Insight Focus

- US corn usage has changed from previous years following Russia’s invasion of Ukraine.

- More corn is being diverted to ethanol, animal feed as demand grows.

- Corn exports should also grow as the US fills the gap left by Ukraine.

The US is the world’s largest producer and exporter of corn. Domestically, the US uses corn to make ethanol as well as in a variety of foodstuffs for humans and livestock. Russia’s invasion of Ukraine has caused turmoil in the corn market, though, with Ukraine the fourth largest exporter of corn. More countries are now looking to the US with Ukrainian corn off the table. On top of this, President Joe Biden is allowing heightened use of E15 fuel ethanol this summer to combat high gasoline prices. The US should therefore divert more of its corn towards ethanol production. With exports and ethanol production likely to increase, the US should have lower stocks. What will this mean for food security and other products that have corn in them?

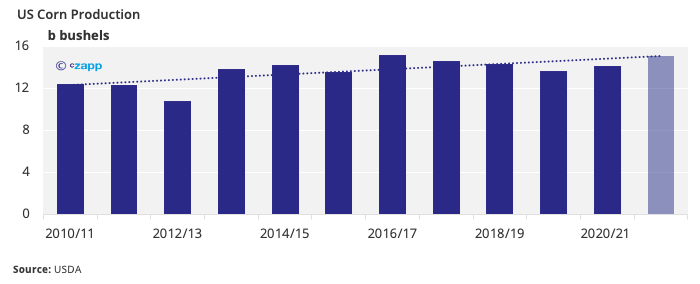

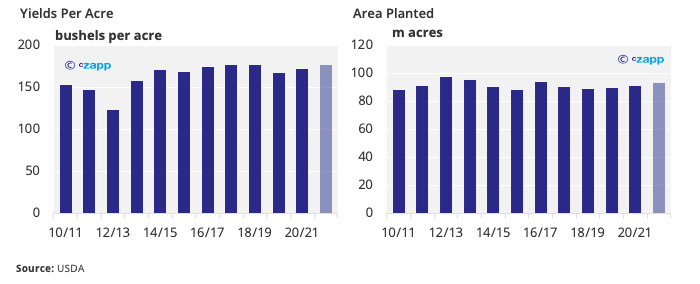

Corn Production Rebounds from the Pandemic

The US is the world’s largest corn producer and exporter.

Whilst production has been relatively stagnant across the past decade, it should increase this season due to higher yields and increased plantings compared to 2019/20.

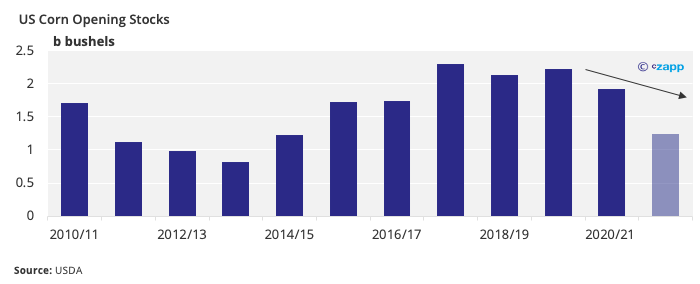

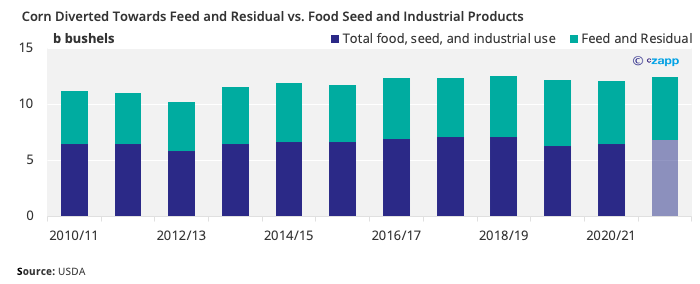

Opening stocks dropped to their lowest level since 2013/14 this season, though, as more corn was used to make ethanol and animal feed.

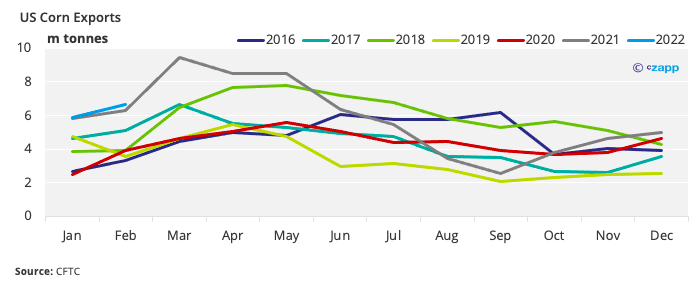

US Corn Exports Hit a Six-Year High in February

The US exported a record 6.7m tonnes of corn in February, and the USDA thinks corn exports will continue to increase in the coming months given the gap left by Ukraine.

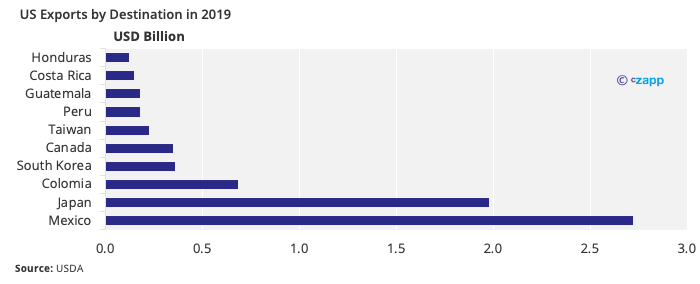

Most US corn usually goes to Mexico, Japan, and Colombia, but according to the USDA, more should go to Europe this season to plug supply gaps created by the Russian invasion.

