- Front-month soybean oil futures are lower year on year despite biodiesel demand.

- USDA sees global soybean oil production, ending stocks rising,

- Chinese soybean oil demand hit by COVID lockdowns

What is USD.0.6568, Friday’s closing price for a pound of soybean oil in the “spot” futures” (the July 2022 futures, now in delivery) at the Chicago Mercantile Exchange, minus USD 0.6682, the spot price for soybean oil at the Chicago Mercantile Exchange a year earlier? That would be minus 1.14 cents a pound. Said more plainly, spot soybean oil prices on the Chicago Mercantile Exchange, where the world discovers the price of agricultural commodities such as soybean oil, are lower than they were a year earlier.

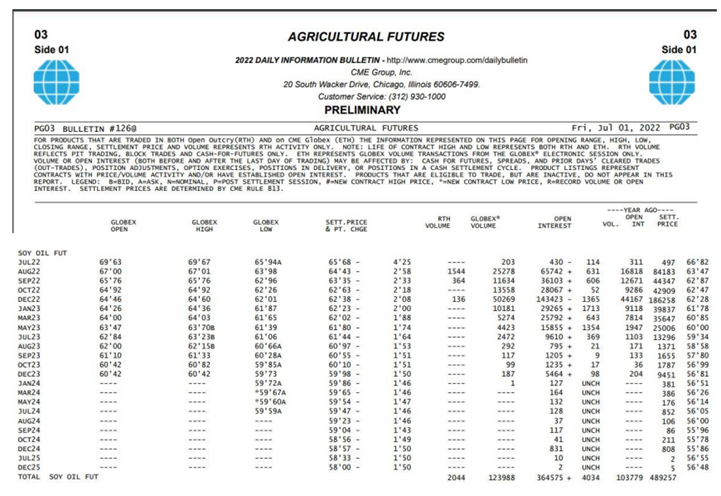

Lower prices than a year earlier even with higher consumption of soybean oil for renewable diesel? Yes. See the entire strip of Friday’s soybean oil futures settlement prices (and a year earlier) below:

You might also note that soybean oil prices for delivery this October and December were almost exactly where they were a year earlier. Total year-on-year price inflation for those contracts: ZERO. Maybe even going lower? Maybe, if the US Federal Reserve intends to collapse commodity prices, lower may happen.

