Opinion Focus

- Food prices are rising, causing many to re-evaluate purchasing behaviours

- Several factors in 2021 already caused alternative protein sales to stagnate.

- With additional price pressure expected in 2022, the future looks bleak for alternative meat.

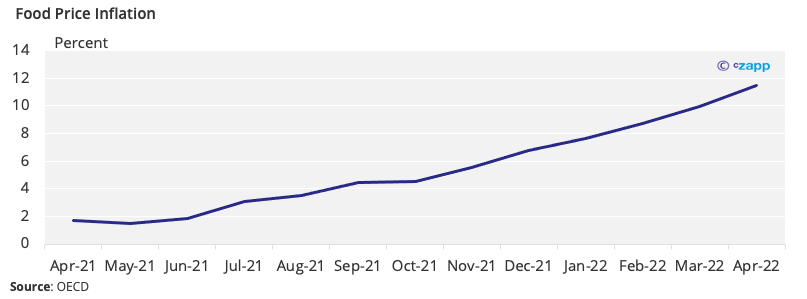

After a successful 2020, growth in the alternative meat segment has slowed in the past year. The reasons for this are diverse, from less footfall in supermarkets to a drop in investment. But one thing is certain: cost is playing a significant role. As the world emerges from pandemic lockdowns into an inflationary environment, costs are rising, and luxury products tend to be one of the first casualties. Alternative meat is no exception.

Growth in the Plant Based Market

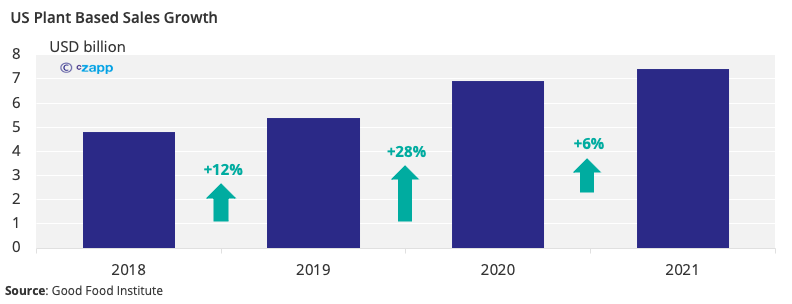

Since 2018, the plant-based market has continued to grow. After a 28% growth rate from 2019 to 2020, annual growth in the US slowed slightly to 6% in 2021.

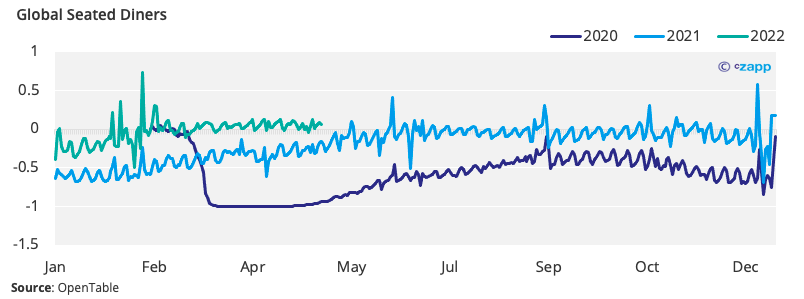

As the world reopened in 2021, people began eating in restaurants and cafes again, which could partially explain the dip in momentum for plant-based meat. Lower levels of at-home cooking during 2021 led to less choice between traditional and meat-free options. People also tend to view eating out as a luxury, and therefore consume more calories and fat, with less consideration for “healthier” options.

According to a Good Food Institute report, “only consumers who highly value health or ethical aspects of food will tolerate higher prices, lower sensory appeal and less convenience.”