Corn Diverted to Animal Feed Production is Set to Rebound

We’re already seeing the US divert more corn towards the production of food, corn seed, industrial products (starch, corn oil, beverage and industrial alcohol), and animal feed as demand recovers following the pandemic and because of Russia’s invasion of Ukraine.

Global demand for animal feed has grown since COVID hit, with logistics disruption leaving farmers worried that they would not have enough supply to maintain production. In the US, corn-based animal feed demand has grown as domestic barley supply has fallen following last year’s drought. In addition, Ukrainian sunflower oil exports have been slashed by the invasion, meaning oilseed-based animal feed supply has decreased and demand for corn-based animal feed has increased.

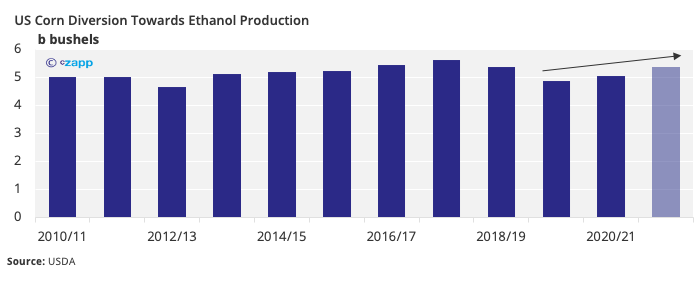

Increases in Ethanol Production as Biden Changes the Ethanol Mandate

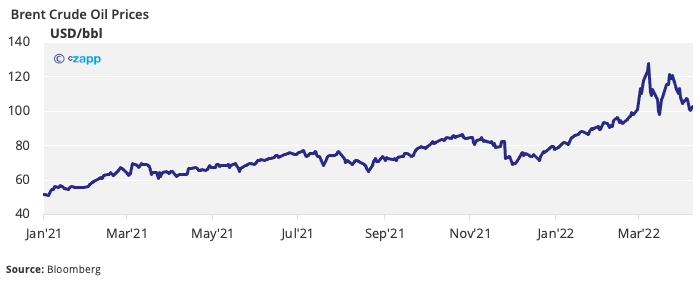

On the 12th April 2022, Biden announced that gas stations could continue to use E15 fuel throughout the summer, perhaps to combat rallying Brent crude oil prices, whilst reducing reliance on oil imports.

This should mean US ethanol production increases, with 5.4b bushels of corn being diverted towards ethanol production in 2021/22, up 400m bushels on the year.

Cron Sweetener Production Should Continue to Fall

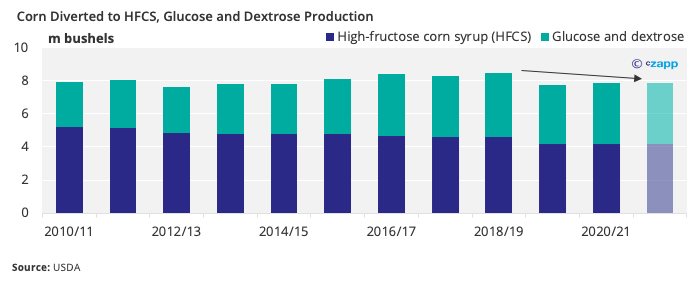

These changes should mean the US has less corn available for use in other products. The country’s high fructose corn syrup (HFCS), glucose and dextrose production has been decreasing for at least a decade, and this trend looks set to continue.

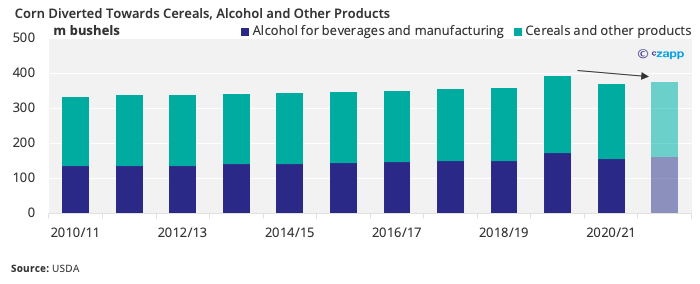

In addition, corn diverted towards the production of alcohol for beverages, cereals and other products has also been decreasing, though not by as much as other sweeteners.

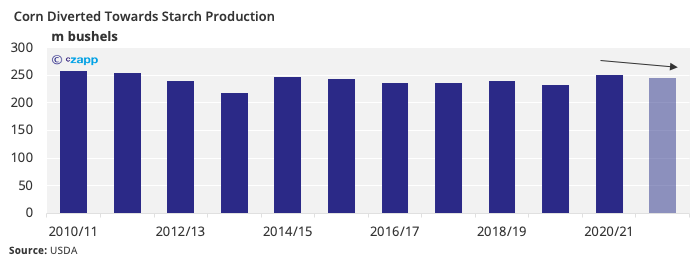

Another output that should decrease this season is corn starch. Corn starch demand has grown significantly over the past decade. However, as more corn is diverted towards ethanol, corn starch production could take a hit.

What Does This All Mean for Corn Supply?

The US, Brazil and Argentina are all expecting large corn crops this season, so global supply should be sufficient for this season.

The USDA has been tight-lipped about whether it’ll revise its opening stocks forecast for 2022-23, but it seems highly likely that the US will be using more corn than it has done previously to make ethanol and animal feed. Exports should also increase with Ukrainian supply off the table, so upward adjustments from the USDA seem highly probable.

Other Insights That May Be of Interest…

Brazil and USA to Boost Fertiliser Output on Russian Invasion

Will Mexico Become a Regular World Market Sugar Exporter?

Explainers That May Be of Interest…