Insight Focus

- Final June PX contract price still unsettled, leaving producers blind on production costs.

- Producers struggling to pass on costs as European buyers nervous, resistant to higher spot prices.

- Current heatwave may not translate into any meaningful uptick in spot resin sales.

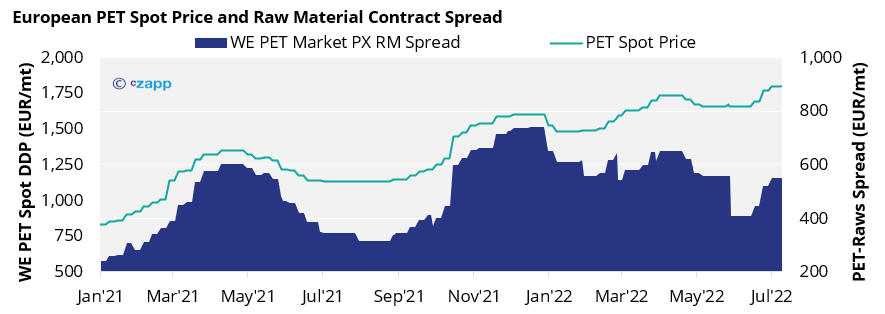

European PET resin prices have leapt to multi-year highs over the last fortnight, driven by rising feedstock and production costs.

But with no final settlement still for June’s PX European Contract Price (ECP) settlement, even at the current highs, producers have been left guessing as to their true production costs.

Whilst some producers experienced initial panic buying as buyers realised the move in feedstock costs, spot demand is now faltering in the face of higher resin prices.

Producers are struggling to pass on any hypothetical movement in feedstock costs onto spot sales and have already moved to slash production rates as buyers move to stocks.

Buyers are increasingly reluctant to purchase at current prices, with only those in desperate need buying, and even then, only small orders to keep lines running.

Will Heatwave Precipitate Fresh Demand?

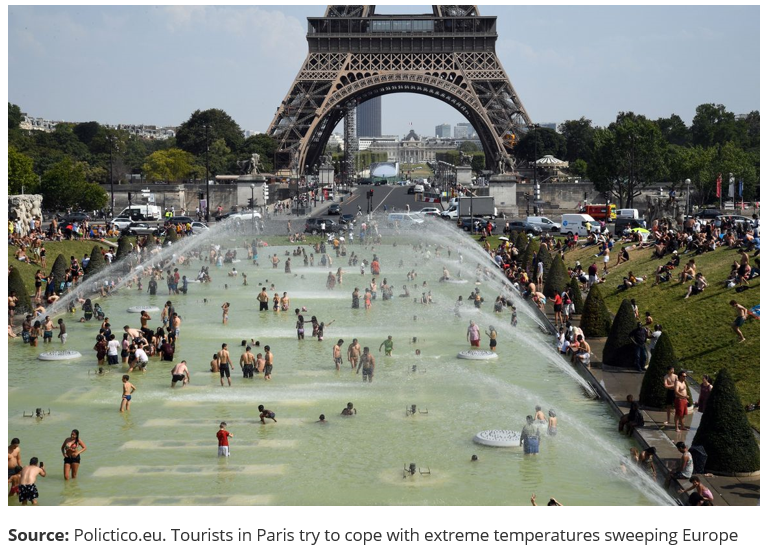

Whilst spot sales flounder, an unusually early and exceptionally intense heatwave is sweeping across Europe. June was the hottest month on record for the continent, with the average temperature of 2°C above normal.

There also seems to be no let-up in July, as temperatures in Germany and France look set to exceed 40°C; Spain could see maximum temperatures touching 46-47°C in parts.

The hotter weather and a resurgence in travel and tourism, particularly in Southern Europe, is expected to result in strong PET bottle consumption at the consumer level.

But with many converters seemingly with adequate coverage and stocks, any resulting increase in downstream demand may not necessarily translate into a significant uptick in spot resin sales.

Prices Heat Up as Producers Try to Avoid Meltdown

European spot prices for virgin resin typically ranged from EUR 1,760 to over EUR 1,830/tonne, averaging EUR 1,800/tonne mid-July; a EUR 140 increase from June.

Although spot prices have strengthened in the Italian market; cheap Turkish resin was capping prices in Greece and the Balkans, sources said.

Buyers in Northern European had little reprieve though with spot offers and monthly freely negotiated prices around EUR 1,800/tonne ex-works, or EUR 1,820-1,850/tonne delivered.

Despite the push towards higher prices, fewer deals were heard at the upper end of this range and offers from some producers now appear to be falling back as sales dip.