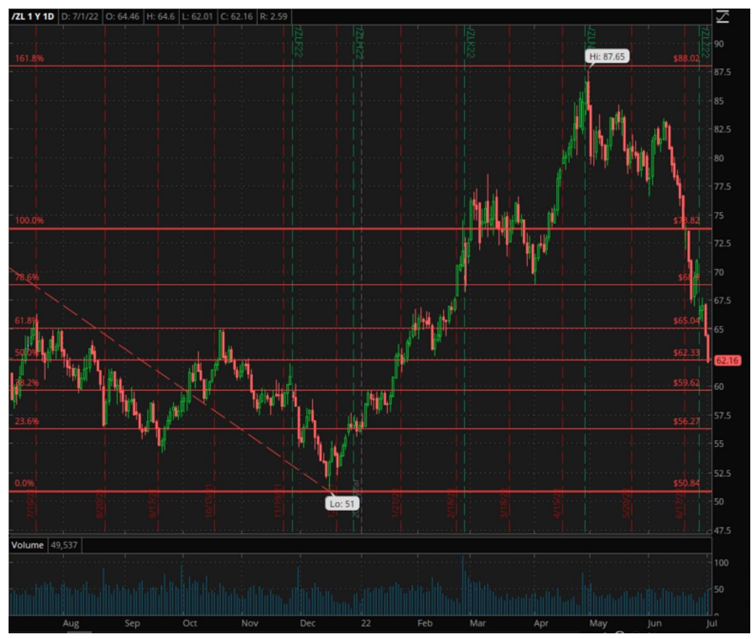

Soybean oil futures prices have continued to moderate since their peak in April and recently have dropped sharply (Fed interest rate hikes, a broad-based commodity sell-off, increasing supply and decreasing demand). The inverted, or backwardated futures curve has moderated significantly: the commonly observed, by agricultural traders that is, relationship between the July soybean oil and the December soybean oil spread is inverted by 3.30 cents this year compared with 4.54 last year. Below are the continuous price series soybean oil futures chart that displays both the recent strong rally from the December 2021 low price of USD 0.51 a pound to the April 2022 high of USD 0.8765 with prices recently falling sharply to USD 0.6216 for the Friday settlement of the December contract. (I can hear the rumblings from the professionals about the chartist rolling the price series from July to the December futures instead of the August futures but in either case prices are significantly off their April highs. I also must think that the professional traders reading this are aware that USD 0.6216 is the near perfect 50% retracement of the recent low to high rally, normally a key testing price point for the bulls and bears).

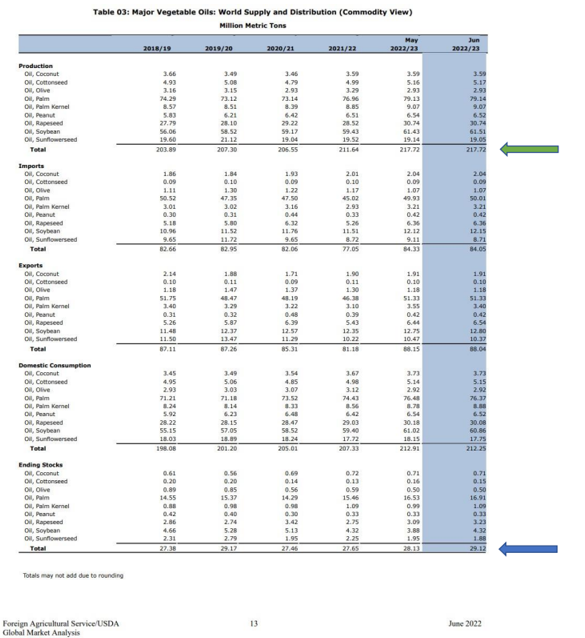

Why the cool down in vegetable oil prices even as US domestic demand for soybean oil continues to expand led by the renewable diesel industry? The global vegetable market currently anticipates production increases and larger ending stocks of all the key oils. The USDA’s June 2022 Oilseeds World Markets and Trade details the global, all vegetable oil production increases, 217.72 million tonnes compared with 211.64 million a year earlier, the green arrow, and the resulting larger ending stocks, 29.12 million tonnes compared with 27.65 million a year earlier, the blue arrow, a result of demand not keeping up with supply.

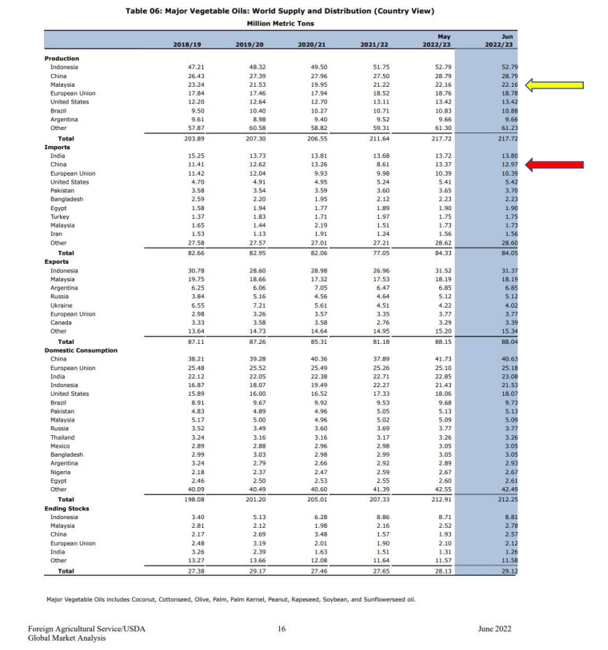

And who is leading the charge on supply increase? Except for Malaysia, yellow arrow, everyone!

