Insight Focus

- The No.11 has traded above 20 c/lb.

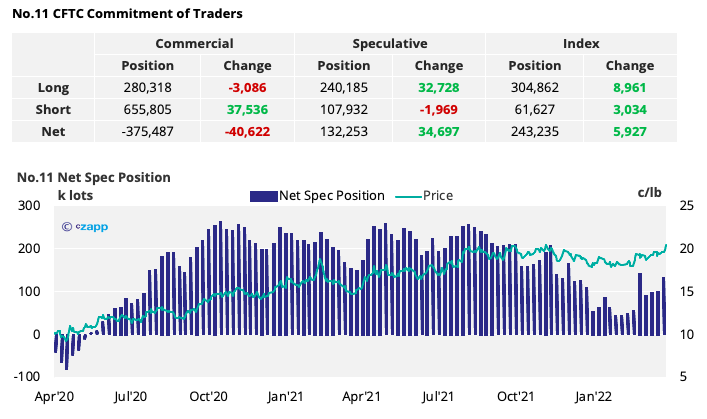

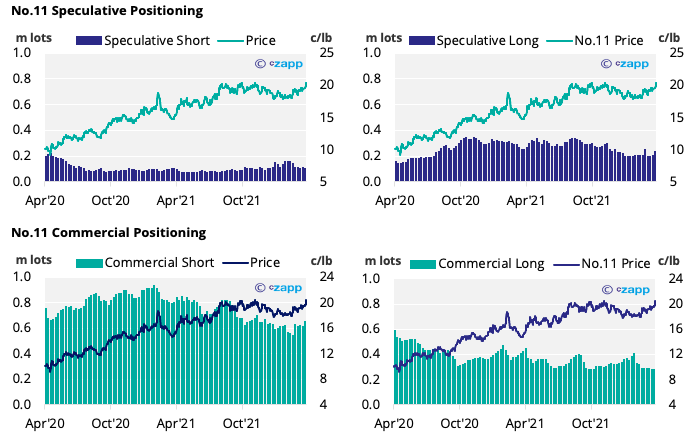

- The net spec position climbed with strong spec buying.

- This has facilitated additional producer hedging.

New York No.11 (Raw Sugar)