Having had a first settlement of EUR 1,490/tonne for June’s PX ECP, final June settlement remains elusive with negotiations continuing.

Expectations are for June and July to potentially settle together. A failed June settlement would be a first for the European PET industry and unknown territory.

Some producers are already having to make do with provisional pricing structures. However, producers have little clarity on actual cost positions and are experiencing demand losses because of this market breakdown.

Potential July PX Increase Could Further Erode Buyer Confidence

To compound issues, expectations are that the PX ECP is likely to increase in July.

Some producers are now anticipating a July settlement of over EUR 1,800/tonne, with an average of around EUR 1,650/tonne for June and July.

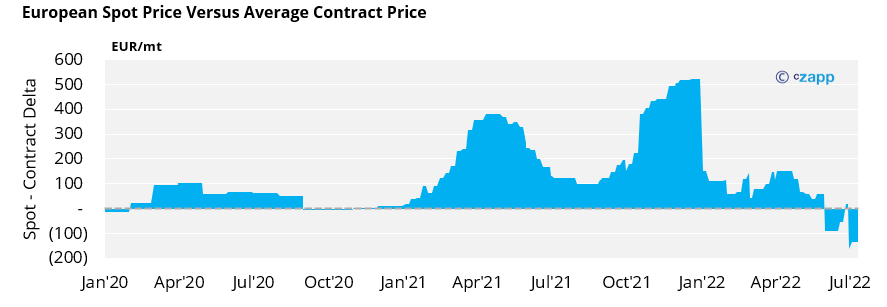

Further increases in the PX ECP could push raw-material-formula contract prices well above current spot values.

Based on anticipated PX levels for June and July above, average spot prices would be around EUR 133/tonne below potential contract prices.

Import Arbitrage Opens, USD Strength Limits Damage

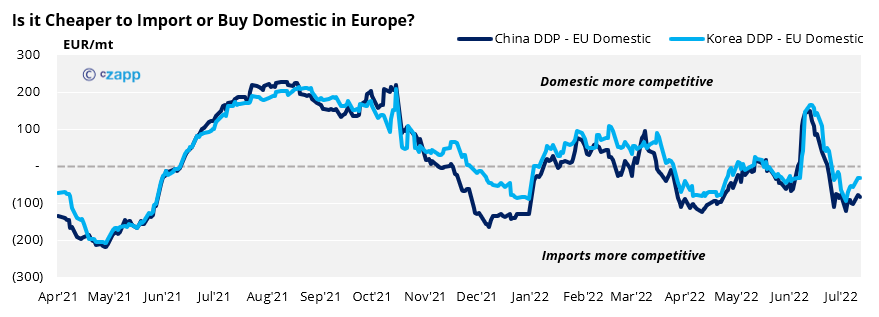

Whilst European PET prices have sky-rocketed, Asian export prices have been headed in the opposite direction, dragged down by falling crude and upstream costs.

On July 12, the China PET resin export price averaged around USD 1,155/tonne, down around USD 145 on the month.

As a result, the gap between containerised imports and domestic European PET resin on a delivered basis has widened to around USD 100/tonne, making imports increasingly competitive in Europe.

The dollar’s strength against the euro over the past fortnight has helped European producers by keeping the import parity delta from widening further.

However, any further increase in the July PX ECP, or even June final settlement, is expected to exacerbate the Europe–Asia pricing disconnect.

Market Outlook & Concluding Thoughts

- Although downstream consumer demand is expected to strengthen with the current heatwave, any meaningful rebound in spot sales looks to be beyond the current market.

- Beyond mid-August spot sales could hit a wall as demand evaporates at the close of the summer season.

- Current expectations are for European producers to move swiftly into maintenance in September, to constrain availability of PET resin to the market and attempt to weaken PX demand.

- With a worsening of the European energy crisis looming this winter, producers may face a squeeze between feedstock costs and runaway energy costs, prolonged shutdowns are not off the cards.

- Increased competitiveness of imports will present opportunity for pre-buys, particularly in Q4.

- However, imports will take time to arrive and until then both producers and buyers find themselves in the same boat.

Other Insights That May Be of Interest…

PET Resin Trade Flows: China’s PET Exports Surge as Logistics Ease Post-COVID

Asia PET Market View: Chinese Consumption Rebound Drives New PET Orders

Initial European PX Settlement Rocks PET Market

European PET Market View: Will Revenge Spending Boost European PET this Summer?

PET Raw Material Futures Outlook: PTA, PET Producers Struggle to Pass on Feedstock Price Rises