Insight Focus

- Soybean meal demand is absorbing the increase in supply.

- High margins are keeping less efficient soybean processing plants from halting for upgrades.

- Rail logistics are hampered by a shortage of train drivers.

Last week featured the release of two regularly issued, monthly statistical reports detailing US soybean crush rates and US and world soybean meal supply and demand and those releases occurred at the same time as a nearby soybean meal future expired.

The combination of the price action of the futures at expiration as well as a review of the monthly statistics got me thinking about the current state of the US soybean industry and the future of the industry with a focus on soybean meal, the historic revenue and margin driver for the soybean processor. Here are my thoughts.

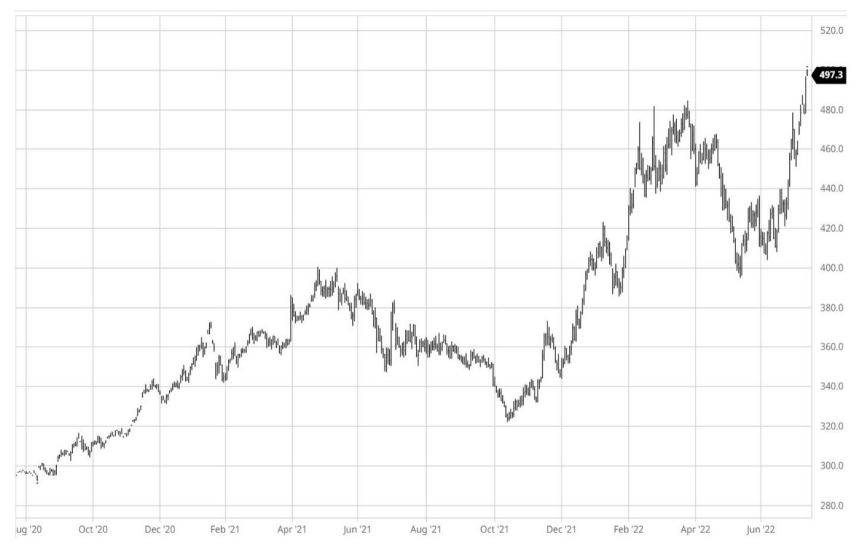

The below chart details the end of the life of the July 2022 soybean meal contract as it slowly morphed from a futures contract into a physical contract, expiring into its purest form, priced at parity with its other self, the physical price of spot soybean meal (economists call this convergence). RIP SMN22, your days of being run over with algorithmic order flow, crushed and reversed crushed, and spread into the future are over.

Sharp Rally in Futures near Expiry

Even the casual observer who does not spend all day looking at price charts as we futures traders do can see that the price series is achieving (rapidly) its highest level at the end of the futures contract’s life. That sharp rally into expiration suggests the futures price was likely discounted to the physical price which can happen frequently along the forward futures curve, but not at expiration when convergence occurs. Why is that?

If the futures price is at a premium to the physical market price, then soy processors sell the futures and deliver meal (shipping certificates for the pros reading this) against the futures; if the futures price is discounted relative to the physical price, then feed compounders buy the futures and hold on to the futures into delivery sourcing their physical needs via the futures market. These are two significant groups, the soy processor, and the feed compounder, and they (think Cargill and Tyson Foods for example) have lots of cash to police the futures expiration and force convergence to occur.

Why was this sharp rally of July soybean meal into expiration significant? (Spoiler alert: the August soybean meal contract, just beginning its morphing phase from future to physical, is behaving in the same manner as the July did; the September contract is showing signs of doing the same).

