Insight Focus

- Ukraine crisis, and an Indonesian export ban is cutting global vegetable oil supply.

- This is compounding a drought hit South American soy, and Canadian rapeseed supply.

- High prices encouraging more rapeseed planting in EU, UK.

European Rapeseed Oil Had Struggled

Russia’s invasion of Ukraine and Indonesia’s ban on palm oil exports have drained what was already a tightly supplied global market of vegetable oil. The resulting rise in prices is sustaining a rebound in rapeseed (canola) planting in the EU and UK after a period in which the crop was unpopular with farmers because of crop damage and falling yields.

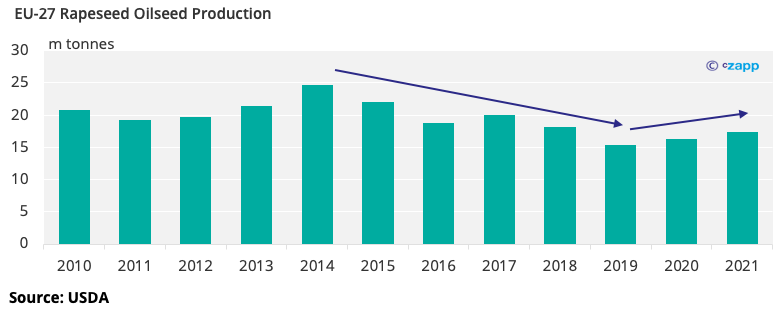

Growing rapeseed in Europe was becoming increasingly unpopular from 2014, and whilst it is currently looks in recovery, production is still well below the first half of the 2010s.

The EU is one of the largest producers of rapeseed globally, producing just over 17m tonnes in 2021, this has shrunk over the last half decade from a peak of 24m tonnes.

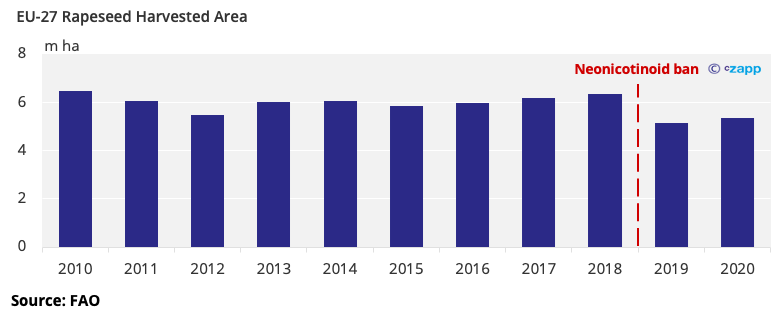

In the UK, harvested area has fallen by around 50% since 2017/18 as well.

The ban on neonicotinoid use in 2018 leaving the crop more vulnerable to pest damage, alongside poor weather had made the crop less attractive to European growers.

Though despite a large fall in area, production of rapeseed oil has declined more gradually because the crop has multiple uses, such as for animal feed.

However, with disruptions to key suppliers of vegetable oil throughout the last year an argument is emerging over whether European rapeseed can step in to help bridge this shortfall.

Export Bans, War, and Drought

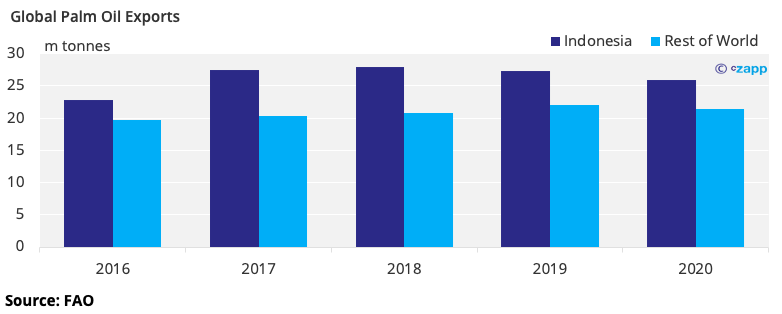

Indonesia banned palm oil and all other cooking oil exports in April to stabilize domestic prices in response to shortages.

Indonesia is the world’s largest producer of palm oil and usually accounts for around a third of global vegetable oil exports, and over half of all palm oil exports. This equates to almost 26m tonnes of palm oil a year that look set to be removed from the world market for the time being.

This is the latest in a succession of supply disruptions currently plaguing the world vegetable oil market.

