Insight Focus

- Container shortage forcing Latin American exporters to ship in breakbulk.

- Switch to breakbulk adding to delays caused by container shortage.

- Congestion at Guatemalan ports typifies results of switch to breakbulk.

Guatemala’s logistics woes are typical of many sugar-producing countries in Latin America. A shortage of containers has forced them to look to exporting in breakbulk. However, the switch is throwing up its own problems such as port congestion, and shipping delays are likely to continue for the foreseeable future.

No Containers Available in Latin America

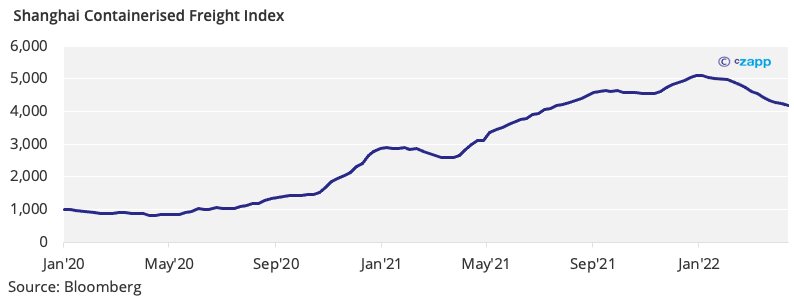

Container freight prices for all products, including sugar out of Latin America have been rising since COVID hit due to a lack of shipping containers. During the pandemic, as ports shut down it was difficult to get containers from one port to the next. As a result, prices increased and there was a delay in imports/exports. Even though restrictions are now easing, there is still a shortage of containers and even though prices also seem to be going down, they are still high compared with pre-pandemic levels.

Before the pandemic, exporters would order the number of containers they required, and these orders would usually be fulfilled hassle-free. Today, though, exporters can wait for as long as three months before they hear whether they’re able to get some, if any containers.

This issue particularly acute in Latin America as the distances between the region’s ports and the countries to which they’re exporting are greater, meaning the voyages are longer and thus less profitable for shipping lines. Sugar exporters have subsequently been forced to switch to shipping in breakbulk, creating further complications.

Transitioning from Container to Breakbulk Shipments

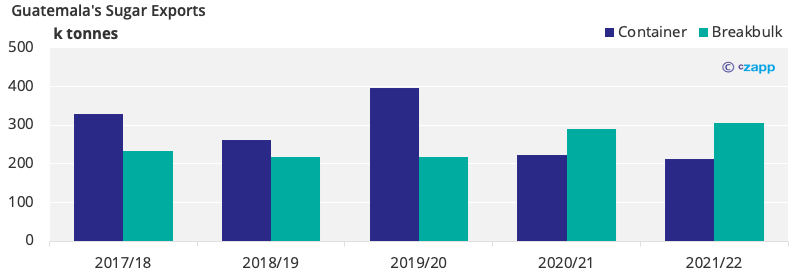

A growing number of countries in Latin America are switching from container to breakbulk exports, even if the logistics are more complex. Greater quantities are needed when shipping in breakbulk to fill up the ships even if the sugar is going to various destinations. This means that suppliers will load the ships, then send all the sugar to a specific port, where it is unloaded and then the cargo needs to be divided up into the right quantities and then shipped on to the final destination. All this creates additional logistics costs to transport the right amount of product to the right buyer. Guatemalan sugar exporters, for example, have been increasing their breakbulk shipments ever since COVID hit.

Despite switching to breakbulk, Guatemalan sugar is still being exported in bags, making loading more complicated and time consuming as the size of the shipments increases.

In Guatemala this has resulted in port congestion because the ports there don’t have the infrastructure to load and unload that many breakbulk shipments. This means storage costs have spiralled upwards as exporters wait to load their products onto ships.

Are Breakbulk Shipments Becoming the New Normal?

Latin American sugar exporters are increasingly turning to breakbulk to mitigate the container shortages. This switch is adding to the supply chain complications in the region because it’s causing shipping delays. There are delays at ports in Guatemala and Colombia as suppliers struggle to get containers in which to ship their products and grapple with the complexities of switching to breakbulk. The upshot is queues outside ports and shipment delays of around three weeks. Countries in the Caribbean with smaller markets that are highly dependent on sugar exports from Central and South America could suffer shortages as a result. This will continue to be the case unless container availability returns to 2019 levels; and there are no signs of that happening any time soon.

Other Insights That May Be of Interest…

Will Mexico Become a Regular World Market Sugar Exporter?

Seafarer Shortage Foreshadows More Freight Bottlenecks

Explainers That May Be of Interest…