Insight Focus

- The No.11 has rallied back above 20c/lb.

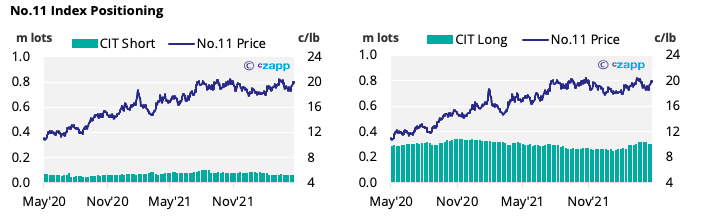

- This rise was helped by spec buying.

- Both producers and consumers have continued hedging.

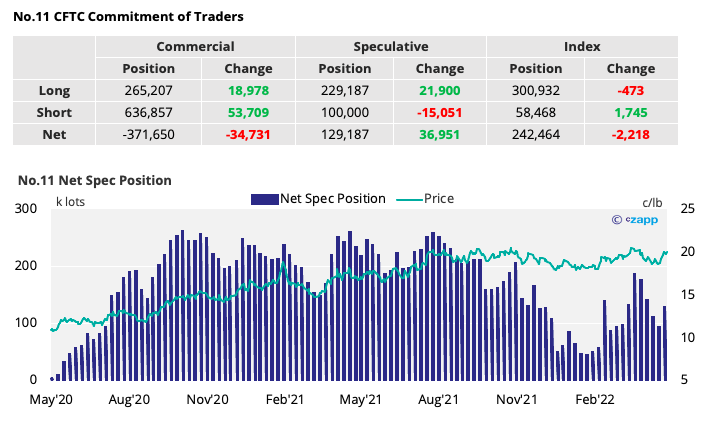

New York No.11 (Raw Sugar)

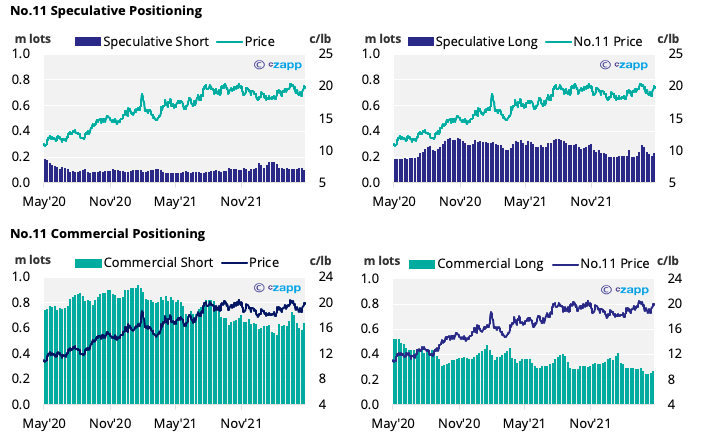

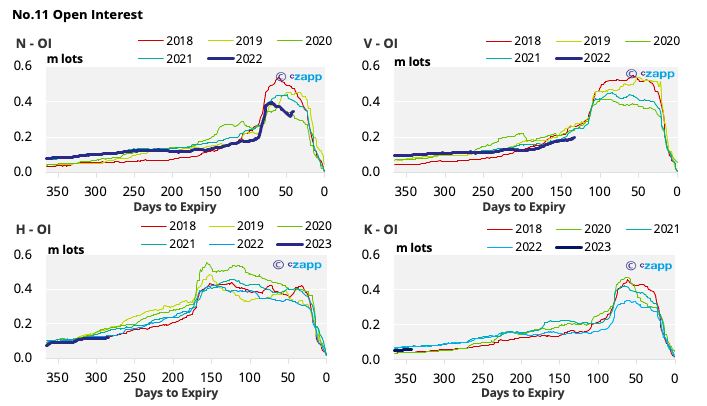

- In the week up to the 17th of May, the No.11 saw lows below 18.5c/lb and highs above 20c/lb – this has given opportunity for both consumers and producers to advance their hedging.

- Consumers added almost 19k lots of cover, whilst producers added over 53k lots as prices strengthened back above 20c/lb.

- 22k lots of spec buying helped drive prices upwards, reversing the trend of a declining net spec position seen in recent weeks.

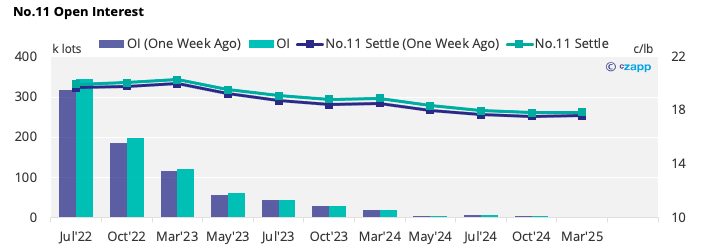

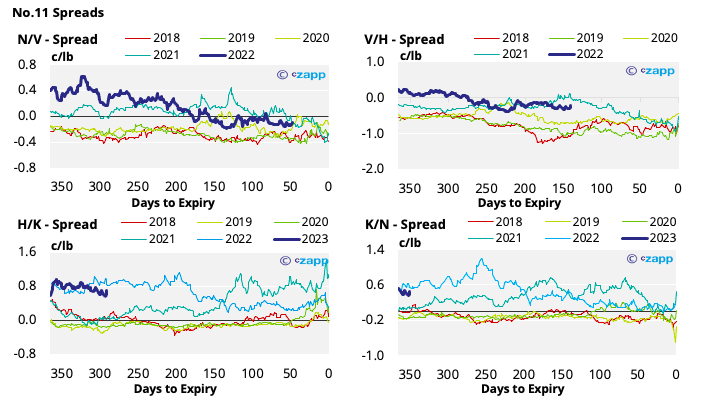

- The No.11 forward curve is still slightly contango towards H’23, then backwardated across 2023.

