Insight Focus

- Chinese raws import margins have been negative for 3 months.

- Margins are rising due to stronger demand as COVID measures are lifted.

- Chinese refiners may delay their raws demand to later in 2022 in the hope of higher margins.

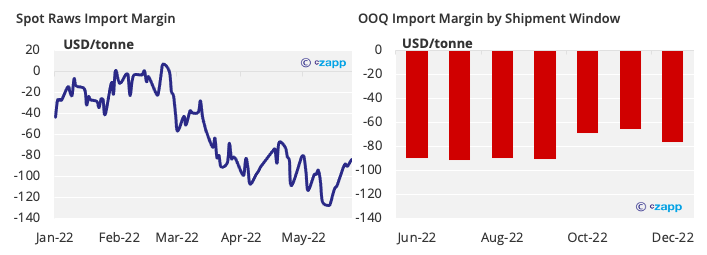

The Chinese out-of-quota (OOQ) raw sugar import margin has been negative for the last 3 months. Despite this we think around 2m tonnes of Chinese OOQ demand has been covered so far in 2022, at times when the No.11 dipped to the lower end of its range (around 18c/lb).

The weak margin is because of an excess of sugar on the domestic market, the depreciation of the yuan and weak demand because of repeated COVID outbreaks and lockdowns. The margin has recently recovered from the lows of -127 USD/tonne on May 16th to around -80 USD/tonne, due to the lifting of COVID restrictions and government measures to stimulate domestic consumption.

Still, it’s too low for refineries to hedge their raw sugar demand at current prices; their break-even level is at 18.5c/lb

Despite this, we think refiners will look to take up their Automatic Import Licenses (AILs) in full even at a small loss, so that their allocation for 2023 is not reduced. Refiners that didn’t use their full allocation in 2021 received a lower allocation in 2022. These licenses are usually on a calendar-year basis which means we think refiners may postpone the balance of their demand (1m tonnes) until Q4 if margins don’t pick up.