Insight Focus

- PTA futures continues to move higher, driven by rising PX prices.

- PET resin supply continues to remain constrained, export demand strong.

- Easing of COVID restrictions is expected to improve supply, boost demand.

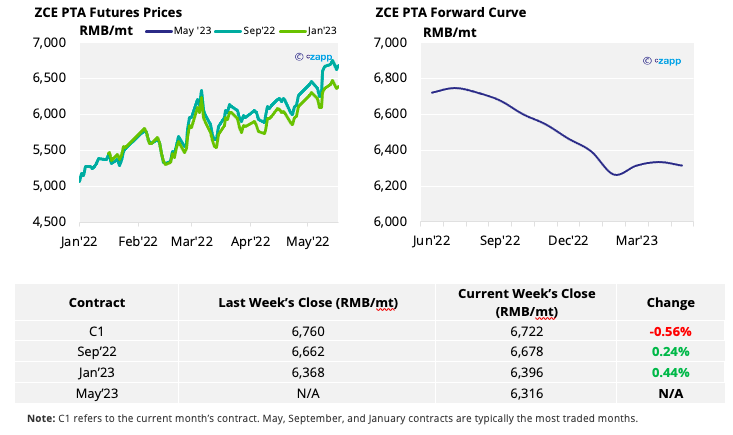

PTA Futures and Forward Curve

- PTA futures continued to press higher on the main contract months.

- Soaring PX prices coupled with the depreciation of the yuan continue to pressure PTA margins.

- Last week’s explosion at the South Korean S-Oil Onsan refinery may also affect the regional PX supply chain.

- PTA 12-month forward curve remains backwardated falling away into 2023.

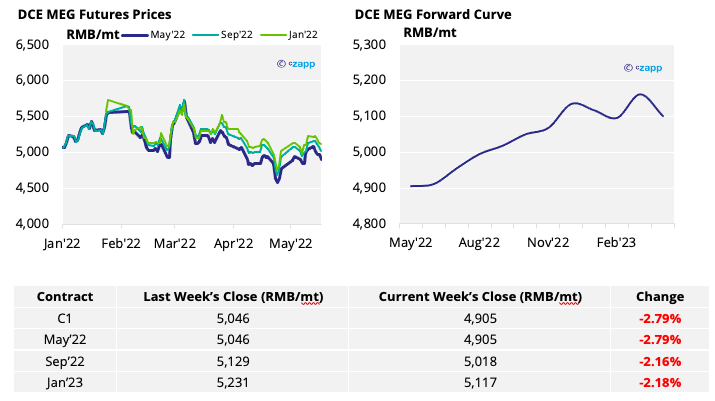

MEG Futures and Forward Curve

- MEG futures ended the week lower, with market fundamentals still bearish.

- The easing of COVID restrictions in Shanghai and across China is expected to result in a gradual recovery in MEG and downstream demand over the next month.

- However, high inventories are likely to keep prices in check despite sizable production cuts.

- The MEG forward curve remains in contango, with future contracts trading at a premium to current levels.

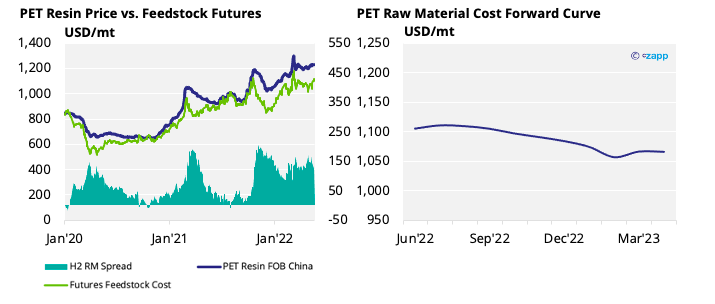

PET Resin Export – Raw Material Spread and Forward Curve

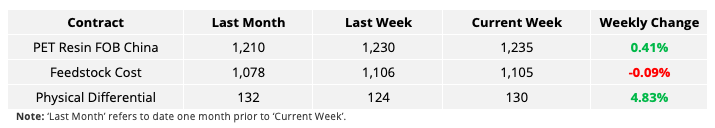

- Export prices for Chinese PET resin edged up slightly through the week, ending at USD 1,235/tonne.

- Following a sharp increase in feedstock costs at the end of last week, the PET resin physical differential played catch-up last week recovering to USD 130/tonne by Friday.

- The PET export-raw material forward curve remains partially backwardated over the next 12 months.

Concluding Thoughts

- Demand for PET resin exports remains strong, enabling producers to maintain high physical differentials.

- PET export supply continues to be constrained due to the impact of COVID restrictions, with production at several producers affected in recent weeks.

- In addition, authorities in Changzhou have now asked local manufacturing industries to stop or slow down production for a few weeks due to environmental protection concerns (ozonosphere damaged), and regional PET resin production has been reduced.

- However, with COVID restrictions beginning to ease, production and supply of resin is expected to grow over the coming month.

- Although logistical bottlenecks may slow the speed of any initial recovery, domestic and export demand is expected to increase through June and into July.

- With shortages across the Americas and major Asian exporters sold-out through the summer months, export margins are now expected to remain strong through Q3.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

China’s zero-COVID Approach Hampers PET Resin Exports

China’s Zero-COVID Policy Hits Domestic PET Resin Demand

European Buyers Under Pressure as PET Prices Hit New Highs

PET Resin Trade Flows: China’s COVID Response Slows Exports

Explainers That May Be of Interest…