Insight Focus

- Palm oil output may fall in coming years.

- Palm oil producers, consumers will have to change policy if it does

- Soybean oil may be able to fill any supply gap left by palm

If I were a betting man, and I am, I would bet that more people in the world today know more about palm oil than at any time in the past.

Why would I make that bet? The rapid entrance of the US petroleum refining industry (P66, Marathon, Chevron) into US agricultural investments, specifically the domestic oilseed business via their equity investments into soybean processing to support their build out of renewable diesel (RD) refining capacity, necessarily leads them to put eyes on the global vegetable oil markets which in turn leads them to palm, the largest source of vegetable oil in the world.

Along with the “new” eyes of the US RD refiners on palm come the “new” eyes of more US policy makers, mostly in California but also other states as well as Washington, D.C., policy wonks at the UN, and attendees at the World Economic Forum in Davos, Switzerland. A lot more eyes now are watching palm oil production and consumption statistics and MOST importantly government policy adjustments to palm import taxes and export taxes.

Before I go on may I again recommend to readers that if you have not done so in the past you take the time to watch this excellent overview of palm production and forecasts for the impending issues for global supply presented by Dr. James Fry of the LMC consultancy done at the behest of the US Soybean Export Council (USSEC) in December of 2021 Start at minute 23.50. Spoiler alert: due to multiple agronomic issues the future of palm production expansion is in serious doubt.

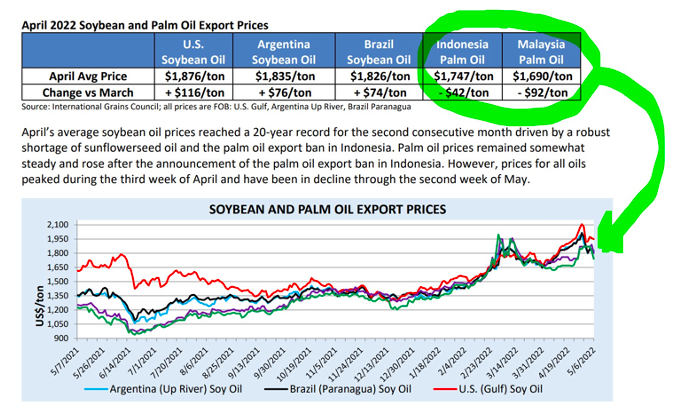

I have covered the change in global vegetable oil prices at length in recent posts (long story short, a doubling of prices for all the major vegetable oil in the last year) but as a reminder here is the latest monthly price chart from the USDA’s Oilseeds: World Markets and Trade May 2022. Palm prices appear in green on the chart.

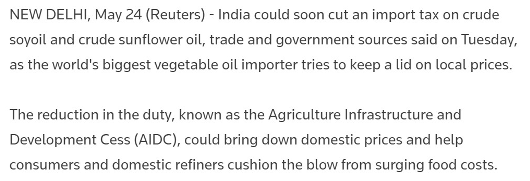

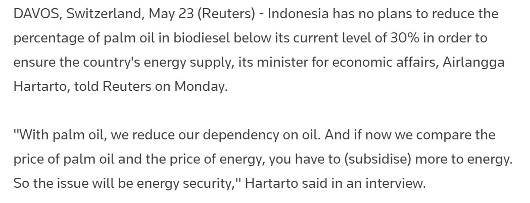

High prices and questionable supply plus global political uncertainty (Ukraine/Russia) have caused policy makers in Indonesia, the largest producer of palm, Malaysia the second, and consumers, India, the largest, and China and the EU nearly an equivalent second, to shift export and import policy seemingly daily. The pace of policy announcements quickened this week and here are just a few:

#1

#2

#3

Three days, three policy announcements and likely more to come. Indonesian biofuel policy, US biofuel policy, the Russian incursion into the world’s largest sunflower oil exporter Ukraine, last year’s crop losses in Canadian rapeseed (canola), and this year’s losses in soybean production in Brazil, Argentina, and Paraguay have all contributed to the policy anxiety.

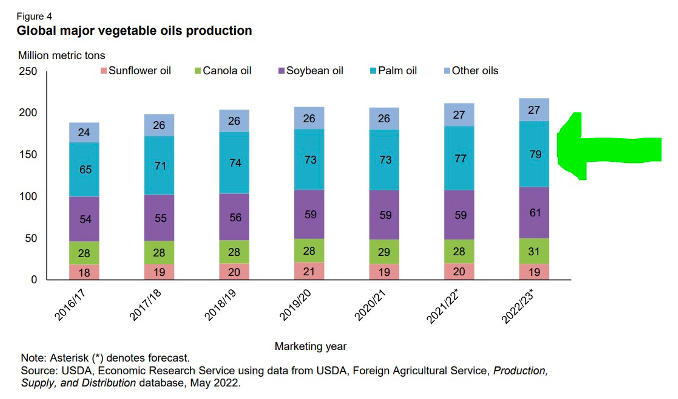

The below USDA forecast gives me anxiety (from USDA’s Economic Research Service’s Oil Crops Outlook May 2022):

I wonder, is global palm production really headed toward 79 million tonnes this year as the USDA forecasts? Will Indonesia produce 1 million tonnes more palm than year ago and will Malaysia produce 800k tonnes more? Can they harvest the expanded production? Is labour available? The outcome remains to be seen; but if their collective production does not expand and their collective domestic use increases then expect more (frenzied) palm policy adjustments.

If Fry is correct in his overview that palm production may drift lower in the coming years because of long term agronomic drivers (the age of the plantations) and the inability of palm producers to reorient labour back to the plantations following COVID-19 disruptions, then trouble is brewing.

Falling production of palm in both Malaysia and Indonesia, a greater commitment to self-sufficiency in both countries via domestic biofuels policy with palm as the feedstock reducing export supply, higher domestic use of soybean oil in the US for RD, and a questionable world sunflower oil balance sheet will lead to more policy reconsideration (higher export taxes and great government revenues for producers, lower import taxes and reduced government revenues for importers, especially India) as well as sharply higher prices.

Is there a solution to declining palm production and higher domestic consumption for biofuels policy? There is. Is it here today? It is, or at least well started to being a

solution.

Consider the chart below, also from USDA’s Economic Research Service’s Oil Crops Outlook May 2022:

Soybean crush to the rescue (with a big “maybe” for the forecast rapeseed/canola expansion).

As Fry details, peak palm may be unfolding, but global expansion in soybean production (record high US acreage planted this year) and crush is underway to provide some relief in the short term but the world needs more production (much more) in the long term.

Note to those worried that US RD feedstock policy changes due high vegetable oil prices could mean a future curtailment of clean oils (soy, canola, corn, sun) receiving California’s low carbon fuel standard credits as well federal blenders’ tax credits sometime in the future resulting in sharply lower soybean oil prices as well a global glut of vegetable oil: consider the implications of peak palm! If not palm, then with what will China and India cook? Soy (to the rescue)!

**************************

Are California policy makers getting anxious about RD policy’s impact on global vegetable oil prices?

No, not even close.

How do I know?

Consider what happened (shockingly, UNANIMOUSLY) in Rodeo, California two weeks ago: approval for one of the largest vegetable oil consuming centers to produce RD in the US:

No policy adjustment any time soon coming from California! US RD policy unfolds, unanimously!

For further information, please email waltercronin@msn.com.