Insight Focus

- Since then, prices have reverted above 19c.

- This will put new short positions under pressure.

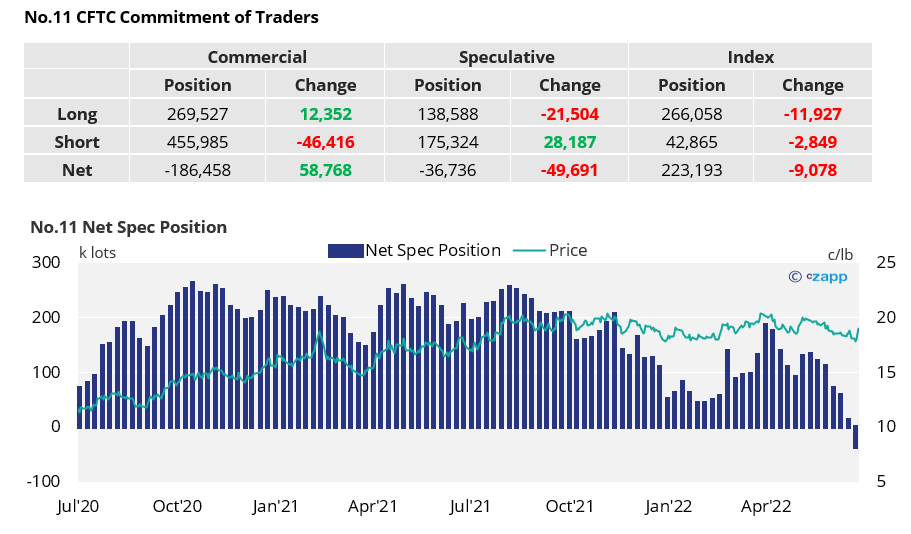

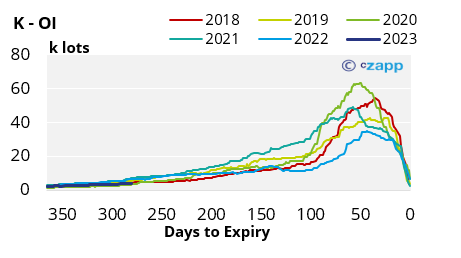

New York No.11 (Raw Sugar)

- No.11 prices quickly rallied above 19c/lb by last Friday, from lows of 17.7c/lb in the middle of the week.

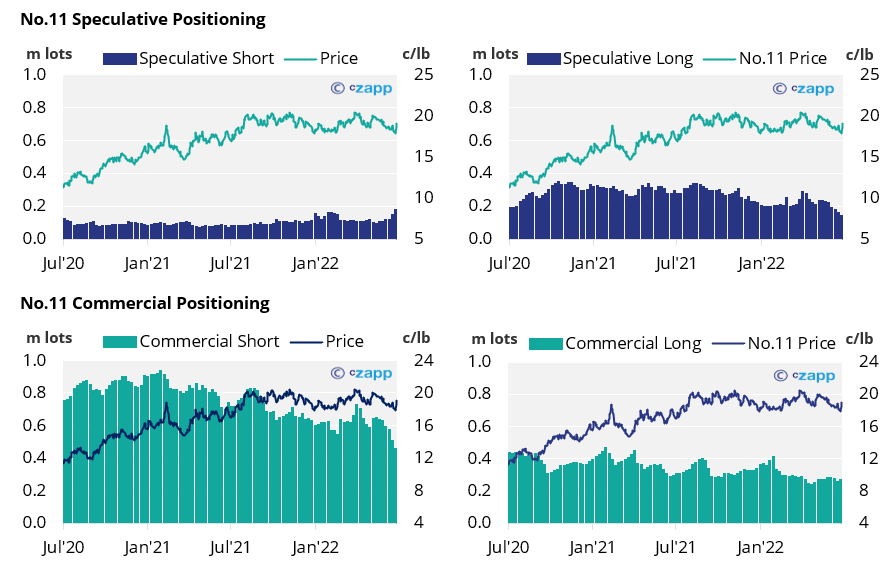

- The timing of this has been unfortunate for the 28k of fresh spec short positions opened by the 5th of July (latest CFTC COT report), which are now likely under pressure.

- The closure of 22k spec long positions as well means the net spec position has fallen negative for the first time since May 2020 when the market was below 10c/lb – though this could be short lived if prices sustain closer to 19c.

- Raw sugar consumers capitalised on prices dipping below 18c/lb as over 12k lots of hedges were added by the 5th of July – producers saw over 46k lots of short positions close out over the same period.

- This means consumers are becoming increasingly well hedged whilst producer cover is falling away.

