- Corn falls as US planting continues apace

- Wheat prices rise on supply fears from Ukraine, India

- Dry weather sparks wheat supply concerns in Europe

Nixal’s Forecast

We have increased our price forecast for 21/22 (Sep/Oct) Chicago Corn to around USD 6,60 /bu on average for the crop from USD 5,50-6.00/bu.

The average price since the new crop started is USD 6,37/bu.

Market Commentary

It was a volatile week for corn in Chicago with a bearish start on good progress on corn planting, a rally after the WASDE report was published, and finally a sell-off on Friday with good weather forecast for this week and profit taking. Wheat rallied in all regions on risk of lower supply. India announced a ban on private wheat exports.

US corn planting made good progress and is now 22% complete but this was below market expectations of 28%. This is compared with 64% last year and the

five-year average of 50%.

And then we had the May WASDE last Thursday forecasting a global stock draw of 20 m tonnes in all grains, with 13m tonnes coming from wheat and the rest almost entirely from corn.

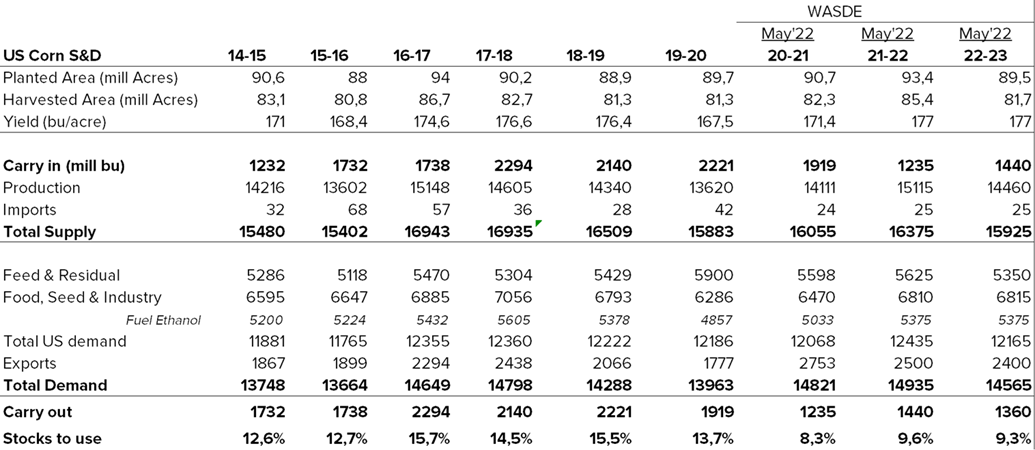

On the corn side, the May WASDE did not surprise with their acreage numbers which were the ones published in the prospective planting report at the end of March. But yield was left unchanged from 2021/22 at 177 bu/acre due to the slow pace of planting. The market was expecting a trend yield above 177 and rallied after the publication. See table below:

Despite cutting feed demand by almost 300 mill bu year on year due to high prices, the carry out number is 80 mill bu lower than in 2021/22 leaving the stock to use ratio at 9,3%. We have now three years in a row with stock to use below 10%.

Global corn ending stocks see a draw of 4m tonnes and only 19,5m tonnes of production in Ukraine compared with the. 42m tonnes produced in 2021/22. They are finally recognizing a drop in production from Ukraine.

Brazil’s Conab lowered their corn production forecast by 1,6ml tonnes to 114,6m tonnes.

In the Black Sea region, spring planting in Ukraine continues to make good progress with 70% of the area now planted. The agriculture minister maintains the projected area at 14,2 mill ha vs. 16,9 planted last year which represents a loss of area of 15%. Corn planting is 59,2% complete of the planting area in 2021 compared with 71,7% last year.

On the wheat side, the May WASDE also used the area published in the prospective planting report resulting in higher production but the 1,849 billion bu of total supply (including imports) are not enough to meet the 1,885 billion bu of expected demand resulting in a sizable stock draw of 36 mill bu.

Global wheat ending stocks see a draw of 13 mill bu including 21,5m tonnes of production in Ukraine compared with 33m tonnes in 2021/22.

US wheat conditions improved 2 percentage points to 29% good to excellent vs. 49% last year. French wheat conditions worsened 7 points to 82% good to excellent from 89% last week and 76% last year. Dry and hot weather in northern Europe is starting to worry French and German farmers.

Watching the Weather

We should have some repositioning this week after the May WASDE, but overall, the market is tight and we are back to looking at the weather. The forecast this week is showing rainy and cold weather in Brazil with a risk of frost, favorable conditions in the US for both wheat and corn, and another week of hot and dry weather in Europe risking wheat yields.

Wheat

is looking really tight with Europe facing a potential heat wave this week being a major Wheat producer, and the same thing is happening in India which after being hit by a heat wave has finally decided to restricts Wheat exports.

Let’s see how is the progress with planting in the US with favorable weather, but the delay is big and if farmers are not able to catch up quickly, too much corn planted outside of the ideal indow will result in lower yields.

Expect another week of volatility around European temperatures, US planting progress and the impact on the India export ban. Still, the high prices environment will stay.