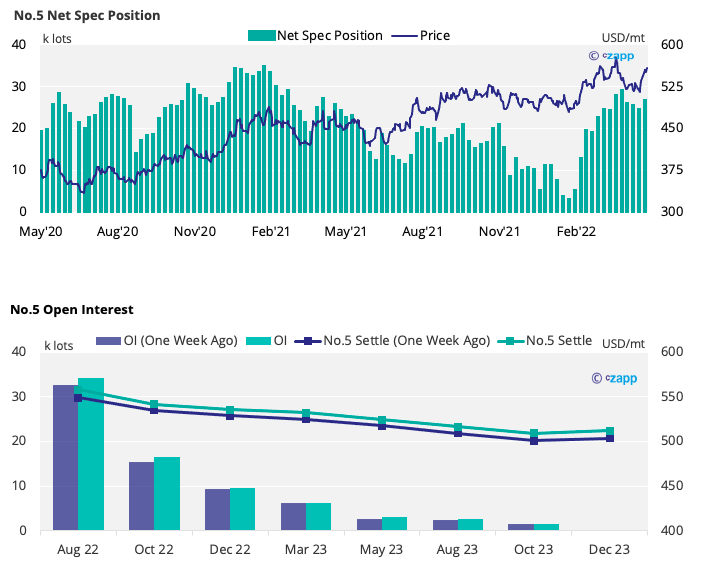

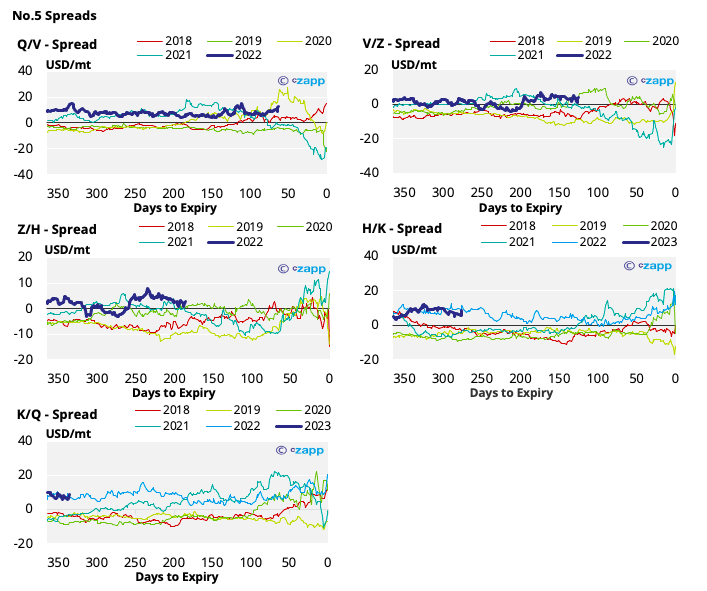

London No.5 (White Sugar)

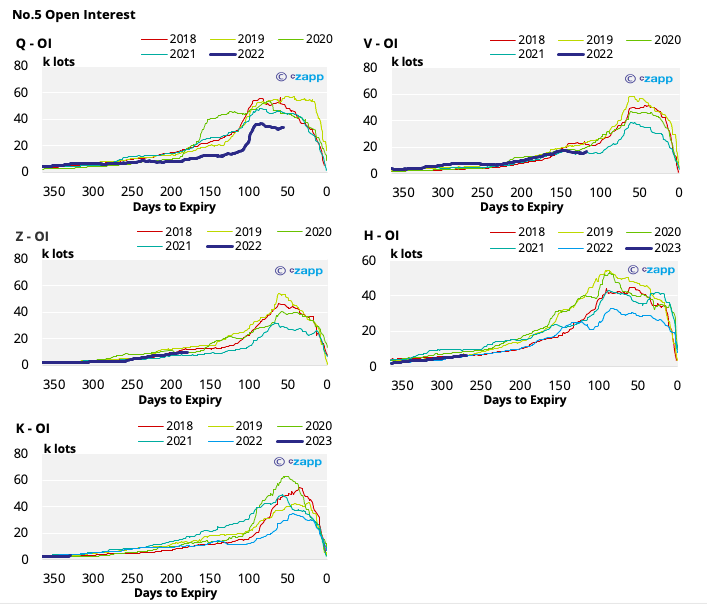

- The No.5 saw similar strength leading up to the 17th of May, with prices strengthening back up towards 560USD/mt

- White sugar speculators assisted the drive upwards, adding around 2k lots to their spec long.

- The white sugar forward curve remains backwardated across 2022 and 2023.

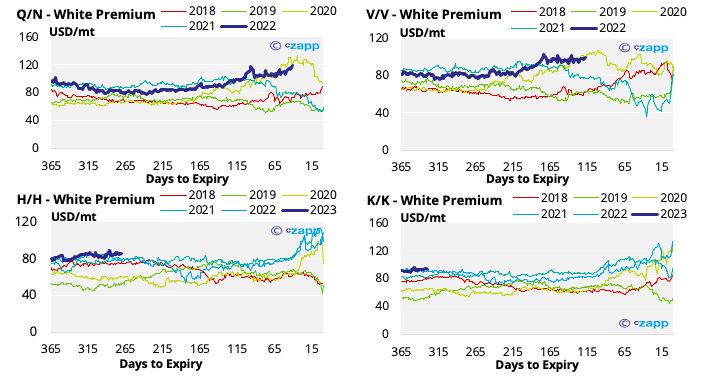

White Premium (Arbitrage)

- With No.5 strengthening more than the No.11, the white premium has widened to just below 120USD/mt.

- At this level we think more re-export refiners should be able to operate profitably.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix

Other Insights That May Be of Interest…