Non-Dairy Milk is Leading the Charge

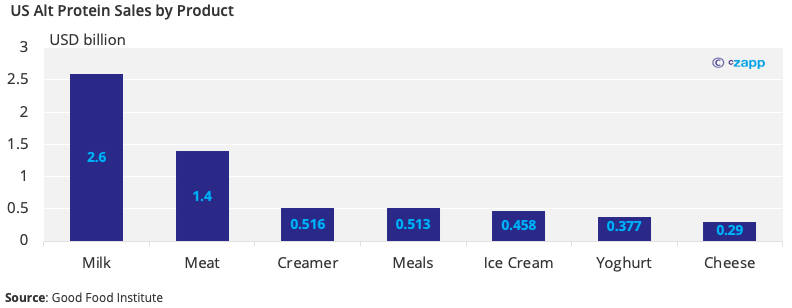

US plant-based foods are growing across some categories, with dairy options leading the expansion. Non-dairy milk accounts for by far the largest chunk of the market, with sales of USD 2.6 billion in the US in 2021.

Some of this is probably down to a rising awareness of lactose intolerance. In the US, 36% of the population has lactose malabsorption and around the world this number skyrockets to 68%. Certain demographics are more likely to suffer from lactose intolerance. Northern Europe is one of the only regions where the population carries a gene that allows them to digest lactose after infancy.

However, lactose intolerance cannot account for all of the growth in alternative milk. Europe is also a high growth market for the products, which include oat, almond, soy and pea variations.

While other factors such as increased health awareness, sustainability and concern for the environment may play a role, the most likely reason is that alternative milks can compete with dairy milk on price.

According to research by Mintec, milk prices in the UK and Europe are around USD 0.35 a litre, while in the US they tend to be around USD 0.40 a litre. This is often considered “too cheap”, especially since the cost of milk production has gone up this year due to increasing input costs.

While the price of alternative milk varies, the unit cost is generally low as the named materials make up only 2% to 5% of the ingredients. In total, about 75% to 90% is water, with the remainder made up of small amounts of flavours, colours, vitamins and minerals. This brings the cost of alternative milk to between USD 0.96 and USD 1.60 a litre. If growth continues, price parity will arrive sooner than expected due to economies of scale.

Alt Meat Struggles for Market Acceptance

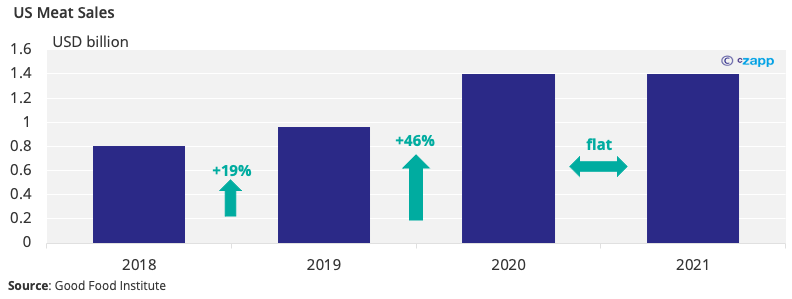

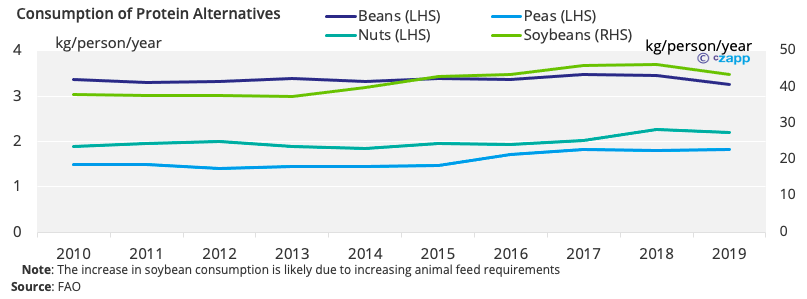

Meat is the second largest plant-based food in the US. But in 2021, plant-based meat sales were flat despite growth in the plant-based market as a whole.

This lethargy seems to indicate that the world has fallen out of love with alternative meat. There are several potential reasons for this – the first of which is health concerns. Some questions have been raised over the true health benefits of alternative meats.

