Opinion Focus

- Meat has been viewed as a luxury, and in a recession, consumers switch to cheaper types.

- But those cheaper meats are also likely to be subject to inflationary pressures.

- This should lead to flat meat demand until a global economic recovery.

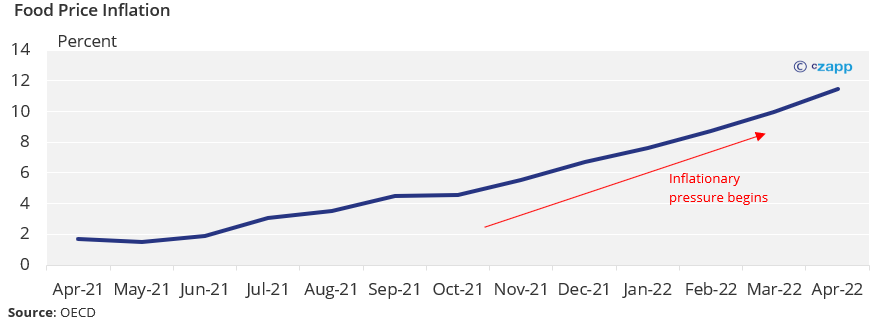

Global food prices are rising fast, and meat is no exception. Given the rising cost of inputs such as feed and energy, meat is becoming more expensive. Certain measures such as protectionism and disease are adding to the pressure. This situation will change meat consumption trends, with some swapping to cheaper types of meat or even avoiding it altogether. This could cause long-term meat demand destruction.

Summer Beef Prices Weaken

During the summer months in the western hemisphere, from May to August, there is typically higher meat demand due to an increase in barbecuing.

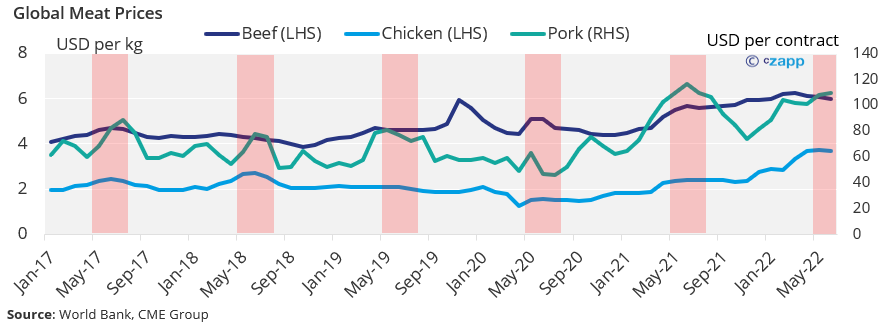

However, this summer, global demand for beef seems to have dropped off. After a price peak of USD 6.24 a kilogramme in March, there has been a flatlining in red meat demand, even during the summer months.

This is very likely a result of the higher cost of living. Red meat is often seen as a luxury, and when budgets are stretched, people tend to opt for cheaper sorts or avoid meat entirely.

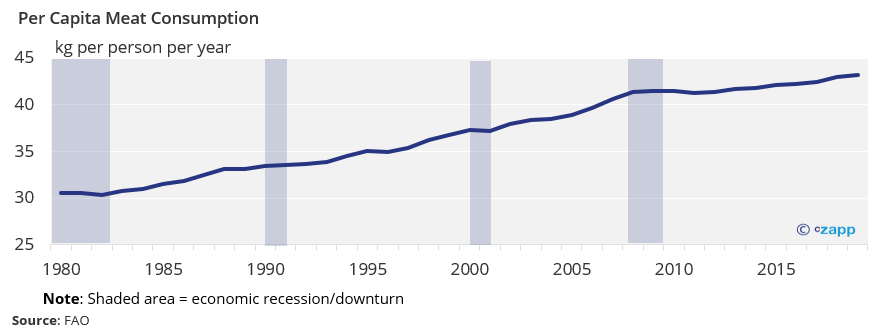

Still, meat consumption is at an all-time high globally, both on an absolute and per-capita basis. It seems that beef is being largely replaced by pork and poultry as the cost-of-living crunch takes effect. There also tends to be lower consumption in general during economic downturns.

The Pork Problem

But as consumers turn to typically cheaper meats such as pork and poultry, this increased demand in turn seems to be pushing up prices.