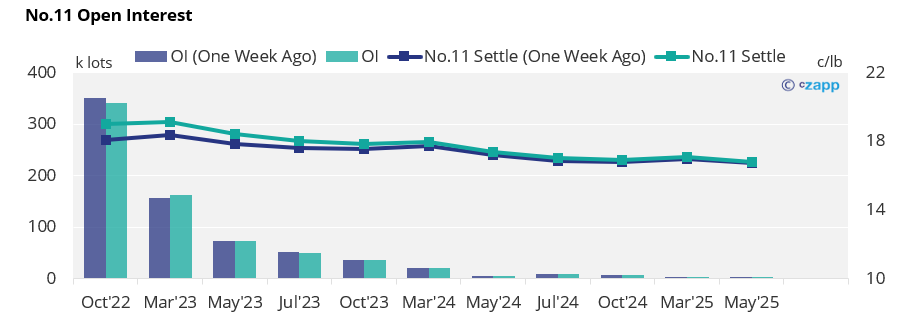

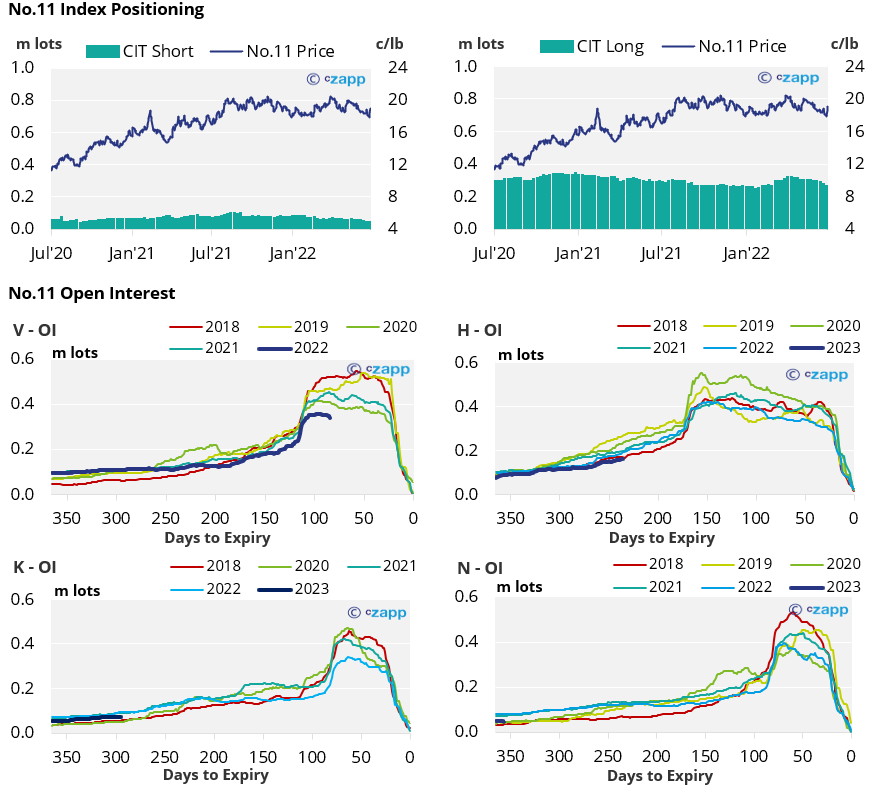

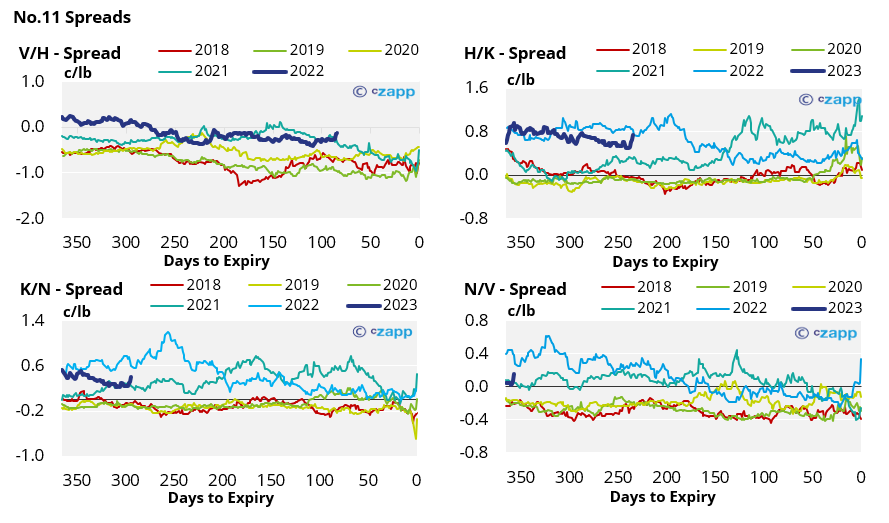

- With recent strength in the near-term contracts, the No.11 forward curve now looks more backwardated through 2023.