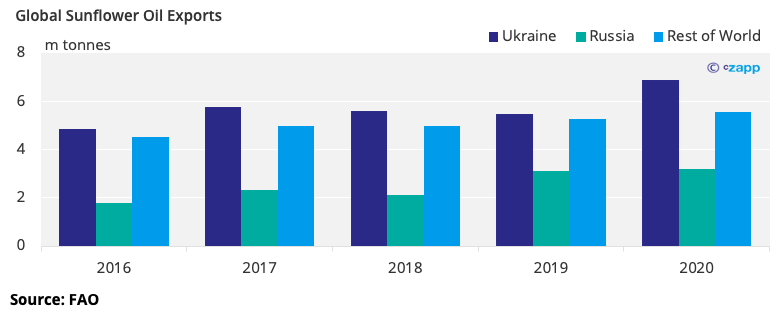

Since late February, Ukraine, the world’s largest exporter of sunflower oil, has had large stocks of sunflower seeds and grains stuck in storage across the country because of Russia’s blockade of its Black Sea ports.

Ukraine normally accounts for close to half of all sunflower oil exports globally and almost a quarter of EU consumption.

There are obvious question marks too around the availability of Russian sunflower oil, which in normal times would account for around 20% of global sunflower oil exports.

Global oilseed supply was already suffering before the war in Ukraine and an Indonesian export ban disrupted markets further. Droughts in key growing regions in 2021 heavily compromised rapeseed supply in Canada, and soybean crops across South America.

With shocks to major growers of each of the main vegetable oil crops: soy, rapeseed, and now sunflower and palm there is serious concern over sharply rising retail prices and shortages across Europe and elsewhere in the world.

High Prices and Shortages

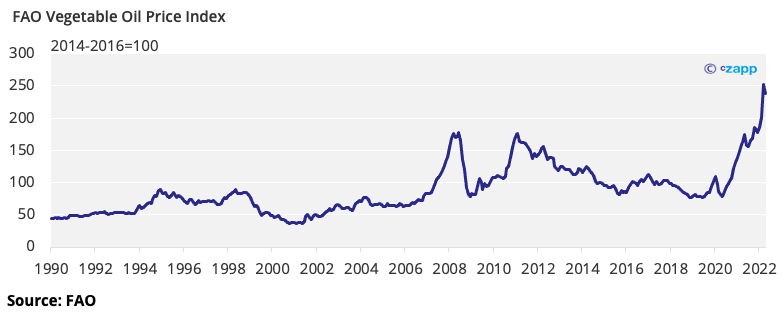

The FAO Vegetable Oil Price Index, a weighted average of 10 different cooking oils was already in sharp uptrend since the beginning of the Covid-19 pandemic, with the outbreak of war helping kick off a new of leg increases.

As such, prices are now on average over twice as high at the start of 2020.

Along with higher prices, many supermarket chains across Europe and the UK are now rationing the purchase of cooking oils to only a few bottles per customer.

The Tesco supermarket chain in the UK has recently announced changes to bottled sunflower oil to include other vegetable oils such as rapeseed oil, or replace the sunflower oil entirely but keeping containers labelled as sunflower oil.

A More Exciting Prospect for Growers?

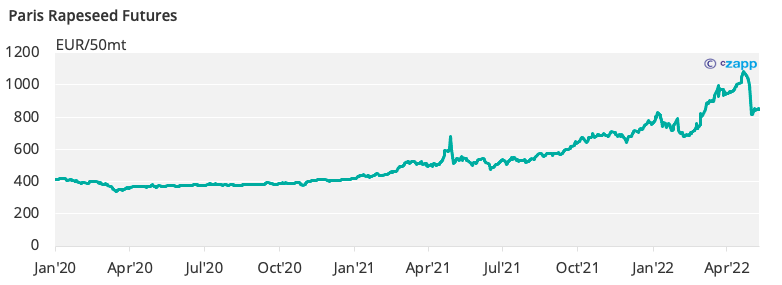

With tightening supply from Canada, and a general rally in commodities, rapeseed prices have seen a comeback in 2021 and into 2022, and now look like a more appealing prospect for growers.

Rapeseed is still currently the top priced oilseed, despite a fall at the start of May as a stronger dollar, higher interest rates and fears of a recession begin to hit commodity markets in general.

Additionally, with fertiliser costs also much higher on grower’s minds this season, rapeseed again looks like a more promising proposition given that it comparatively less fertilizer dependent than other similar crops.

Already, estimates place EU production to increase by 8% for 2022/23 because of higher prices, however, since sowing doesn’t usually begin until the summer in Europe there is still time for this to move higher if supply problems persist or grow as we move further into 2022.

Even at this level, this could ease imports by around 4m tonnes which would help ease supply woes.

In conclusion, whilst the current market and political situation is fortuitous for European growers to pivot back towards rapeseed and start to make inroads into the supply problems we are currently experiencing.

Let’s not forget the why area decreased in the first place, neonicotinoids are still banned in the EU and the UK, and climate change is making weather patterns ever more volatile and unpredictable.

This means that there is still plenty of risk associated with rapeseed, even if it is less than it used to be.

Other Insights that may be of interest

What the Energy Crisis Means for Inflation & Commodities

Interactive Data Reports that may be of interest …

Consecana Panel

CS Brazil Weather Update