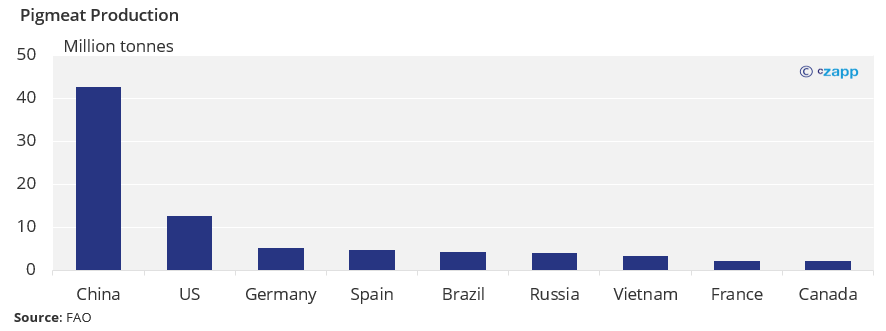

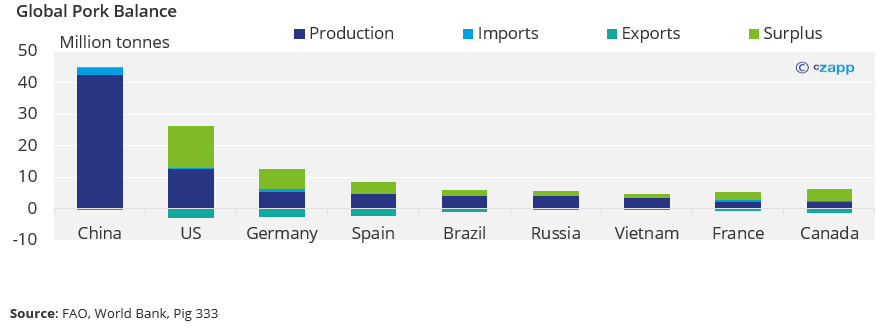

Pork is typically in oversupply, which seems to remain the case in some countries, including Germany.

Germany is consistently one of the top three pig meat producers, alongside the US and leader China.

In Germany, discount retailer Aldi has recently lowered its pork prices, which is unusual during the high demand summer months. This move is expected to provide some consumer relief as other retailers follow suit.

But pressure on Chinese pork supplies may begin pushing up the price again. The lean hog futures front month contract has risen to USD1.12 a pound.

This is only the fourth time in the past 25 years that prices have broken above USD 1.10/lb.

China is one of the only producing countries with no major pork surplus. This is primarily due to disease after African swine fever killed millions of pigs in its herd.

If supply tightens further in China, it could become a major importer, which would lead to lower supply elsewhere. It already imports about 2.2 million tonnes a year, according to FAO data.

Poultry Supply Could Suffer

Price conscious consumers have also turned to poultry as a substitute for red meat as costs rise. But there could be some headwinds for poultry prices that should be considered.

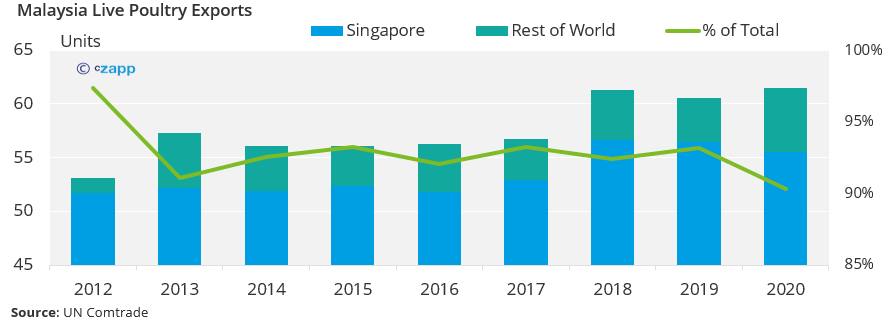

Last month, Malaysia imposed an export ban on chicken, which came as a blow to Singapore. Due to Singapore’s small land mass, it is largely dependent on imports to feed the population. It accounts for about 98% of Malaysia’s live poultry shipments.