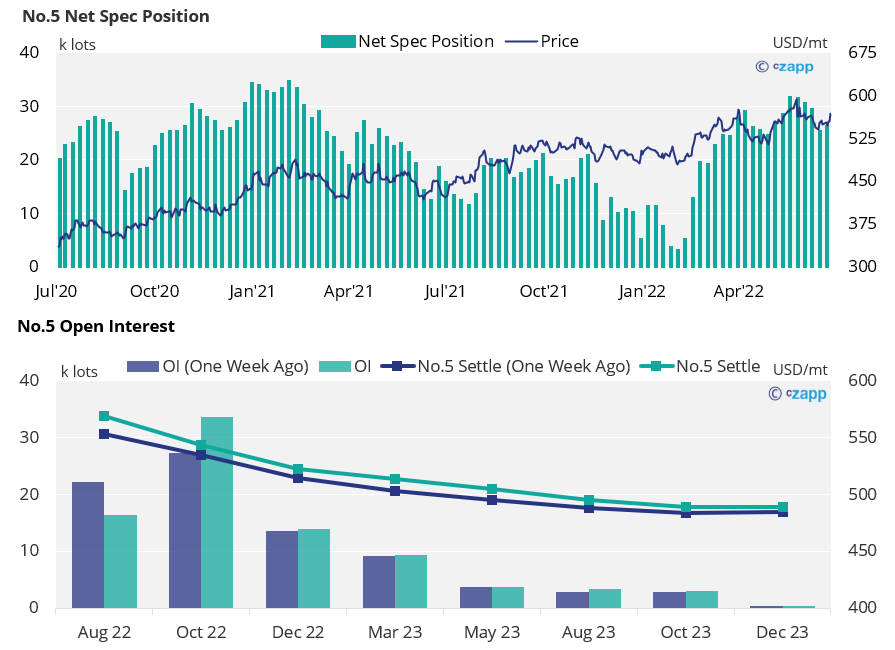

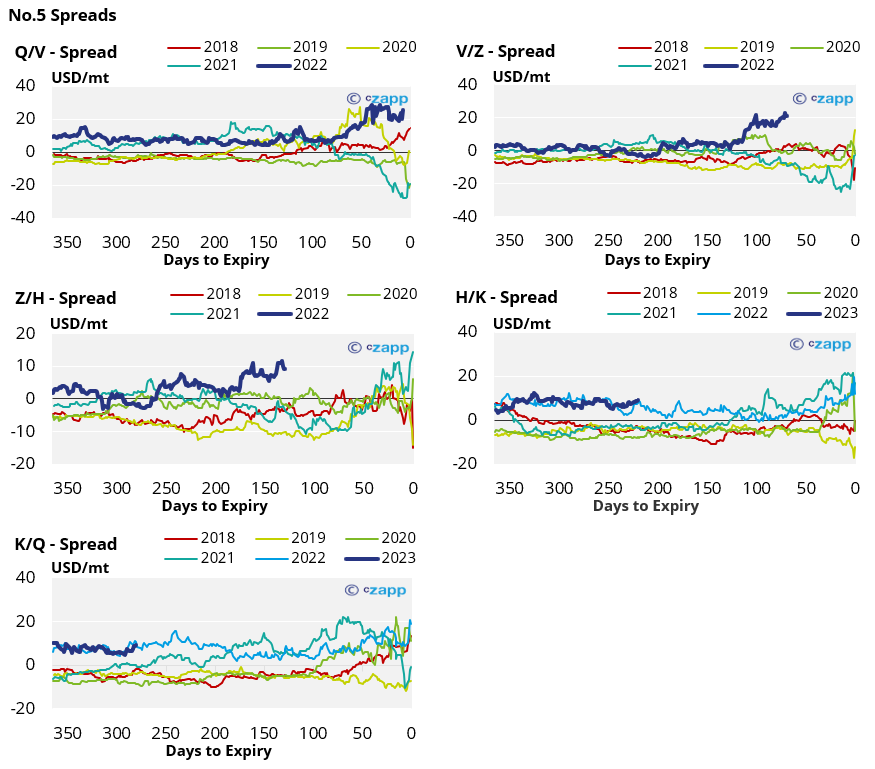

London No.5 (White Sugar)