Although alternative meat products tend to contain fewer calories than traditional options, many alternative protein options are also classified by the UN’s Food and Agriculture Organisation (FAO) as ‘ultra-processed’ due to their ingredients due to requirements for flavours, thickeners, colours, emulsifiers, and protein isolates to replicate the texture and taste of animal meat.

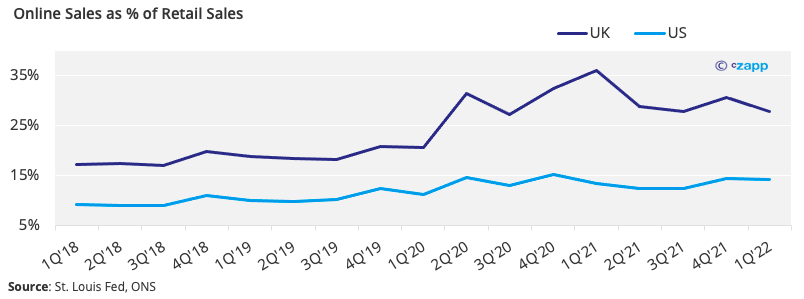

Another reason for a potential levelling off in alternative meat purchases is changing behaviours post-pandemic. Increased prevalence of online shopping tends to reduce spending as there is less impulse buying and less opportunity to sample new products.

However, given that online shopping as a percentage of all retail sales increased by only three percentage points between the first quarter of 2020 and the first quarter of 2022, this only explains a small proportion of the sales dip.

A better explanation could be an increase in out of home dining in 2021 and 2022. In a 2020 report by Good Food Institute, researchers found the common barriers to adopting a plant-based diet “included an unwillingness or inability to alter dietary patterns and a lack of available options when eating at restaurants.”

The report continues to point out that the tendency to order a particular dish at a restaurant requires familiarity with the dish or ingredients. Currently, it says “plant-based meat dishes are not yet widely perceived as familiar and thus are not preferable.”

Ultimately, if alternative protein is to truly compete with traditional meat, there are three barriers to overcome: cost, taste, and texture. According to Good Food Institute: “Only after a food product is perceived as delicious, affordable, and accessible will the average consumer consider its health benefits, environmental impact, or impact on animals in the decision to purchase it.”

Alt Meat Fails to Take Market Share

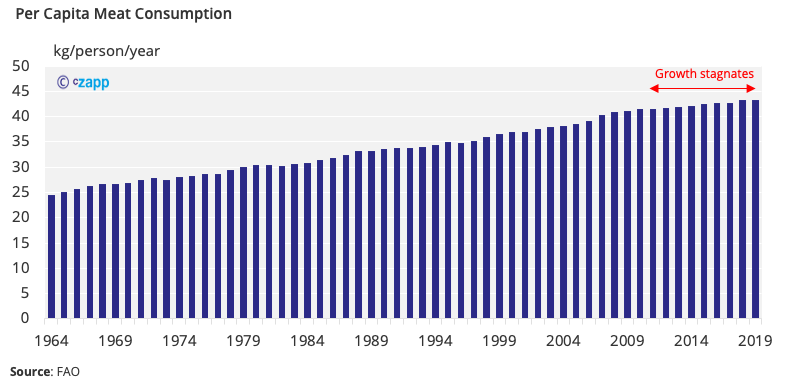

Another factor to consider is that people are already cutting down on meat consumption. This trend is unlikely to change in the near future as prices climb.

As meat demand has stagnated, consumers have not really replaced it with meat alternatives. This suggests that we have reached “peak meat”.

And even the 46% growth rate in alternative meat from 2019 to 2020 only brought total sales to USD 1.4 billion. This compares to the USD 82.2 billion global meat industry.

Inflation, Supply Chain Will Add More Pressure

Companies have perfected some of the tastes and textures of traditional meat, but cost remains a sticking point. Now, as the world enters an inflationary environment and quite possibly a recession, higher living costs are sure to make people consider their food costs.

