Insight Focus

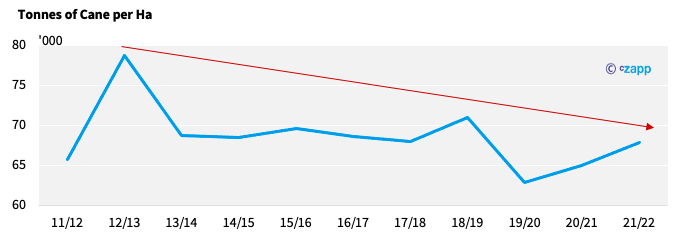

- Cane yields in Mexico have been in steady decline.

- This is due to the age of the cane and the low proportion of irrigated cane fields.

- This is unlikely to change without sustained support for the industry.

Our publishing partner Zafranet wrote a report last week about how Mexican sugar production was being maintained through increased acreage despite falling yields.

We decided to delve deeper into why Mexican yields are in

decline.

What are Sugar Cane Yields like in Mexico?

Most of Mexico’s sugarcane production comes from smallholders around the Veracruz region.

You can learn more about the industry in our Mexico Explainer

Cane yields have been in decline for several years:

There are two main factors affecting yields in Mexico: the age of the cane and whether it is irrigated.

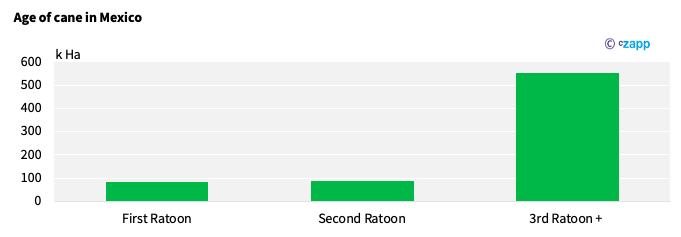

Most of the cane is in the third ratoon and older stage of life (ratoon indicates how many times it has been cut); and the younger the cane, the higher the yields.

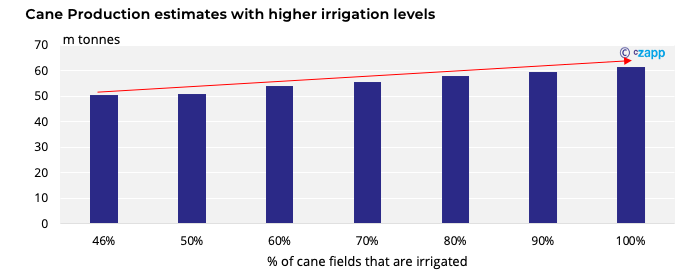

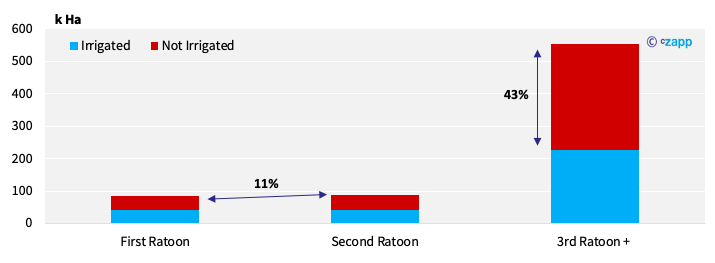

Similarly, about 60% of the cane is not irrigated. The better access cane has to water on a regular basis, the greater the yield.

Altogether, only 11% of the cane in Mexico is considered young (first or second ratoon) and is irrigated, the ideal situation for cane development.

On the other hand, 43% is now past the second ratoon and not irrigated.

So how could this trend be reversed?

Why did the industry let the cane age without a reliable water source? As is often the case, this is down to cost.

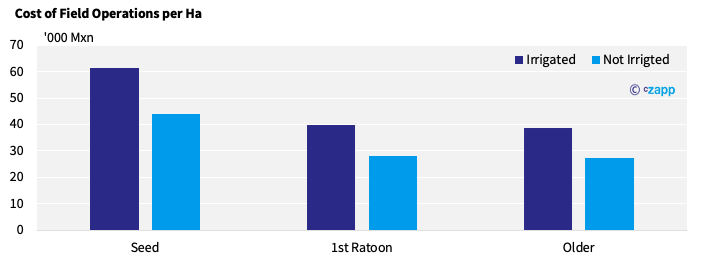

The cost per hectare of growing cane varies considerably depending on age and irrigation practices.

On average it costs MXN 15,000-20,000 (USD 750-1,001) per hectare for farmers to plant new cane compared with maintaining older cane in the fields. This is due to the higher costs associated with purchasing seeds, planting operations, and tending to young cane stalks.

Irrigation also adds on average about MXN 10,000/ha compared with non-irrigated costs.

Ideally, Mexican cane fields would become younger on average and be fully irrigated. However, the structure of the industry makes it highly unlikely this will be easily achieved. The government estimates there are about 170,000 cane farmers in Mexico. This means the average farm is 4.3 ha

Until more support is given to the farmers to invest in irrigation and younger cane, there are unlikely to be any significant changes in the yield profile. Even worse, with rising costs for all products, small-scale farmers are less likely to spend more on fertilisers and seeds, meaning yields will probably decline further over the next few years.

On the other hand, if the necessary investment is made and the cane fields are renovated Mexico could become a much more efficient in cane producer, with output growing by an estimated 30%.