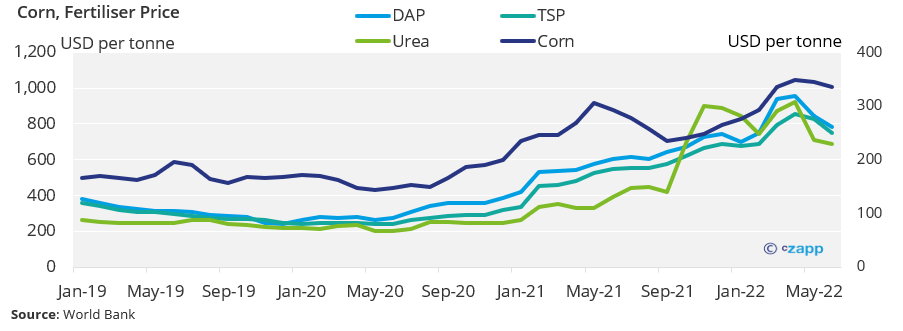

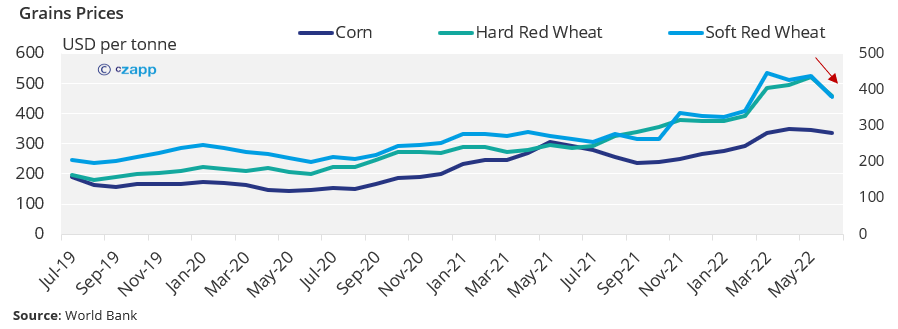

More and more, protectionism is threatening the global food supply chain. Another issue that could push prices up are high feed costs. The price of corn – the primary feed for chickens – has more than doubled in the past two years. Fertiliser prices have also more than doubled or trebled over the same period.

Bird flu is also reducing chicken availability. US turkey processor Hormel Foods warned of “large supply gaps” for its products in the third quarter as the worst-ever avian influenza sweeps across the US Midwest.

There is the risk that all these factors could push up the price of poultry at a time when it is the most economical option for consumers.

Supply Push Could Create Balance

But despite the threat of lower demand, there seems to be no decrease in meat production. According to the FAO’s latest Agricultural Outlook, world meat production is expected to rise to 377 million tonnes in – from 339 million tonnes in 2021. This is driven mainly by pork and poultry, with increases in beef production lagging.

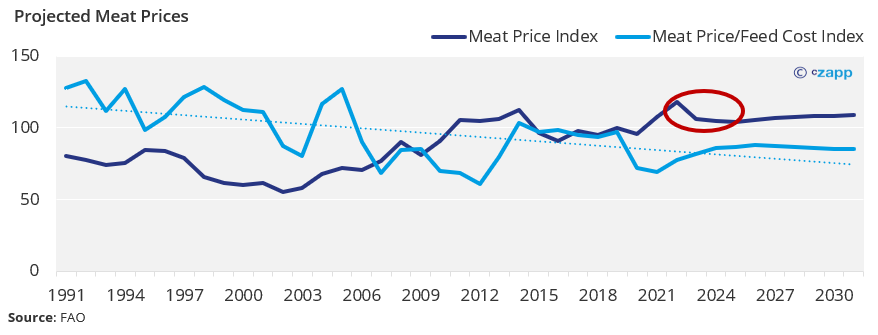

In the long term though, meat prices are expected to decline in real terms, which could drive some production drops, especially with lower productivity. Pork is expected to remain in oversupply, putting downward pressure on prices. Meanwhile, as grains prices begin to drop on prospects of higher Ukrainian supply, poultry prices are likely to track them closely.

Beef prices, on the other hand, are expected to continue reflecting high energy, labour and processing costs.

Production increases should theoretically create a price correction in time. The FAO does expect a dip in prices between now and 2025, but the question will be whether or not this will be significant enough to stave off demand destruction.

Over the longer term to 2031, meat prices are expected to remain strong.

Concluding Thoughts

- In times of economic hardship, consumers tend to switch to cheaper types of meat.

- This means consumption of pork and poultry rather than beef.

- We can already see some drop in beef demand.

- However, market events could drive up the price of these cheaper meats, making them unaffordable for many households.

- If the market does not correct quickly, there could be a widescale drop in meat consumption.

- Just like in most recessionary events in history, meat consumption will probably stagnate.

- But per-capita meat consumption has continued to rise until 2019.

- Meat has not fallen out of favour, but the pressure on purse strings is likely to win out.

Other Insights that may be of interest…

Inflation to Take Bite Out of Alternative Meat Demand

What the Energy Crisis Means for Inflation & Commodities

Explainers that may be of interest…

Czapp Explains: Why We Should Care About Corn

Interactive Data Reports that may be of interest …

Consecana Panel

CS Brazil Weather Update