Insight Focus

- PTA and MEG futures dropped sharply last week, following crude oil price declines.

- PET export prices have now dropped 12-14% over the last two-weeks.

- PET margins are expected to remain robust through Q3 2022 on tight availability.

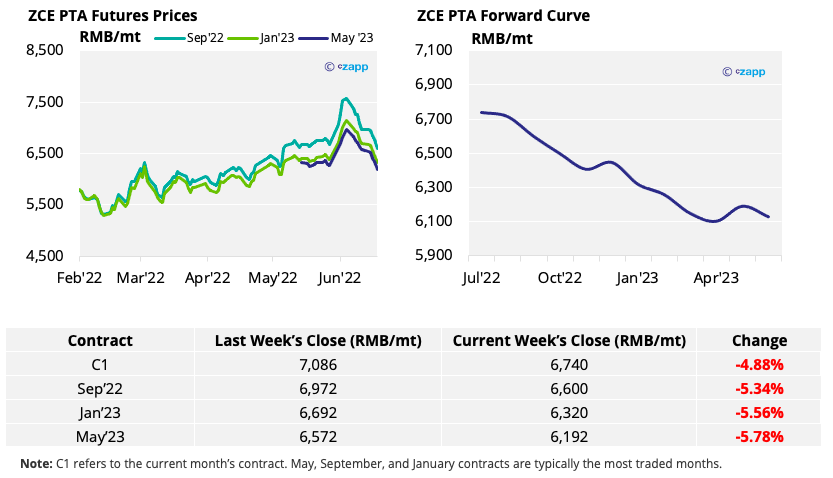

PTA Futures and Forward Curve

- PTA futures fell sharply last week, following a plunge in crude oil prices on fears that the US is heading into a recession.

- PX prices also went into reverse, with buyers resisting high PX prices and the recent market squeeze.

- Whilst PTA-PX spread widened slightly, PTA supply is expected to increase gradually due to higher operating rates, which will constrain margins.

- The PTA 12-month forward curve remains sharply backwardated into 2023.

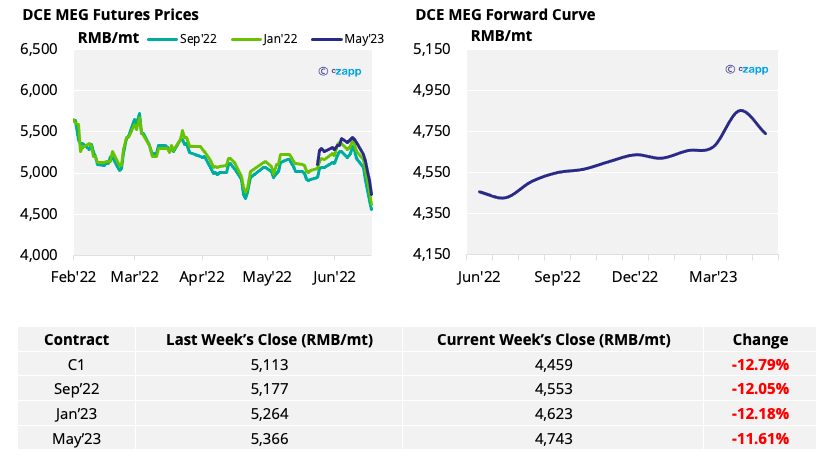

MEG Futures and Forward Curve

- MEG futures plummeted last week, with buyers staying on the side lines.

- Whilst weakness in global commodity markets drove the plunge, already high inventory levels were bolstered by several cancelled plant turnarounds and increased output.

- The MEG forward curve remains in contango, with future contracts trading at a premium to current prices.

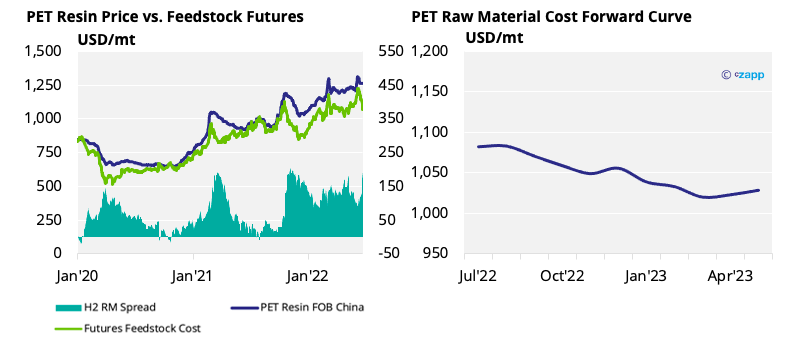

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices continued their dramatic fall, reaching USD 1200/tonne by Friday.

- Current export prices represent a fall of USD 150-200/tonne over the last two-weeks.

- However, despite the fall in price, producers were able to push up the PET resin – raw material physical differential, with the weekly average increasing USD18 to USD 116/tonne. Friday’s daily spread was higher still at USD 129/tonne.

- The PET export-raw material forward curve is now partially backwardated in Q3 2022 and through H2 2022.

Concluding Thoughts

- Whilst many buyers have sat out the recent market volatility, some demand is now returning as prices fall into a more attractive range.

- Whilst averaging around USD 1200/tonne, prices as low as USD 1180/tonne were also heard Friday, indicating a potential further downside to current average prices.

- However, resin availability is still tight with most major producers sold-out through July and August.

- At least one major domestic buyer was heard to have placed an additional 100kt order, to cover summer demand in China, leading to less availability for certain producers.

- Given more attractive price levels, competitiveness in foreign markets, and tight availability, PET margins are expected to remain robust through Q3.

- A potential repeat of strong Q4 export orders, as occurred last year, is also looking increasingly likely.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

Initial European PX Settlement Rocks PET Market

European PET Market View: Will Revenge Spending Boost European PET this Summer?

PET Resin Trade Flows: EU PET Imports Surge Despite Chinese Export Constraints

Plastics and Sustainability Trends in May 2022

Explainers That May Be of Interest…