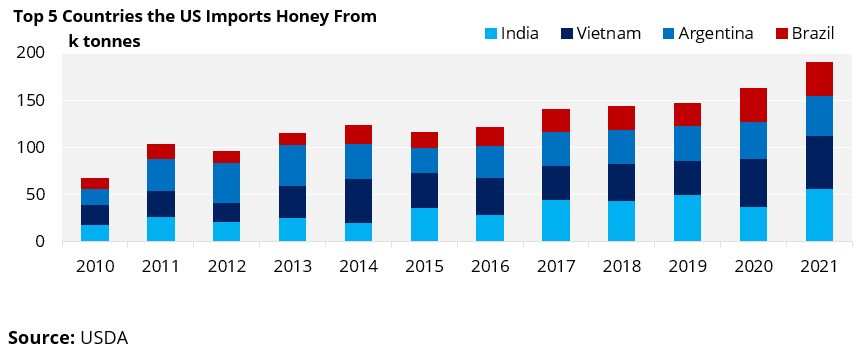

India, Vietnam, Argentina and Brazil account for 86% of US honey imports. However, the US has been finding that the honey that is being imported is not 100% honey and has other ingredients added to it.

What is ‘fake honey’?

One of the major problems in the honey industry is that there are no rules on the definition and quality of honey, meaning that there is no control on the ingredients used to produce it. The Food and Drug Administration defines honey as “a thick, sweet, syrupy substance that bees make as food from the nectar of flowers and store in honeycombs.” In the US specifically, honey is filtred and purified first meaning that the FDA accepts a degree of processing but there is no clarification on whether honey can include added sweetners instead of being 100% raw honey. Neither the US Department of Agriculture nor the FDA have inspection rights for honey and enforcement is only allowed when there is a specific complaint or food safety problem.

Where is this fake honey coming from?

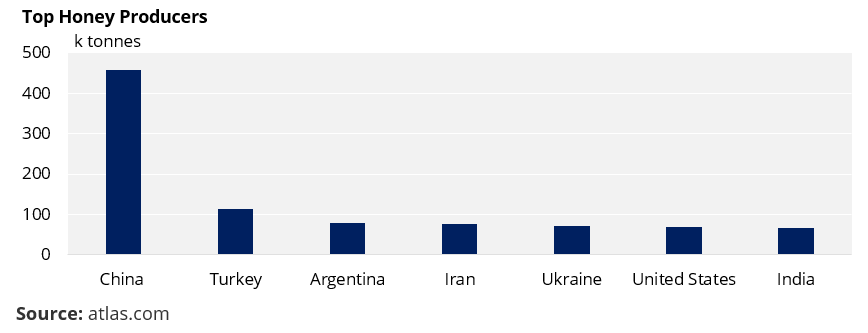

The world’s largest honey producer is China on around 460k tonnes a year. Production ins China has beeen rising year on year but the number of hives has barely grown. Between 2007 and 2019 Asian honey exports more than doubled, but the number of hives increased a mere 6%, fuelling suspicion of widespread honey fraud. Cheap honey from Asia (mainly China) has flooded the global market, undercutting beekeepers in the US.

How are the beekepers affected by cheap honey imports?

Since this honey is not regulated, producers are able to mix in syrups to cut production costs. Testing in recent years has shown many Asian honey imports are ‘cut’ with cheaper sugar syrups. This allows them to export honey at cheaper prices. The lower-priced imports from China are pushing down domestic honey prices, whihc is putting local beekeepers out of business, and causing a further drop in production.

The result of all this is that US beekeepers now make most of their revenue by renting out their bees for almond pollination, not from making honey.

How does ‘fake honey’ affect importers?

Most of the potentially adulterated honey is coming from China and passed off as Vietnamese or Thai honey, a practice known as “honey laundering”. As a result, the US is hestitant to import honey from Asia, which hits bee keepers in Vietnam and Thailand. The US government is trying to intervene and support domestic bee keepers by keeping ‘fake” honey out. The US International Trade Comission slapped Antidumping Duty Orders on imports of from Argentina, Brazil, India, and Vietnam in 2021. This order allows the US to monitor the quality of the honey to make sure they are not importing “fake honey”. The anti-dumping order is therefore not only portecting US beekeepers’ livelihoods but also acting as a kind of certification that the imported honey is “genuine”.

Other Insights That May Be of Interest…

Seeking More Than ‘Plain’ Vanilla

Molasses Struggles Against More Competitive Alternatives

Explainers That May Be of Interest…