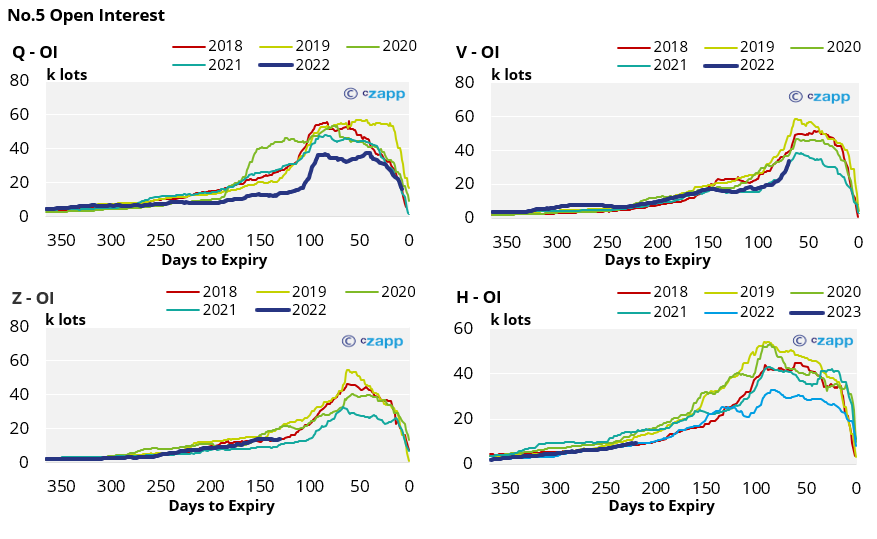

- In a similar move, No.5 white sugar prices have recently strengthened up to near 570USD/mt.

- Whilst this shift is yet to be reflected in the CFTC COT report, as of the 5th of June the net spec position increased by around 1k lots, reversing the downward trend through June.

- Upwards movement in the Aug’22 contract in particular means the white sugar forward curve is further backwardated across 2022 and 2023.

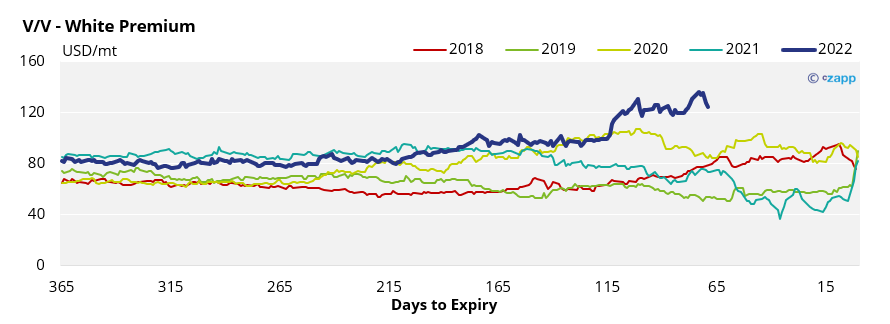

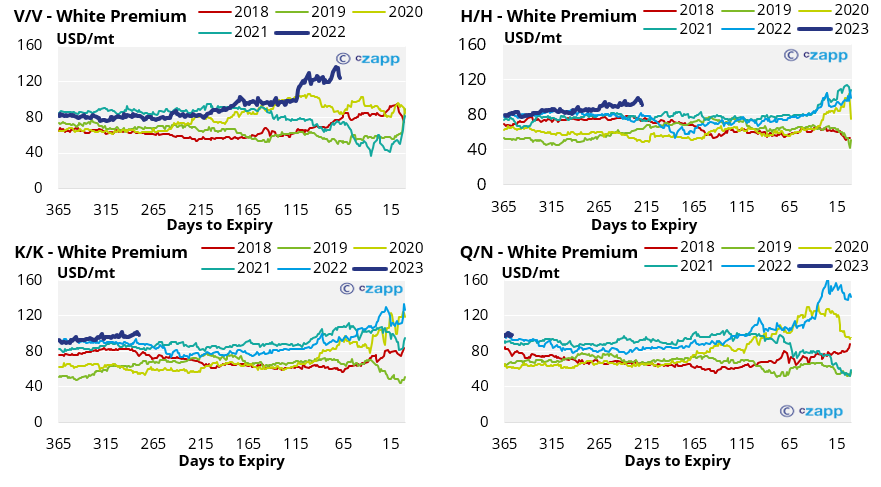

White Premium (Arbitrage)

- A strengthening No.11 has meant caused the V’22/V’22 white premium to narrow to 124USD/mt by the close of trading last week.

- At this level some re-export refiners could struggle to operate profitably which could reduce short term refined sugar supply if this level persists.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix

Other Insights That May Be of Interest…

Sugar Statshot: India Crop Drives Small Global Surplus in 2022/23

Ask the Analyst: How do CBIOs Factor into the Brazilian Ethanol Parity?