Soybean Meal Diverging from Commodity Complex

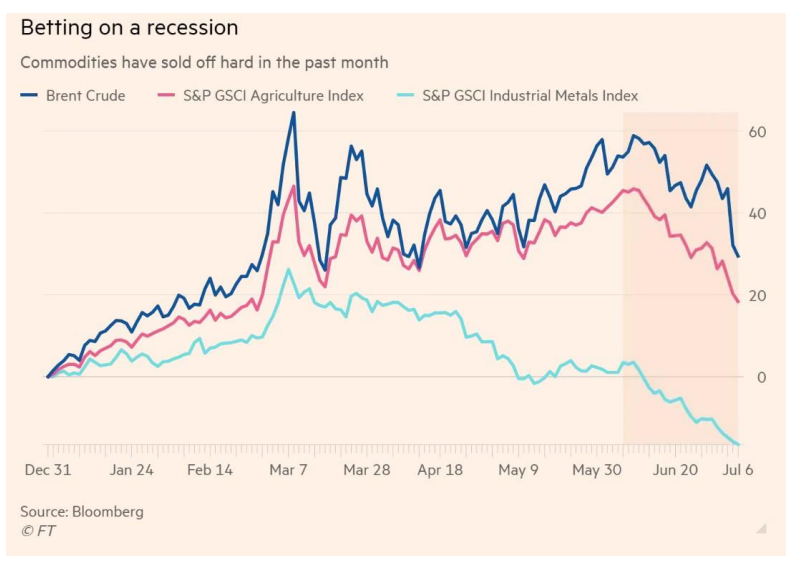

It is significant because the universe of other agricultural futures contracts as well as petroleum futures contracts and industrial metals contracts was headed in a completely different price direction during July soybean meal’s expiration. Massive selling of futures contracts (lots of “investors” leaving the “hot inflation is our future” party all at once shepherded out by the US Federal Reserve) caused the mispricing of soybean meal futures relative to their true intrinsic value, the cash value of physical meal. We traders call this phenomenon “order flow”, i.e., all the orders to buy, or in this case sell, come all at once and create significant volatility.

Consider the below chart, courtesy of the Financial Times, which displays the “order flow” (bloodletting) in commodity world with the red line, the agricultural sub-index of the widely observed Goldman Sachs Commodity Index, moving 23% lower along with the Brent crude oil futures, the blue line, moving 30% lower and the industrial metals sub-index, the neon greenish line, moving 20% lower. While commodity futures markets remained under massive selling pressure during this timeframe (driven by bets of recession according to the FT’s chart title) July soybean meal prices started moving higher and achieved the highest level of the contract’s price right amidst all this selling. Huh.

That was quite the divergence then for July soybean meal to be INCREASING in price while the greater commodity world, and ESPECIALLY all the other agricultural contracts (wheat, corn, soybeans, etc.) as represented by the GSCI agricultural sub-index, were moving lower.

Why the divergence and where is all the price strength for soybean meal coming from?

For the answer to that let’s look at the two interesting statistical reports from last week, the NOPA and the WASDE.

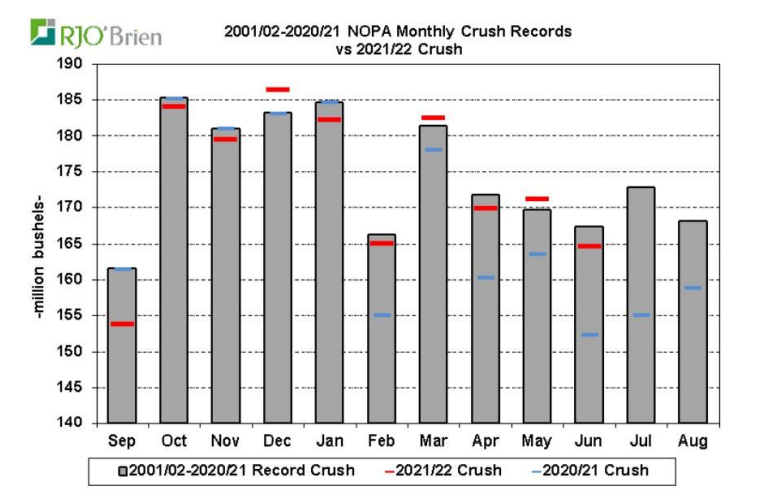

High Margins Spur Capacity Use

The National Oilseeds Processing Association (NOPA), the industry trade and policy group for the US soybean processing industry, reports the operating level of the US soybean industry each month. Last week’s July report provided information for the month of June which suggested the industry was hard at work responding to the key economic signal, the soybean crush margin, (which during June hovered around $3.25 per 60-pound bushel before operating costs so the gross margin) and running as fast and as hard as it can. Remember that phrase, as fast and as hard as it CAN.

The below chart, courtesy of the world’s best commercial agricultural futures brokers, brothers Jimmy and Eddie Connor at brokerage RJ O’Brien, displays the diligent efforts of the US soybean industry to earn those excellent margins throughout the current marketing year (September-August) when margins were, at time, even higher than June’s $3.25 per bushel.

As the chart displays, the industry operated significantly above year ago rates but failed to achieve a new record for June as it did in May, March, and December of this crop marketing year. The industry ran close to a new record rate but it should be achieving new records every month given the very compelling current and prior months’ margin structures, but it doesn’t. It is operating as hard as it CAN, not as hard as it WANTS or SHOULD.

What are the limits on US production?

- There are many older soybean processing plants in the US fleet that have maintenance and old age issues; in a different margin environment management likely would have stopped operating for a 12–18-month period for a major upgrade before returning the plant to service but not in this one; in this environment the older plants run, hard. Are they high-cost plants to operate? Yes. Does that matter? No. Margins remain profitable even for the highest cost plants. And that economic message has been occurring for the last five years: run all the high-cost plants, hard.

