Insight Focus

- COVID-19 and Russia’s invasion of Ukraine have rocked global supply chains.

- Countries are shortening supply chains and forming new relationships to mitigate shortages.

- Lingering pandemic, Ukraine crisis thwart return to ‘old normal’.

COVID has disrupted supply chain logistics for over two years now. Russia’s invasion of Ukraine has added fuel to the fire with sanctions and security issues limiting the movement of staple commodities. To mitigate these issues, countries are shortening their supply chains, diversifying their trade relationships, and boosting their own production. Some of these changes rely on major investment, though, so could reflect what global supply chains will look like for years to come.

Lingering Effects of COVID

COVID restrictions may be easing in most parts of the world, but the Americas’ supply chain remains severely disrupted.

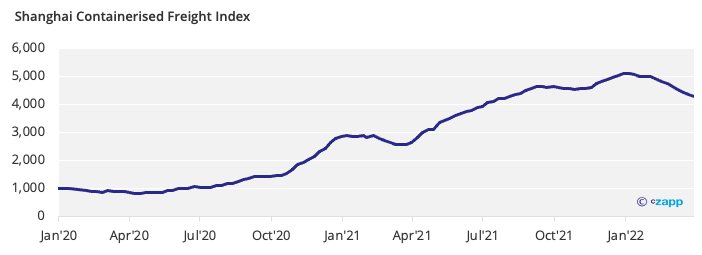

Recent lockdowns in China (the origin of almost 14% of Guatemala’s imported goods), together with Russia’s invasion of Ukraine, mean Guatemala is struggling to import electronics, plastics, fertilisers, and clothing. High freight costs and container shortages are also adding to running costs and logistical strain.

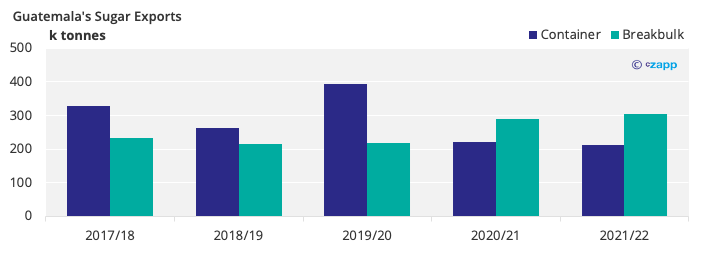

Guatemala’s sugar exports by container took a hit when the pandemic first started and they’re yet to recover.

In Colombia’s confectionary market too, producers are struggling to import raw materials and candy from its usual suppliers (the US, Brazil, Argentina, Germany, and Mexico). According to Infobae, supply in Antioquia’s candy shops is down by somewhere between 30 and 40%.

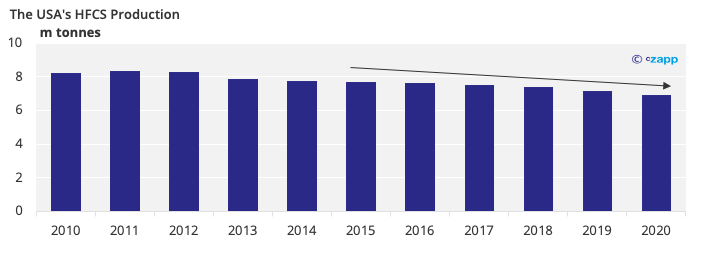

Beyond these examples, the USA’s High Fructose Corn Syrup (HFCS) industry is struggling to get back up and running as maintenance schedules faced delays through COVID due to labour shortages.

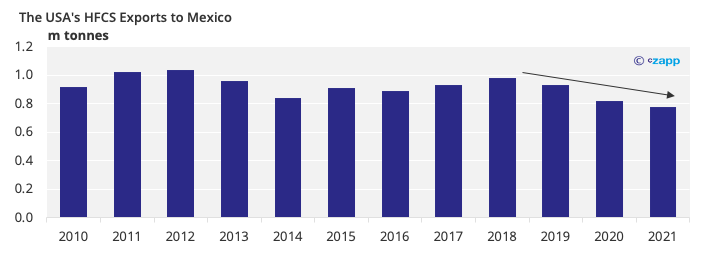

We don’t think production will rebound any time soon as energy and logistics costs have climbed following Russia’s invasion of Ukraine. Additionally, more of the USA’s corn is being used to make ethanol as gasoline prices surge, and importers are turning to the USA with Black Sea supply down, leaving less available for HFCS production. This could hit Mexico’s world market sugar exports as it soaks up its surplus to offset lower HFCS supply from the US.

What Measures are Being Taken to Mitigate These Issues?

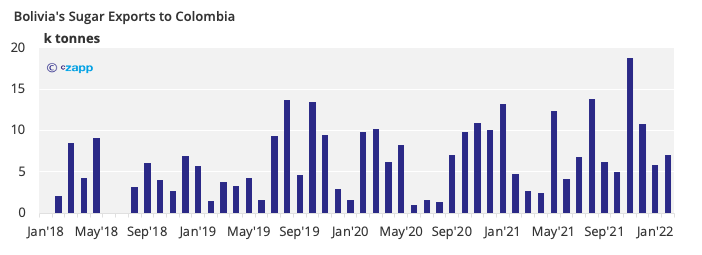

To allieviate these issues, manufactures are shortening their supply chains to minimise freight expenditure and energy consumption. Energy costs have surged following the Russian invasion. This means countries are looking to export to places that are closer to them. Bolivia, which has a free trade agreement with Colombia, formerly shipped most of its sugar there. These flows have now decreased, though, with the sugar instead going to Chile or Peru by truck.

Truck transportation is cheaper than ocean freight, but the ongoing fuel price rally means even the cheaper options are becoming less affordable.

We’re also seeing countries diversify their trading partners. Brazil and the US plan to start importing fertiliser from Nigeria as well as Canada, reducing their reliance on Russian supply. They’re also looking to boost their own production.

Concluding Thoughts

As industries continue to find their feet post COVID, and Russia’s invasion of Ukraine disrupts supply chains, we’re seeing major changes that may indeed become the “new normal”. The move towards diversifying sources of imports as well as re- and near-shoring supply chains could well be long term because of the cost involved. Another argument in making such changes long term is the realisation that there’s great risk involved in relying on a small number of suppliers.

Other Insights That May Be of Interest…

Brazil and USA to Boost Fertiliser Output on Russian Invasion

Will Mexico Become a Regular World Market Sugar Exporter?

Explainers That May Be of Interest…