Insight Focus

- Spanish citrus crop set to fall at least 5% on year, USDA says.

- Other European citrus producers hit by weather.

- EU orange prices have been steadied by imports, but lemon prices are rising.

Citrus production in Spain, the world’s largest exporter, has been reduced by poor weather and rising input costs. The picture is similar for the continent’s other producers.

However, orange prices in the EU have been stable with Egyptian exports normally destined for Russia, potentially making up for the shortfall.

The picture is different for lemons as South African exports usually Russia bound have been diverted to the Middle East rather than the EU.

Heatwave Currently Sweeping Spain

Spain has just completed one of the hottest Mays in the 21st century. This follows months of low rainfall since November, and periods of heavy rainfall and frost during March and April.

The extreme weather has been a downside for production in 2021/22.

World’s Largest Citrus Exporter

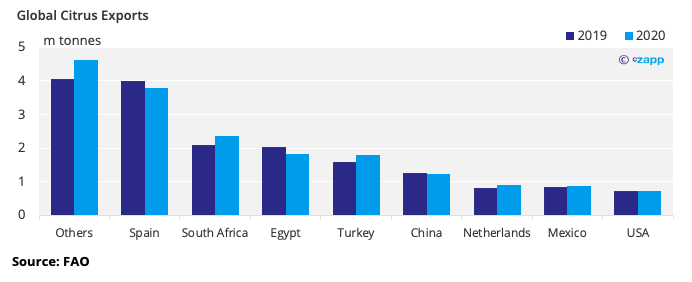

Spain typically accounts for just over half of total EU citrus production and exports at least half of its production.

Almost all exports head to other countries in the EU, with 15% heading into non-EU European countries (UK, Switzerland, Norway) and elsewhere. In total Spain accounts for around 25% of annual global citrus exports, making it the world’s largest exporter.

This means any production shocks have consequences for EU supply.

Persistently Abnormal Weather

Around 90% of citrus production (oranges, lemons/limes, mandarins) in Spain is near the Mediterranean coast in Catalonia and Valencia, and in the southern Andalusia region.

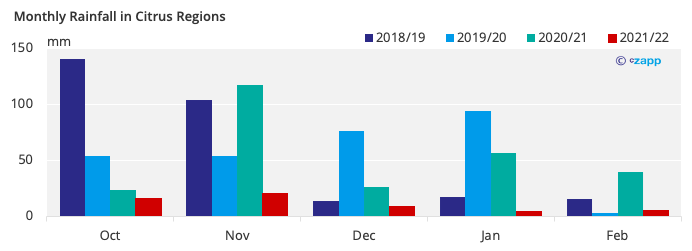

Rainfall in this combined region has only been around 20% of the average of the previous three seasons between November and February this year when the drought was at its worst.

This has been detrimental to reservoirs across the country which sustain around 65% of agricultural production, and is essential for production of lemons and oranges.

By the end of February many reservoirs were lower than half capacity at a time when they should be at their highest.

The most striking example of this is the re-emergence of the former town of Aceredo, which was flooded 30 years to create a reservoir.

Higher rainfall in some of March and April allowed reservoir levels to recover slightly, though high rainfall over a short period causes problems of its own. The rain was accompanied by lower temperatures and frosts in some regions.

Now, many regions have reported temperatures well above 40 degrees Celsius as hot, dry winds from North Africa sweep north, putting the country into an unusually early and intense summer heatwave.

Citrus Production Affected

Peak season for citrus production is generally between October and May, with different fruits and cultivars being harvested at different points across the season.

Coming off the back of a strong 2020/21 campaign, the recurring themes of higher fertiliser, fuel, and logistics costs were all expected to disrupt production for 2021/22 before the season began.

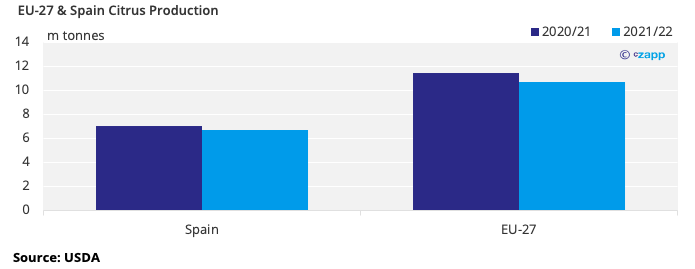

The USDA forecast in January for 2021/22 predicted production at 6.7m tonnes, an almost 5% year-on-year drop. This took into account the increased input costs and poor weather.

Reports from Valencia indicate poor weather meant orange and mandarin crops were left unpicked and new blossom rotted in the wet, leading to hundreds of tonnes of losses estimated in the tens of millions of euros.

January estimates by the USDA put orange production at around 3.5m tonnes, around flat from last season. However, in light of these conditions it is likely that final figures will be lower than this.

Moreover, the Verna lemon harvest currently underway also seems to have suffered from the wet, with production expected to fall by almost half on the year to around 190k tonnes.

Beside the size of the harvest, more rain in spring means larger lemons. Demand is generally stronger for smaller lemons and so growers may struggle to find homes for these larger examples.

Lower Production Elsewhere in the EU

With Spanish production of several orange and lemon cultivators set to be lower than last year, how does this fit in to the broader European market?

The second largest EU producer, Italy suffered floods to orange groves in October, which along with a smaller planted area helped 2021/22 production estimates (USDA) down to 1.5m tonnes, almost a third below the 10-year average.

Likewise, the USDA forecast production downturns of 17% and 10% respectively for Greece and Portugal.

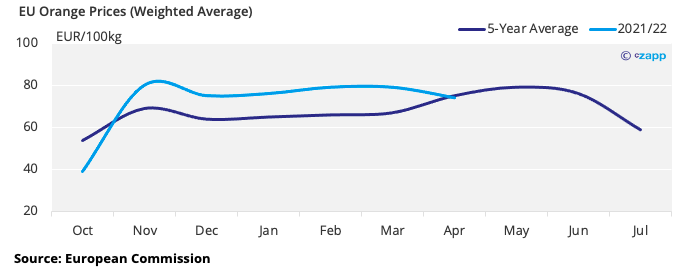

Whilst this has been bullish for prices, EU oranges are now close to the 5-year average at around EUR75 (USD 81) for 100kg in April.

This could be due to Egyptian exports traditionally destined for Russia and Ukraine finding their way onto the EU market instead. In normal times around 80% of Egyptian production goes to the Russian market.

The picture for lemon production looks similar with the Campania region in Italy experiencing a 50% fall in production, and Turkey also suffering from poor weather around the harvest.

Whilst war in Ukraine has disrupted flows of South African lemons to the region, these exports have not been directed towards Western Europe, instead flowing to the Middle East.

Along with the poorer crop in Spain this has helped drive up prices. Likewise, demand is growing as many European countries move beyond the COVID pandemic.

Other Insights that may be of interest