Insight Focus

- Record high fertiliser prices have tempted farmers to use cheaper, substandard fertilisers.

- The use of ineffective fertilisers could cut cereals production in 2022.

- The Chinese government took various measures to ensure normal spring planting.

China is the world’s largest producer and consumer of fertiliser, accounting for around 28% of global production and consumption each year. Almost half of China’s fertiliser goes towards grains production, which has been climbing since 2003. However, with fertiliser prices at record highs, some farmers are applying substandard fertiliser, which could hit yields and act as a roadblock to China’s next grains harvest. Any drop in production could have serious implications for global food security. Although China is home to just 9% of the world’s arable farmland, its crops feed 19% of the world’s population.

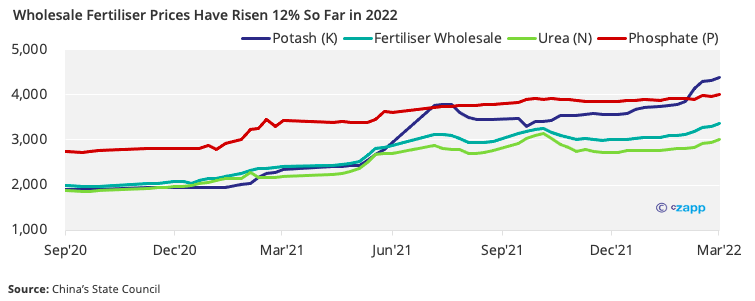

Record Fertiliser Prices Push Farmers Towards Substandard Fertilisers

China’s Central Television (CCTV) network recently reported on “fake fertiliser” use in Guizhou when spring plantings were underway. According to the network, farmers were lured in by the cheaper price and misleading labelling to buy what they thought was a compound fertiliser. This so-called compound fertiliser contains only nitrogen, whereas China’s National Standards of Compound Fertiliser (GB/T 15063-2020) stipulate that compound fertiliser must include at least two of the three nutrients (nitrogen, phosphate, potash), with the content clearly marked on the packaging.

Which Fertiliser is the Scarcest for Chinese Farmers?

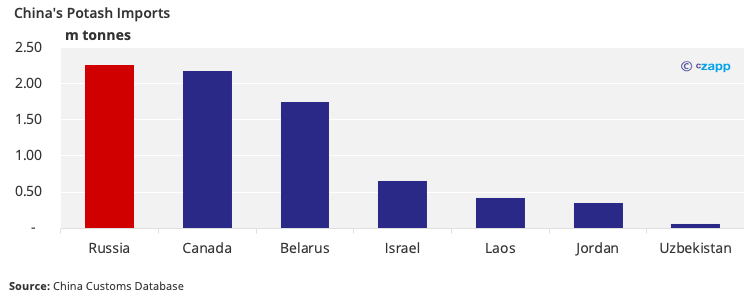

China is self-sufficient in nitrogenous and phosphatic fertilisers, exporting over 5m tonnes of each to the world market every year. However, it imports the majority of the potassic fertiliser it consumes. It imported 7.67m tonnes of potash last year, most of which came from Russia (29%), Canada (28%) and Belarus (23%).

Phosphatic fertilisers are therefore the main concern for China, with Russian supply severely disrupted following its invasion of Ukraine. China’s potash fertiliser prices jumped to a record 5,133 RMB/tonne (810 USD/tonne) in March, up 22% on the year.

Which Crops Could Be at Risk?

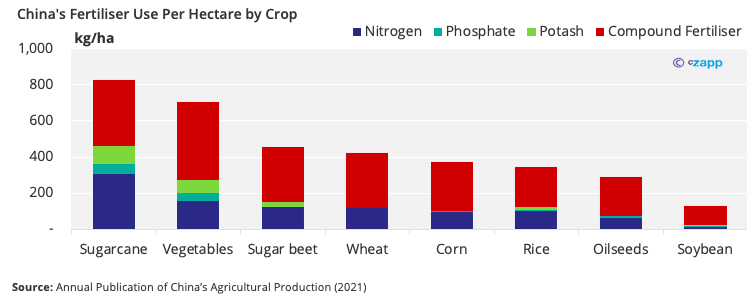

Sugar crops and vegetables are the most fertiliser intensive crops cultivated in China, with soybean the least intensive.

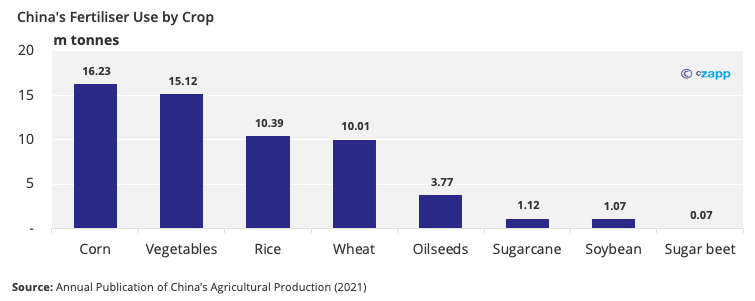

However, corn is the top consumer by acreage, with rice and wheat also large consumers.