Consumers of plant-based foods tend to be educated, high earning professionals between 35 and 44, according to Nielsen research. Penetration of alternative meat positively correlates with higher income thresholds, with the lower income households earning between USD 20,000 and USD 24,999 tending to have low interaction with plant-based foods.

According to a recent Numerator survey, 95% of US households said they would make changes to purchasing habits to account for inflation. Over one-third said they are purchasing fewer grocery items, with 21% of consumers buying less meat and 14% buying less fruit and vegetables.

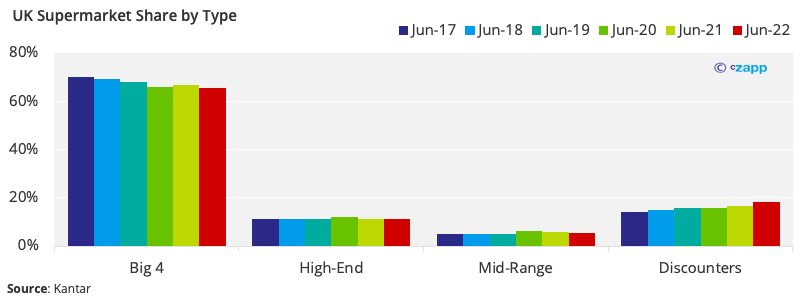

There is a similar pattern in the UK. Although high and mid-range supermarkets earned some market share in 2020, this soon tailed off. Similarly, performance of discounters remained flat from 2019 to 2020 but these supermarkets have since gained market share to bring them to 18.2% of the market in June 2022.

Lack of Investment Jeopardises Future Growth

But investment is also slowing in plant-based meat, with 2021 marking the first year of lower investment than the previous one. Having raised USD 2.1 billion in 2020, the industry managed only USD 1.9 billion in 2021 and the lethargy is continuing in 2022.

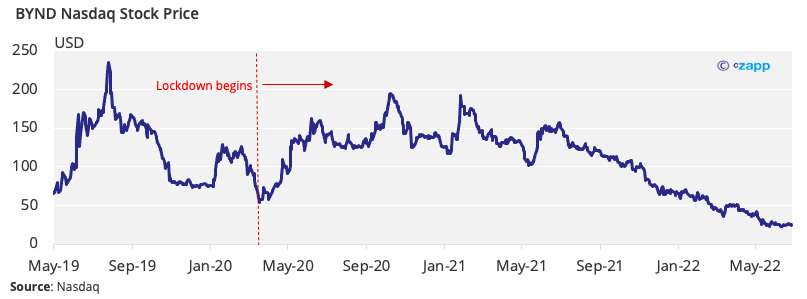

Alternative protein leader Beyond Meat is also struggling to gain traction post-pandemic. In its Q1 2022 earnings statement, the company said its gross profit margin slid to USD 200,000 from USD 32.7 million on the year. And in January it emerged that traders are betting against the company’s stock as 40% of outstanding shares in the company were shorted.

Since the beginning of 2021, Beyond Meat’s stock, BYND, has shed about 80% of its value, closing at USD 23.78 on June 28 from a high of USD 234.90 in July 2019.

A lack of overall investment in this industry will likely lead to lower innovation investment, which is crucial for the future of plant-based meat. There will also be less money for marketing – a crucial tool for market penetration.

Concluding Thoughts

- With higher input costs, the price of food is likely to continue increasing

- This means preference for smaller amounts and own-brand products will probably continue

- Traditional meat will likely also feel the pressure from this, although it is viewed as much more of a staple of the diet and alternative proteins more of a luxury.

- A sharp dip in alternative protein investment could spell trouble for its long-term prospects

Other Insights that may be of interest

Have US Organic Food Sales Peaked?

Alternative Protein: The Future or Just Hype?

Interactive Data Reports that may be of interest …

Consecana Panel

CS Brazil Weather Update