Insight Focus

- Production concerns and the weather add to concerns over wheat supply

- War in the Ukraine drags on preventing the much-needed Black Sea exports

- Options needed to solve the crisis as India bans wheat exports

Introduction

We have been inundated with news depicting the difficult global situation due to increasing commodity prices and the disruption caused by the Russian invasion of Ukraine.

The situation is having a severe impact on the world’s largest wheat importing region, North Africa, and pressure is mounting for a solution to sky-high prices which are unaffordable to many.

Production Concerns

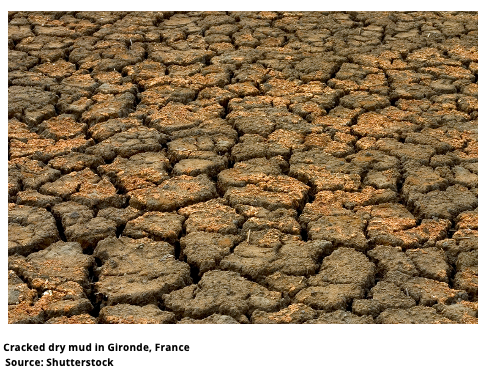

Weather issues are reducing many nations’ wheat crops.

France’s crop ratings have plunged over recent weeks to 69% good/excellent from 91% good/excellent only a month ago.

Other countries around the world are facing similarly difficult conditions, with the likes of Germany, the US, India and many more seeing reductions in prospective harvests.

War and Logistics

The problems in the Black Sea continue to create enormous uncertainty for the markets, as Russia maintains its offensive in Ukraine and the associated turmoil for Black Sea exports.

Replacing Black Sea Wheat

Inevitably the world’s major grain exporters have, since the end of February, been attempting to fill the huge gaps created by the war and Black Sea disruption.

Nonetheless, prices have increased extraordinarily.

There had been a degree of optimism and hope, with talk of India reaping a huge crop of over 110m tonnes for this year, enabling exports potentially to reach 10m tonnes, up from 2.5m tonnes in 2020/21.

However, due to recent heat stress, latest forecasts suggest that 100m tonnes may not be surpassed, resulting in a ban on exports having been introduced in the middle of May.

With the added concerns over upcoming production from major exporters such as Europe and the US there are unanswered questions as to where the large importers in North Africa, the Middle East and Asia will source their wheat.

Having been largely fed by Black Sea wheat in recent years, the current problems are a particular worry for the governments of the wheat hungry North African countries. They have the poorest populations to feed and memories of the Arab Spring uprisings in 2010/11 are all too clear.

Possible Options

Russia

We have previously examined the probably that both international and domestic pressure will mount on President Vladimir Putin to facilitate exports out of

the Black Sea. This will likely increase within Russia as the large 2022 harvest is gathered.

China

In recent days China has called for a ‘Green Corridor’ to allow exports from the Black Sea.

A country that has to date shown no desire to criticise Putin’s war, maybe stepping up pressure on the Russian president.

An interesting alternative thought on China, is the trump card that they hold over the wheat crisis. At 142m tonnes they hold approximately 50% of the world’s total 280m tonnes wheat stocks!

This compares to 35m tonnes in 2006/07, a mere 28% of the world’s total 124m tonnes.

Could China look to export a small amount of their vast stocks?

Concluding thoughts

With record high prices there are major concerns about feeding the poorest nations.

An inability to solve the problem could spell a repeat of the Arab Spring uprisings, adding to the already politically and economically unsettling war in Ukraine.

The 2022 Northern Hemisphere harvests, with the possible exception of Russia, do not look like achieving the desired results.

Russian wheat will need to be sold and shipped, to free up storage in addition to financing their next crop. Pressure will mount on Putin to act.

China could ultimately play the key role in solving the wheat crisis. Whether that be pressure on Putin, or simply by selling off some of their large stocks at these eye-watering prices.

Other Insights That May Be of Interest…

Africa Eyes Cassava to Plug Wheat Deficit