Insight Focus

- PTA producer margins remained weak last week on subdued demand due to COVID controls.

- PET resin export prices tracked feedstock costs higher, face prospect of weaker demand.

- The raw material forward curve remains flat, slightly backwardated over the next 12 months.

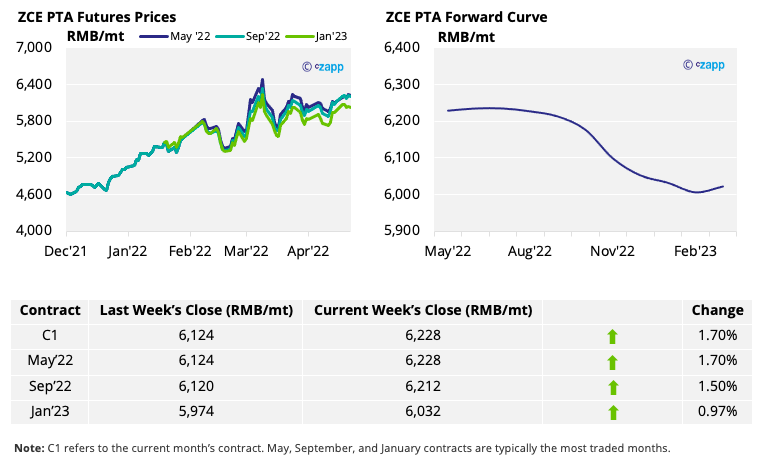

PTA Futures and Forward Curve

- PTA futures closed higher on the week, tracking feedstock costs.

- However, weaker downstream demand resulting from COVID controls has lengthened supply in April and narrowed the PTA-PX premium.

- Polyester operating rates may show signs of increasing as logistics disruptions begins to ease, but operating rates for packaging and fibre in many parts of the country are still low.

- The PTA 12-month forward curve remains backwardated, with future months trading at a discount to the current May contract.

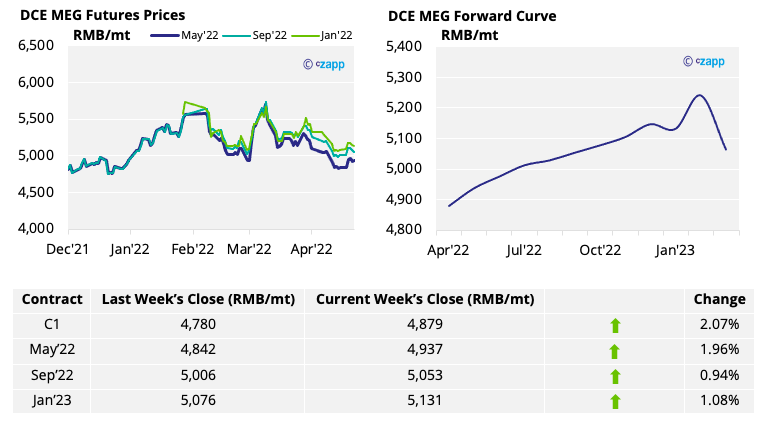

MEG Futures and Forward Curve

- MEG futures moved up last week, driven by the rebound in crude oil prices.

- Market sentiment remains cautious as high port inventory and weak polyester demand persist.

- The MEG forward curve remains in contango with future contracts, trading at a premium to current levels.

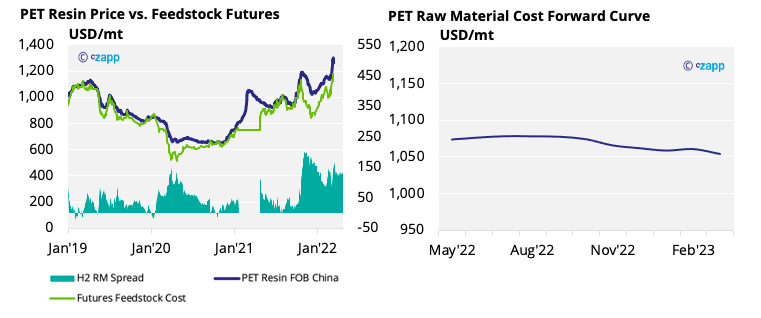

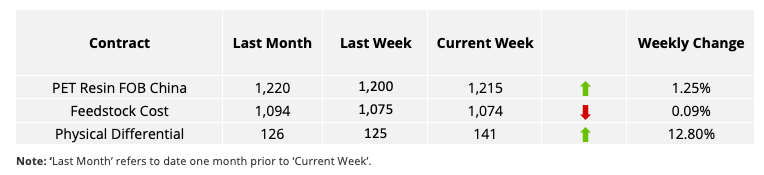

PET Resin Export – Raw Material Spread and Forward Curve

- With China’s PET resin export prices closing the week at 1,215 USD/tonne, the current physical differential to feedstock futures widened by around 16 USD/tonne to 141 USD/tonne.

- The PET export-raw material forward curve remains flat, slightly backwardated over the next 12 months.

Concluding Thoughts

- Whilst PET resin operating rates show signs of rising, consumer demand for beverage and apparel remains weak due to COVID restrictions in Shanghai and other parts of China.

- Weaker domestic demand and additional PET capacity coming on-stream in Q2 should raise supply.

- Chinese PET producers also face the prospect of weaker export demand, which is likely to place greater pressure on domestic sales in the coming months.

- Despite huge export orders in hand, March PET resin export statistics fell short of expectations.

- Exporters must now navigate bottlenecks and congestion to meet schedules.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

European Buyers Under Pressure as PET Prices Hit New Highs

PET Resin Trade Flows: China’s COVID Response Slows Exports

Chinese PET Industry Faces Biggest COVID Outbreak Since 2020

European PET Market Rocked by War in Ukraine

Explainers That May Be of Interest…