- Railroads continue to underperform across the country constraining certain plants from operating at peak due equipment shortages, limiting soybean supply, or clogging local rail yards with meal and oil cars loaded and ready for shipment but looking for a locomotive, and more importantly, the labour to operate that locomotive. My daily conversations with commercial friends and peers in the US agricultural processing industries (wheat, corn, and soybean) start and end with rants about railroad performance (lack of) with real frustration that railroads currently are not providing outlooks for future improvements in executions.

- Replacement equipment for operating plants is in many cases in short supply due supply chain disruption and availability of key operating items has become extremely tight, leading to operating issues. More than one soybean processing operator has told me equipment sheds with replacement parts are getting quite empty, something to keep an eye on.

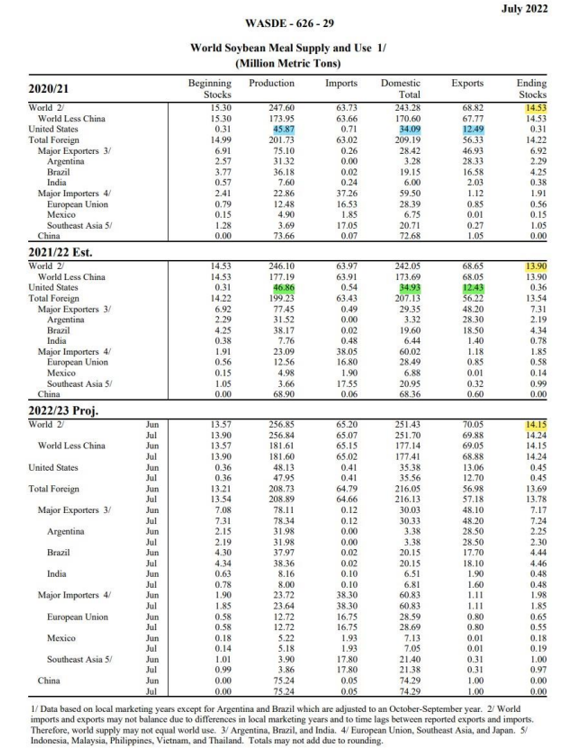

The USDA’s world supply and demand balance for soybean meal appears at the end of this analysis.

Consumption holding up despite high prices

So, margins are great but processing capacity is constrained and high soybean meal prices, as shown in the July soybean meal expiration, are not discouraging consumption, right? Yes, according to the USDA’s World Agricultural Supply and Demand report (WASDE) issued last week, demand for US soybean meal is higher year on year so higher prices (just recently moderating courtesy of the US Federal Reserve) are not discouraging demand. Yes, production is higher by 990k tonnes, but domestic demand is higher by 840k tonnes and exports slightly lower by 60k tonnes, so supply and demand changes are nearly a match; demand increased with supply.

That is both the story today and into the future. Demand for US soybean meal is increasing with supply increases and the available meal supply remains tight, Surpluses do not develop even with record crush rates and the supply and demand balance does not tip to more supply than demand. When will it tip? Not any time soon. Crushing margins remain excellent well out on the forward curve.

Output from new capacity likely to be absorbed

What about all the new capacity coming online in the future, will that tip the balance toward more supply, even oversupply? There is an old saying in the animal feeding business, “You can’t feed chickens with futures contracts”! In other words, having price protection via futures contracts is useful to mitigate the risk of changes in the price of feed but an animal feeder still needs to feed physical feed, not futures. And the physical feed, soybean meal being one of the major components, is tight. I will spin this old saying to answer the question about all the future soybean processing capacity forecasted to come online in 2024 and 2025: “You can’t feed chickens today with future capacity coming online tomorrow.”

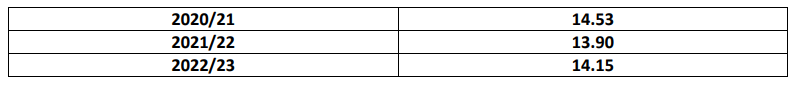

One last detail from the WASDE: look at USDA’s WORLD soybean meal ending stocks projections for the last two years and the upcoming new marketing year (again in millions of tonnes):

Not much variation in these numbers even with a significant increase in world production over the last three years. Why? Demand increases with supply, that is the history of the protein meal supply and demand balances and it will continue as a truism into the future.

So, what do I think about all the supply of US soybean meal forecast to come online in 2024 and 2025? It will be absorbed by the same amount of demand increase. Will soybean meal supply remain tight until that new capacity comes into production? Yes, it will be the feature in physical markets for the foreseeable future, the crush margin forward curve tells me that, and likely well after the capacity increases. Lucrative soy processing margins will reflect that tightness for the foreseeable future.

For further information, please email waltercronin@msn.com.

Other Insights That May Be of Interest…

Does Brazil Have Soybeans To Export in Q4?

Rising Meat Prices Will Gnaw Away Demand

Explainers That May Be of Interest…