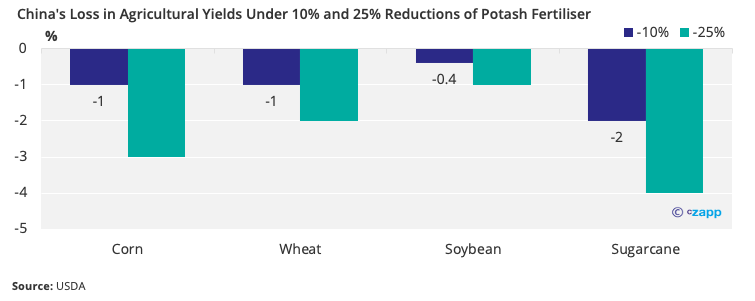

Research by USDA shows that corn yields could decrease by 1% if potash fertiliser applications drop 10%. If these yield losses materialise, we could see crop losses of 2.7m tonnes for corn, 1.37m tonnes for wheat, 2.1m tonnes for rice and a 2m tonnes for sugarcane.

However, with food security a top priority, the Chinese government is acting to ensure successful spring plantings by:

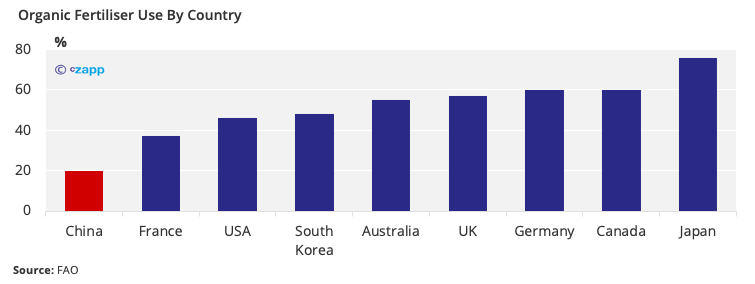

- Encouraging farmers to increase their use of organic fertilisers

- Releasing 1m tonnes of potassic fertiliser stocks to calm prices

- Allocating a RMB 20 billion (USD 3.13 billion) subsidy to grain farmers in March to mitigate the impact of rising input costs

Beyond this, 104 state-owned agricultural supply companies have promised not to raise fertiliser prices.

Leeway to Reduce Fertiliser Use?

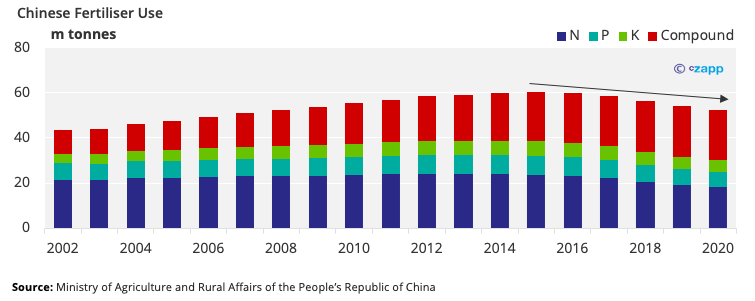

The above 104 companies are just a small fraction of the 2,344 such companies operating nationwide, so their contribution may have little impact. That said, China has cut synthetic fertiliser use by 13% in seven years, and it still has room for further reductions (5-8m tonnes for nitrogenous, 3-5m tonnes for phosphatic and potassic).

This could mean reduced applications in 2022 may not have as great an impact as we fear. China has a long history of over application, which causes issues including soil degradation and pollution. For context, China’s nitrogen fertiliser use was around 400 kg/hectare – far above the recommended safe upper limit (225 kg/hectare).

China’s organic fertiliser consumption is also very low in China, at 20%, compared with 46% in the USA.

Concluding Thoughts

- Use of less potassic fertiliser could cut Chinese corn yields by 1-3%, wheat by 1-2%, sugarcane by 2-4%.

- Chinese government measures on spring planting could mitigate the effects of lower fertiliser use.

- Past overuse of fertiliser could balance out some if underuse now.

Other Insights That May Be of Interest…

Should CS Brazil Fear China’s Sugar Self-Sufficiency Drive?

China’s Sugar Self-Sufficiency Drive Hits Eucalyptus

China’s Coldest Spell in 45 Years Hits Sugar Production

Explainers That May Be of Interest…