Insight Focus

- This season, India has had a record high sugar crop and exports to the world market.

- However, there’s little room for production to grow due land and water availability.

- This means Indian sugar exports will fall in coming years.

India has had record high sugar production this season due to favourable weather and increases in yields. However, it is hard to say whether India will continue to have record production in the next couple of years. This is because sugar production relies on favourable weather. In addition, there is very little land and water availability for the cane acreage to grow. There will have to be changes to government policy and increased investment in farm mechanization, mill capacity and cane varieties for production to be maintained or raised.

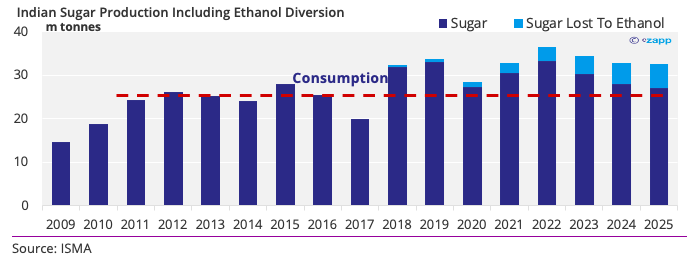

India’s Consistent Overproduction

For the last five seasons, India has consistently produced more sugar than it consumes. This means that it has been able to supply sugar to the world market if needed. This year, India has been able to export 8m tonnes due to high prices. With New York No. 11 prices in an 18-20c/lb range, India has been able to ship out the excess sugar. Lower world market prices would have meant either the surplus being stuck in the country or the government having to resort to subsidies to enable it to be exported.

India’s overproduction is down to high cane prices set by either central or state governments. In addition, unlike other crops, cane farmers can deal directly with the mills. This means that they do not have to share their profits with a middleman.

However, there are two main headwinds to Indian farmers raising cane production even further — the lack of spare land for cane and water availability.

Indian Cane Production is limited by Acreage and Access to Water

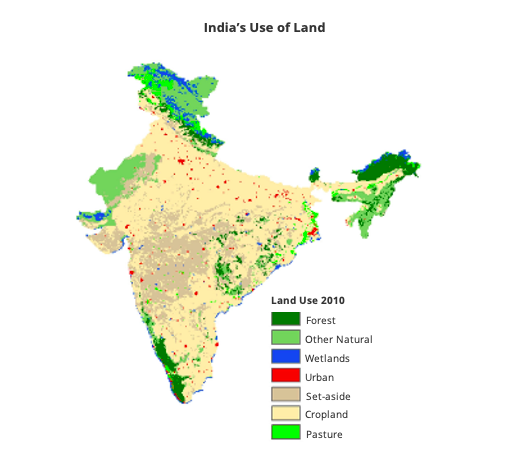

Even though cane acreage in India has continued to increase, there is very little space for it to continue to increase in the future due to lack of spare land.

India has effectively used all its available land for agriculture, so, if the cane acreage is going to expand it needs to take acres from other crops. We believe this is unlikely to happen because farmers that can plant cane will have already maximised plantings given high cane prices and the government is unlikely to extend cane’s profitability over other crops because it is trying to resolve the problem of surplus sucrose.

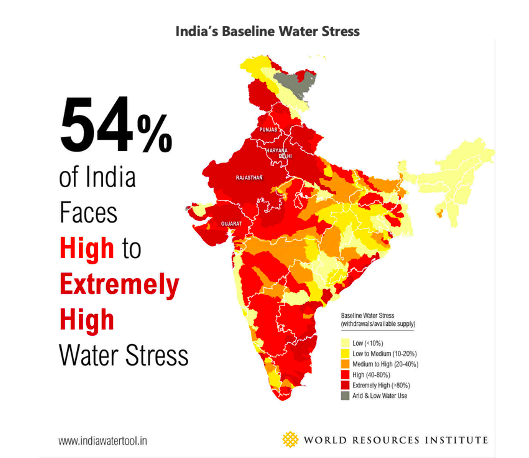

Another reason cane acreage has limited space to increase is lack of water availability. India uses approximately 80% of its water for agriculture and the government is increasingly concerned that the water is used sensitively to ensure an adequate supply of drinking water, especially in years with lower rainfall. This affects sugar production because cane is a water-intensive crop. This is an issue as India’s per capita availability of water is shrinking rapidly and some of the country’s leading cane districts are chronically short of water.

The government is also aware that India’s groundwater resources are depleting, which could have negative long-term implications for water-intensive crops. For this reason, the government is coming under increasing pressure to limit the growth in cane prices and reduce subsidies to the sugar sector, especially in regions with declining water tables and existing drought stress. In addition, there have been increasing water disputes between cane farmers and other farmers. This is because farmers of other crops say cane farmers use large amounts of water. With limited water access in some areas, cane farmers depend on favorable weather for strong cane production.

What Does a Weak Monsoon Mean for Cane Growth?

