Insight Focus

- PTA futures continue to be driven higher by strong PX demand and supply shortages in Asia.

- PET resin and feedstock markets expect a boost from easing restrictions.

- PET resin export prices projected to remain firm through Q3 ’22.

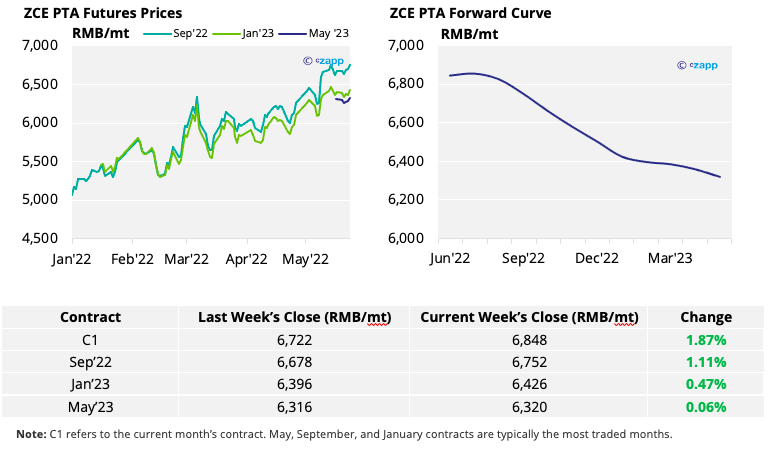

PTA Futures and Forward Curve

- PTA futures continued their rise, driven by higher paraxylene (PX) prices and the weaker yuan.

- PX-naphtha spread hit a 3-year high, with PX production increases expected in June.

- The PX supply deficit may only ease gradually and will depend on sustained arbitrage from Asia to US.

- The PTA 12-month forward curve remains backwardated, falling away sharply from August into 2023.

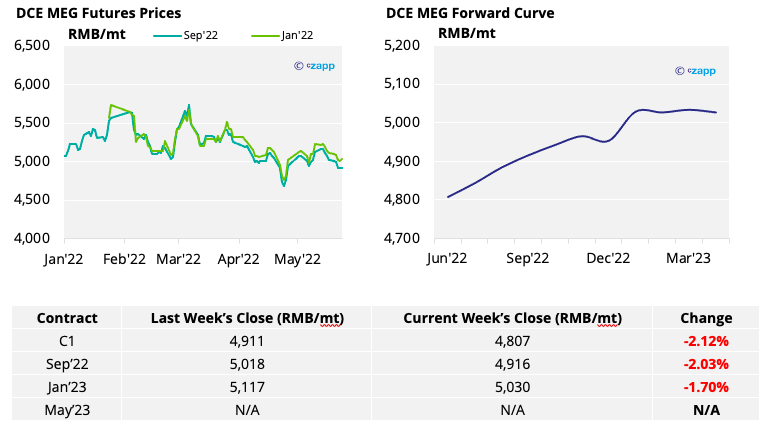

MEG Futures and Forward Curve

- Monoethylene glycol (MEG) futures moved lower through the week, with fundamentals still bearish.

- Although MEG operating rates remain low, port inventories remain relatively high, ample supply is limiting any upside.

- All eyes are on the easing of COVID restrictions in Shanghai and across China, with a recovery in polyester production expected to lift MEG demand.

- MEG forward curve remains in contango, with future contracts trading at a premium to current levels.

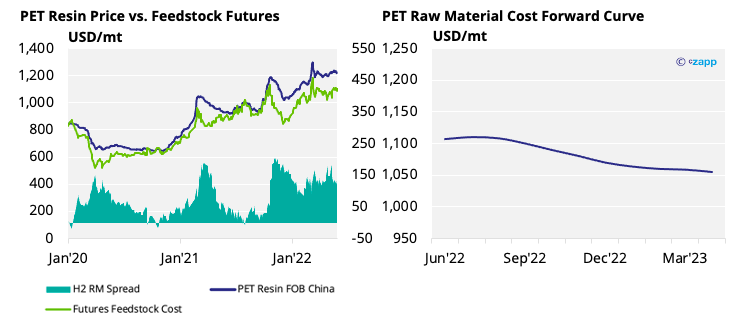

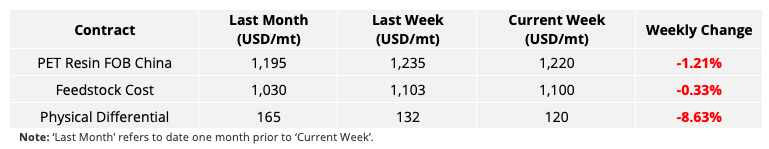

PET Resin Export – Raw Material Spread and Forward Curve

- Export prices for Chinese PET resin softened through the week, ending at USD 1220/tonne.

- Whilst the PET resin physical differential slipped to USD120/tonne by Friday, the weekly average is only USD 2/tonne below the previous week, and a modest recovery is expected early next week.

- The PET export-raw material forward curve is only slightly backwardated over the next 12 months.

Concluding Thoughts

- Despite production constraints at several of China’s major PET resin producers, much of the industry’s attention is now focused on how quickly domestic demand and logistics can recover once restrictions are eased.

- Authorities in Shanghai are set to begin the reopening process on 1st June.

- However, a releasing of pent-up demand may also result in some temporary bottlenecks at ports as manufacturers rush to export.

- Though resin supply is expected to grow over the coming month, major exporters are sold-out through June and July, most now offer August shipment at the earliest.

- Whilst the forward view on feedstock remains relatively flat through Q3 ’22, robust PET resin export fundamentals are expected to enable producers to maintain high physical differentials.

- PET resin export prices for August shipment currently average around USD 1,255/tonne, but highly dependent on individual producer availability and location.

- As a result, PET resin export prices look set to remain supported through the next quarter.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

Plastics and Sustainability Trends in May 2022

Could Chinese Restriction Easing Boost PET Demand?

European PET Market Loses Momentum as Demand Slows

China’s zero-COVID Approach Hampers PET Resin Exports

Explainers That May Be of Interest…