Insight Focus

- Wheat markets have fallen sharply in recent weeks

- The lack of significant Black Sea exports remains a major hurdle

- A look at what might lie ahead

Introduction

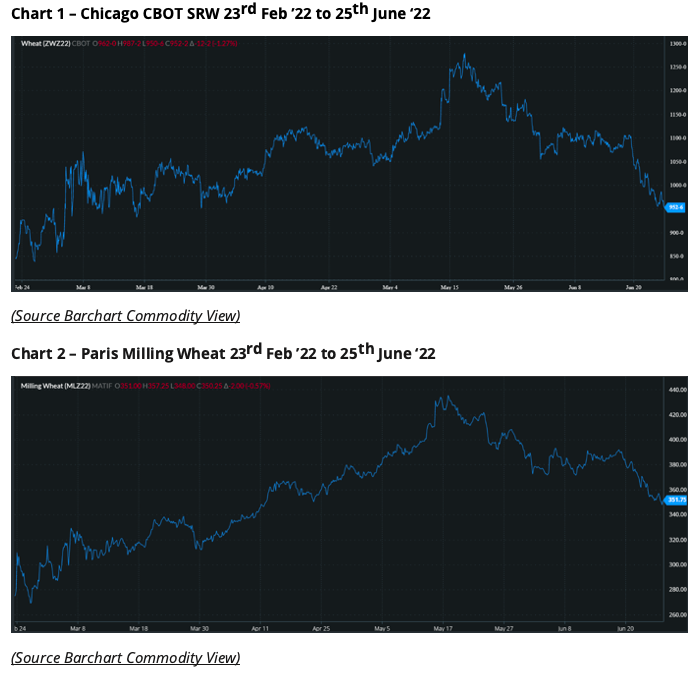

Wheat markets had been rising, driven by diminishing global reserves, when Russia’s invasion of Ukraine in February, added fuel to the fire and prices hit.

Despite the war and no obvious increase in world stocks, prices have tumbled since mid-May.

Why have markets fallen?

Reports have suggested that some of the pressure has come from external markets, with inflation and interest rates creating concern.

On 4 May, a couple of weeks before the start of the downturn, we examined a number of factors that would likely aid a fall in prices.

High prices and global economic concerns enhanced by the war, appear to have reduced buyers’ confidence in maintaining the level of purchases needed to support the market.

Ukraine is making some grain exports. Last week Romanian President Klaus Iohannis said his country had ensured safe transit of over 1m tonnes of grain exports from Ukraine since the beginning of the war. It’s not much, but it is progress.

Pressure on Russian President Vladimir Putin is most certainly increasing, which will be encouraging the market bears.

Northern Hemisphere wheat harvests are beginning and thus the potential for more availability adds to the price pressures.

A Complex Black Sea Issue

The results of a meeting between the UN, Turkey, Ukraine and Russia in Istanbul to establish corridors for grain shipments could pave the way for some optimism.

However, even if progress is made, there is no quick fix to resuming pre-war levels of movement.

Mines laid in the Black Sea by the Ukrainians to deter Russian naval assaults are not swift to clear. Furthermore, it is hard to see the Ukrainians agreeing to reduce this while war continues.

There is also the problem of Ukrainian infrastructure, which has been devastated by the war in some regions. This will take time to restore if the efficient running of logistics to ports is to resume.

It must also be noted that for free movement to ports across occupied territories, relations between Russia and Ukraine would need to improve radically given the current lack of trust.

Looking Ahead

Although prices have fallen significantly, they remain very high, given the need to feed the poorer importing nations at a time of global economic pain.

History suggests that sharp falls in price are often followed by some retracement back up, as sellers run out of enthusiasm, while buyers grasp the opportunity to purchase at lower levels.

There is the continued uncertainty over the weather and the size of harvests in 2022, which will contribute to volatility.

The next twist to an already desperate situation in the Ukraine as Putin mulls his future actions, may yet add some unknowns to the market.

Conclusions

Prices are on a downward trend.

With the world’s poorer nations desperate for cheaper wheat, it is difficult to see the markets rebounding to early May’s highs.

A reaping of reasonable Northern Hemisphere harvests over the coming months would contribute to a weakening of markets.

Relations between Russia and Ukraine, coupled with their ability to coordinate a resumption of trade through the Black Sea ports, both of which seem improbable, would no doubt have an important impact on values.

In the meantime, volatility will likely continue with each news report, but a bear market as the weeks pass seems more likely than a raging bull driving prices to anywhere near their previous highs.

Other Insights That May Be of Interest…