Insight Focus

- PTA futures correct downwards, partially reversing the previous week’s rise.

- PET export prices track feedstocks, margins stabilise, rise slightly on tight supply.

- PET resin inventories remain low, with September shipment typically the earliest available.

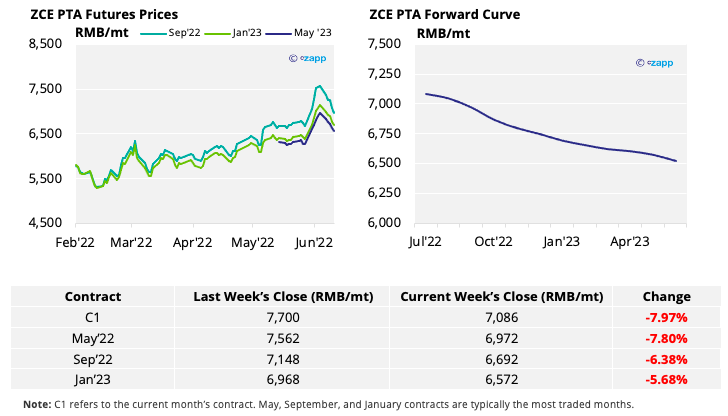

PTA Futures and Forward Curve

- PTA futures fell last week, partially reversing the previous week’s rally.

- PTA prices tracked PX lower, with PTA producers’ margins growing.

- The PX sell-off was largely driven by higher PX operating rates, the start-up of a new plant, and PTA producers selling PX because of their own production cuts.

- However, PTA supply is still expected to grow in June because of operating rate increases, which will cap margins.

- The PTA 12-month forward curve remains sharply backwardated into 2023.

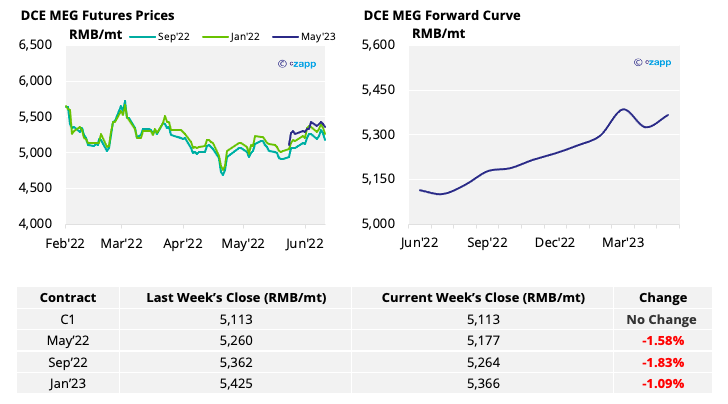

MEG Futures and Forward Curve

- MEG futures fell back last week, with traders actively selling at higher prices.

- Whilst supply continues to decrease, there remains ample supply and high inventories.

- The MEG forward curve remains in contango, with future contracts trading at a premium to current prices.

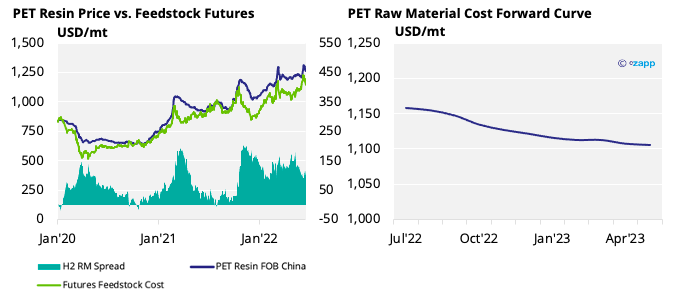

PET Resin Export – Raw Material Spread and Forward Curve

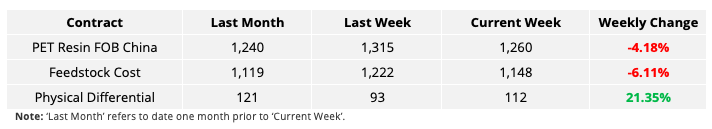

- Chinese PET resin export prices have been on a roller-coaster ride in June, increasing over USD 100/tonne before reversing last week and settling at an average of USD 1,260/tonne FOB Friday.

- The whipsawing has led to volatility in daily physical differentials, but the weekly average has risen modestly to USD98/tonne. Friday’s was higher at USD 112/tonne.

- The PET export-raw material forward curve has moved to partially backwardated in Q3 2022 and through H2 2022 and is now beginning to look flat in early 2023.

Concluding Thoughts

- Having fallen sharply in recent weeks, PET resin export margins are expected to stabilise around current levels, or even rise slightly in the next few weeks.

- A recovery in export margins to April/May levels is unlikely and would not follow previous seasonal trends.

- PET resin supply is expected to grow through June, with the easing of restrictions and improved logistics.

- However, inventories are showing little sign of growing, with major Chinese exporters increasingly selling out September shipments.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

European PET Market View: Will Revenge Spending Boost European PET this Summer?

PET Resin Trade Flows: EU PET Imports Surge Despite Chinese Export Constraints

Plastics and Sustainability Trends in May 2022

Could Chinese Restriction Easing Boost PET Demand?

Explainers That May Be of Interest…