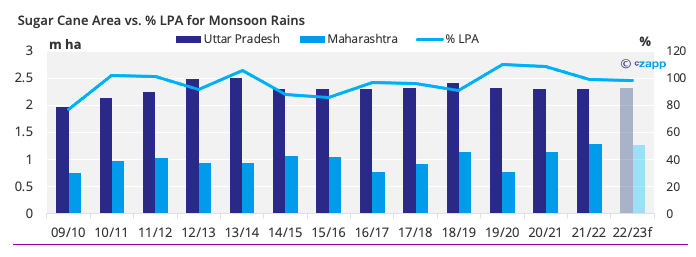

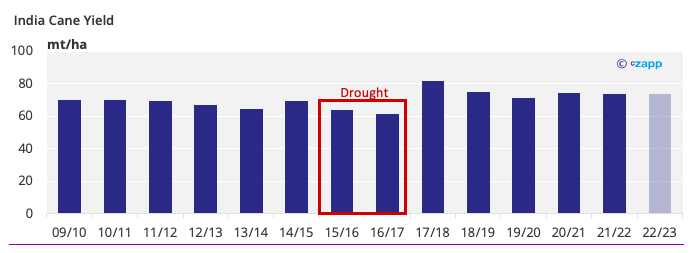

The key weather element for Indian agriculture in general and cane cultivation in particular is the monsoon. If India has a poor monsoon, yields and cane development will be severely affected. For example, the drought in 2015/16 slashed yields and its effect on cane development lingered into 2016/17.

This is one of the main reasons why it is hard to rely on India producing consistent crops every single year. The impact of a poor monsoon will hit differently depending on the area. Maharashtra is more dependent on weather than Uttar Pradesh because their access to water supply is more limited.

Impacts of Weather, Water Availability and Land in Uttar Pradesh

Cane farms in Uttar Pradesh are well irrigated; irrigation is widespread and fed from rivers which flow from the Himalayan watershed. This means that the effects of the monsoon on cane development are less pronounced here than they are in the rest of the country. Water stress is therefore not a key consideration for cane farmers in most of the state, except for in the far South West. Soils in Uttar Pradesh can retain moisture well and so are excellent for cane growth. However, if there is excess rain the soil will retain water and the cane fields can become waterlogged.

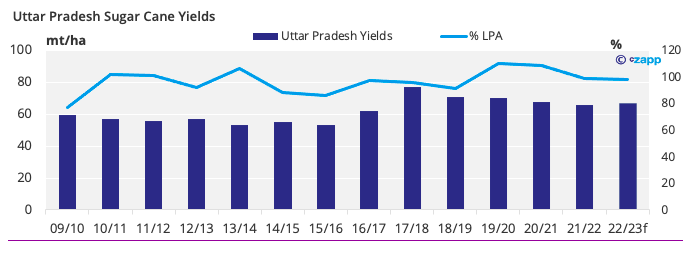

Even though Uttar Pradesh might not be exposed to water shortages any time soon, this is an issue that must be considered in the long term. To increase sucrose production the state will have to focus on cane yields, mechanization and milling capacity. Uttar Pradesh has been investing in cane varieties which has raised yields and will continue to find cane varieties that thrive in its climate. With the introduction of new cane varieties in 2009 over the last decade, agricultural yields increased from around 60mt/ha towards 80mt/ha and have remained above 60mt/ha.

In the north of the country the small farm size has meant that planting is manual, not mechanised. This risks sub-optimal cane density in a field. Proper soil mapping and precision irrigation systems could lead to better application of field inputs and therefore better cane growth.

Impacts of Weather, Water Availability and Land on Maharashtra and Karnataka

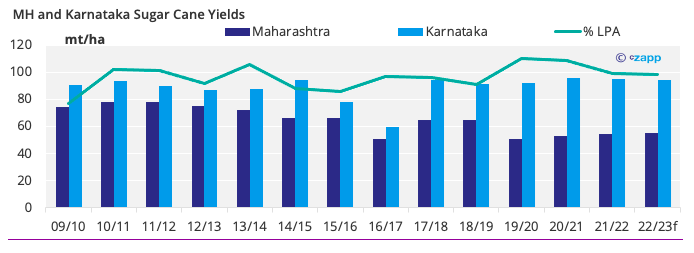

Maharashtra and Karnataka have a tropical climate which is ideal for cane cultivation. However, agriculture in both states is dependent on monsoon rainfall. Monsoon rains are generally stored in reservoirs for irrigation throughout the year, so reservoir levels are crucial for cane health. during times of low rainfall, access to water can be difficult for the cane industry and can lead to excessive groundwater use, especially in districts in the north of Maharashtra and the North of Karnataka.

The whole region is well known for its heavy clay soil, known locally as “Black Cotton Soil”. This is excellent at retaining moisture, which is helpful when growing water-intensive crops like sugar cane. Black Cotton Soil is expansive, which means that when it dries out, it hardens and cracks. This can make cane planting challenging in drought years and means cane acreage often reflects water availability in the region. In times of drought, not only is cane growth/yield affected, but it also becomes difficult for farmers to plant new cane in dry ground. The 2016-17 drought show how difficult the situation can be in Maharashtra and Karnataka.

Can the World Market Rely on India to Continue to Have Large Crops?

It is hard to determine whether India will continue to have large crops like this season’s because there is little leeway to raise cane production by increasing the planted area. This means that for sugar production to grow there need to be higher yields. Cane and sucrose yields have the potential to increase, but the amount of cane diverted to ethanol production is expected to increase year-on-year, meaning that overall sugar production is expected to be affected in the long term. Finally, the weather also plays a significant role in the size of the crop, adding to the uncertainty about the amount of sugar that can be produced in India. Therefore, it is hard to rely on India to continue to continue to set new record highs because sugar production is not consistent from season to season. This means that in the coming years, India might not be able to produce a surplus if the world market needs more sugar.

Other Insights That May Be of Interest…

Russia & Ukraine Grain Flows Likely to Be Disrupted into H2’22

What the Ukraine Crisis Means for PET