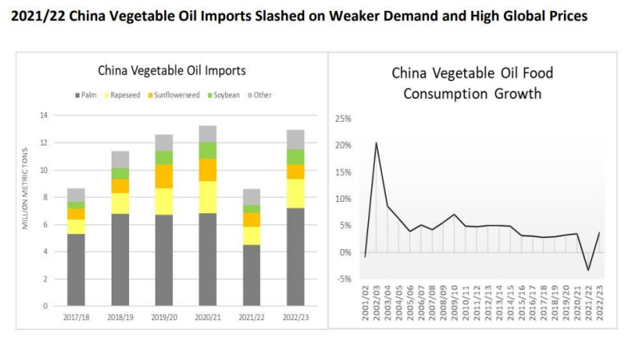

On the demand side, China, the red arrow, has slowed its economy with its aggressive COVID lockdowns that have led to a severe fall off in vegetable oil imports, 8.61 million tonnes for this year compared with 13.26 million a year earlier (but the USDA forecasts a sharp recovery next year to 12.97 million tonnes). We will see.

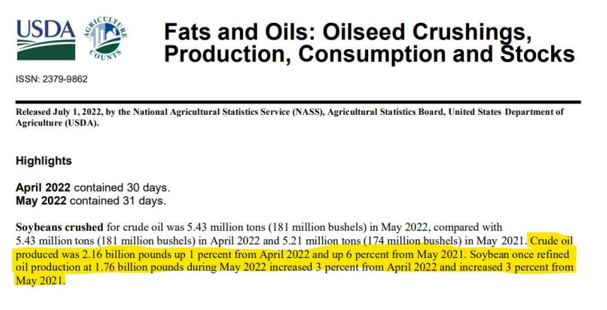

What about in the US? What is going on here?

Friday the USDA issued its most updated detail, for May 2022, on production and consumption and I have highlighted the detailed year-on-year increase in supply below (yellow highlights).

In summary the USDA forecasts more global supply of vegetable oils, more US soybean oil supply, and a global supply cushion (ending stocks) expanding, not declining. All this amid increased usage for US soybean oil for renewable diesel.

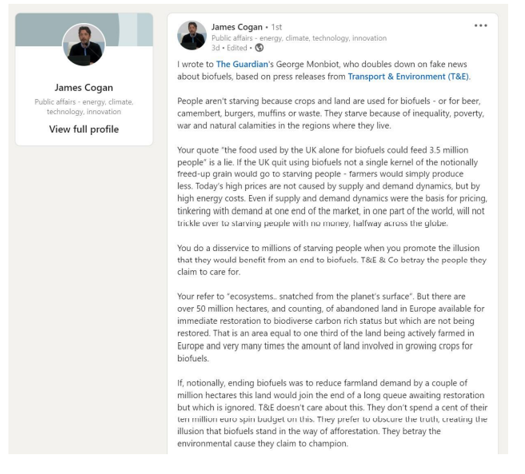

As I pointed out in my previous and most recent post on the food-to-fuel debate, the drum beats continue to sound for the end of biofuels initiatives, journalists continue to print end of the world scenarios (hats off to James Cogan who wrote an insightful response to an egregious and irresponsible biofuels-will-starve-the-world story featured in the Guardian), and all the while producers in the world respond to high prices by producing more renewable diesel feedstocks and consumers respond to high prices by consuming less.

As I said in my previous post, biofuel production cannot be switched off; that will not happen. The implications for global agricultural economies would be disastrous. Is there room for a serious consideration of some moderation of mandates in any given year when weather, global conflict, and price increases require it? Yes. How can that be accomplished? It will have to happen locally (California amending their LCFS for instance) and then nationally (the federal government amending ethanol or renewable diesel blends). Can these adjustments happen with real consideration for all the supply and demand factors of global biofuels production? I have my doubts.

For further information, please email waltercronin@msn.com.