Insight Focus

- PTA and MEG futures stabilised last week after sharp falls.

- Weak polyester demand keeps PTA and MEG markets in oversupply.

- PET resin export margins remain high on lower raw-material costs and tight supply.

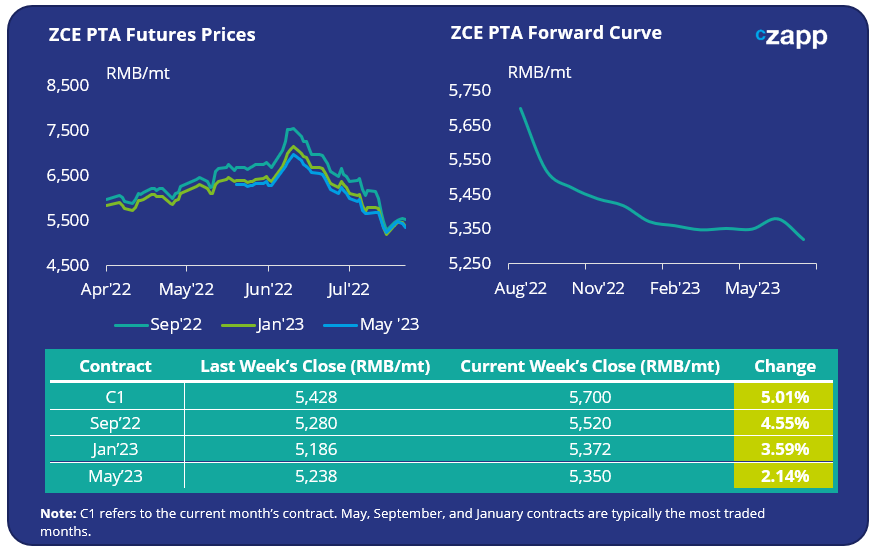

PTA Futures and Forward Curve

- PTA Futures were lifted last week as crude prices staged a modest rebound. However, slowing gasoline demand and fears of a global recession mean forward prices continue to face downward pressure.

- A recent reduction in PTA production has gradually widened PX-PTA spreads.

- Polyester and downstream demand has been reduced in recent weeks due to the extreme summer heat, keeping the PTA market in oversupply.

- The PTA forward curve remains in steep backwardation through Q3, before stabilising in early 2023.

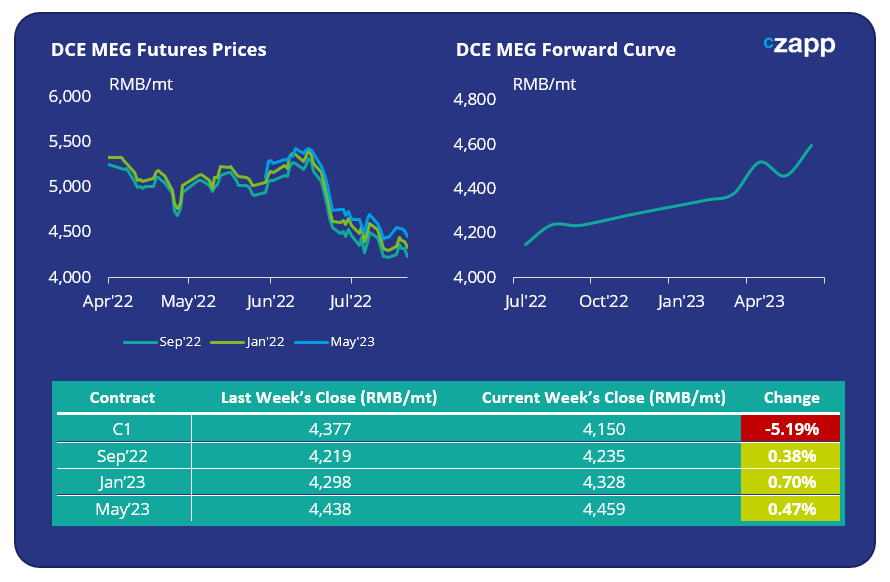

MEG Futures and Forward Curve

- MEG futures stabilised last week after some sharp drops.

- Demand from downstream polyester plants, which continue to run at low operating rates, has been weakened further by recent power curbs.

- Whilst port inventories fell slightly, their high level and slow off-peak demand from the textile industry continue to provide resistance. Any easing of oversupply is unlikely before September.

- Future MEG contracts continue to trade at a premium to current prices.

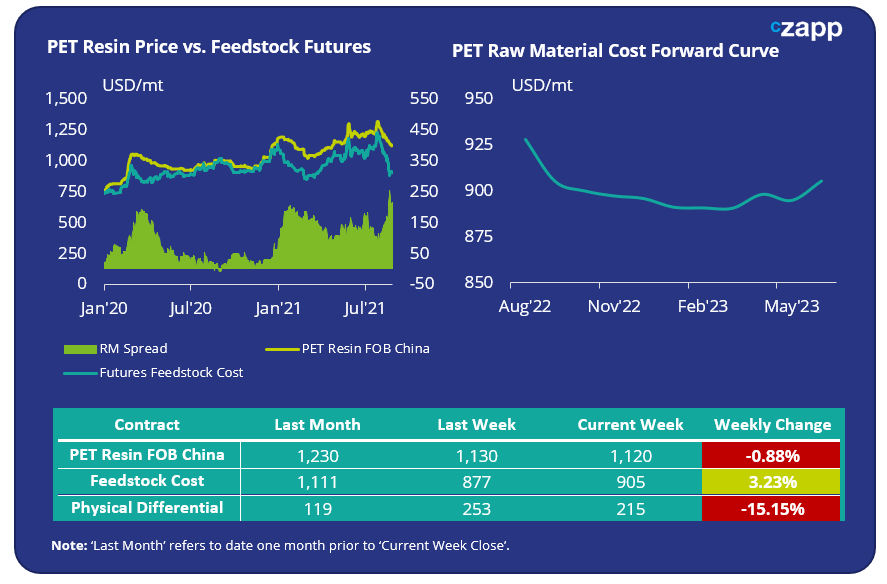

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices dropped to around USD 1120/tonne by last Friday, an average weekly fall of USD 10.

- Producer margins continued to be supported by short supply and the recent sharp decline in raw materials.

- The weekly average PET resin – raw material physical differential widening slightly to USD 215/tonne, up USD 7 from the previous week’s average. By Friday, the daily spread had risen to USD 215/tonne.

- The PET resin raw material forward curve remains slightly backwardated over the next couple of months, before flattening out through Q4 and into 2023.

Concluding Thoughts

- Having hit fresh highs, PET resin export margins moderated last week, playing catch-up with the recent sharp fall in raw-material prices.

- Despite the decrease in the physical differential to raw material futures, margins remained high, supported by strong domestic restocking and added interest in Chinese exports.

- PET resin supply is expected to remain tight through to September, supportive of current spreads.

- Beyond September and into the traditional off-season, PET resin export prices are expected to fall slightly through Q3 due to seasonality and backwardation in raw materials.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

Plastics and Sustainability Trends in July 2022

European PET Market Stumbles as Producers Left Blind on Costs

PET Resin Trade Flows: China’s PET Exports Surge as Logistics Ease Post-COVID