Insight Focus

- Russia’s invasion of Ukraine aided the surge in prices

- Shrinking supply continues to cause concern for 2022/23

- Looking at history for a steer on the future

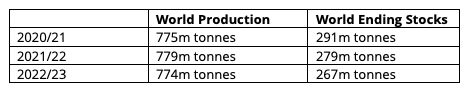

Falling stocks have been supporting wheat prices for much of the last two years.

Russia’s invasion of Ukraine on 24th February 2022, with both being so critical to the global trade of wheat, sent prices skyrocketing to all-time highs.

Last week the USDA’s monthly World Agricultural Supply and Demand Estimates (WASDE) report pegged global ending stocks for 2022/23 lower than anticipated, in their first forecast for the new year. Thus, the ‘War Bulls’ have been usurped by ‘Supply Bulls’ sending wheat prices ever higher.

A further driver for the bulls was the announcement over the weekend by India it would halt exports of wheat. A blow to those that were expecting up to 10 m tonnes of exports in the coming months.

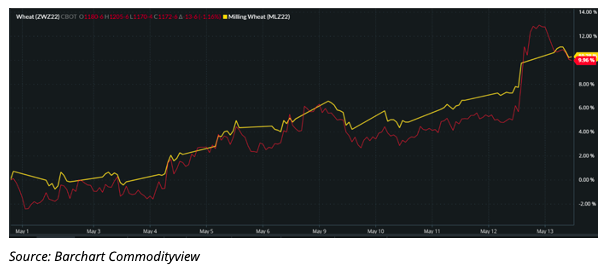

Chicago Soft Red Wheat (Red line) and Paris Milling Wheat (Yellow line) 1st – 13th May

(Percentage increase in prices)

History often repeats itself

Looking at past supply concerns may offer some assistance in considering the year ahead.

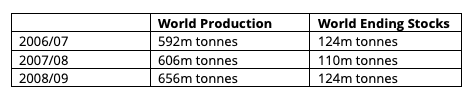

In 2007/08 there were record high wheat prices around the world as supply concerns drew on global stocks.

The consequences of the price hike in what was an extraordinary year for values, drove wheat farmers to increase production for 2008/09, uparound. 8%, with such profitable returns. This allowed a return to more comfortable quantities in store.

The consequences of the 2021/22 record prices could well be for farmers to plant more acres for the 2023 harvests.

An increase in planted area, coupled with global economic concerns leading to some demand erosion, as previously discussed), may help a restabilising of global wheat inventories.

Conclusions

Prices look well supported at present with war still raging in the Ukraine, limiting the world’s export trade, accompanied by the ban on exports by India.

Weather continues to be a market driver as production questions elsewhere currently remain unanswered.

A better picture of the 2022 harvest will emerge as combines roll in the coming months across the Northern Hemisphere.

The possibility of mounting pressure on Russia, in particular President Vladimir Putin, will hopefully see Black Sea wheat exports returning to more sensible levels by the latter stages of 2022.

High returns are likely to enthuse farmers to plant more acres in 2022 for the 2023 harvests.

There is no knowing what the next twist will be to the war in Ukraine and thus the possible short-term impact on the world of wheat.

Together with the increase in production costs for crops, it is hard to see a return to the lows seen in 2019.

However, as history suggests, a calming of the market storm may be on the horizon.

Wheat harvests in the Northern Hemisphere should be sufficient to supply the initial demand for new crop wheat. With high prices, the autumn months should see increased plantings progress for a larger 2023 harvest.

Expectations that 2023 will rebalance the woes of 2022 should lead to a more sustainable outlook with the final quarter of calendar 2022 and into 2023, encouraging some reduction in prices.