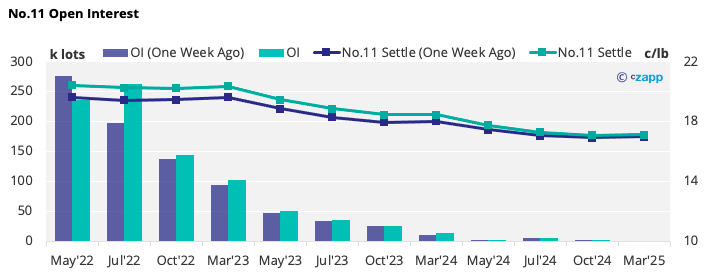

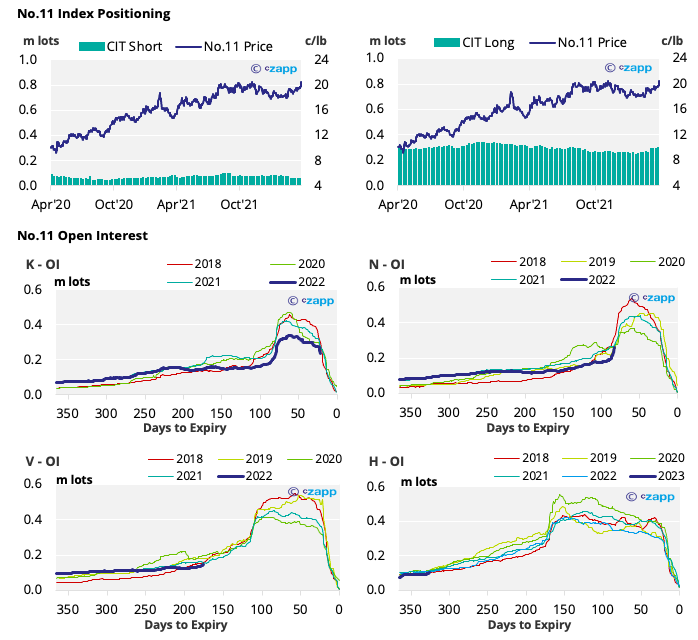

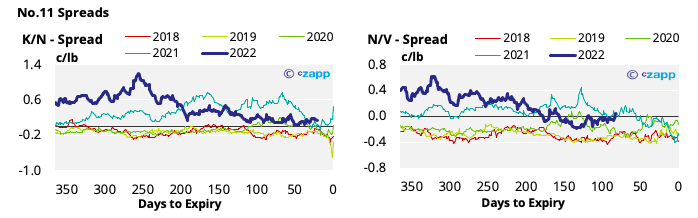

- No.11 prices have been steadily climbing, surpassing 20c last week for the first time since Nov’21.

- As of the 5th April, speculators have added over 32k lots of long positions, pushing the net spec position upwards.

- Over 37k lots of producer hedges have been added in light of higher prices, leaving producers well covered at a very good price compared to previous years.

- The forward curve remains mostly flat across the rest of 2022.

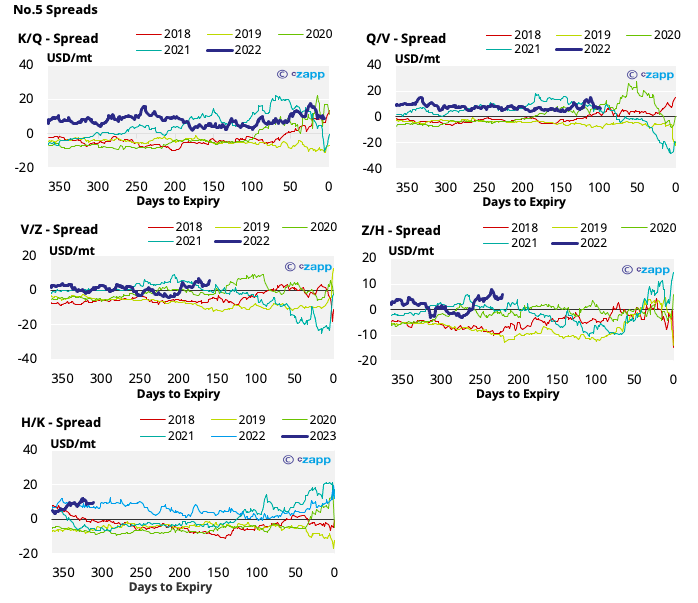

London No.5 (White Sugar)

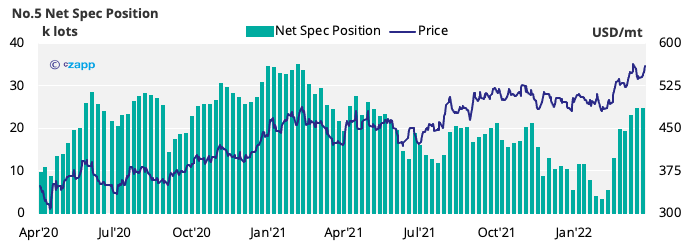

- Following it’s retreat at the beginning of the month, white sugar prices have rallied back to 560 USD/mt this last week.

- This rally is yet to be reflected in speculation, with the white sugar net spec position decreasing slightly as of the 5th April.

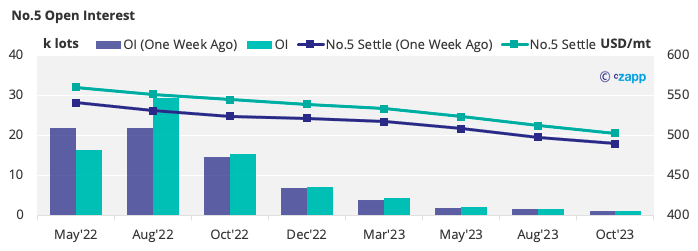

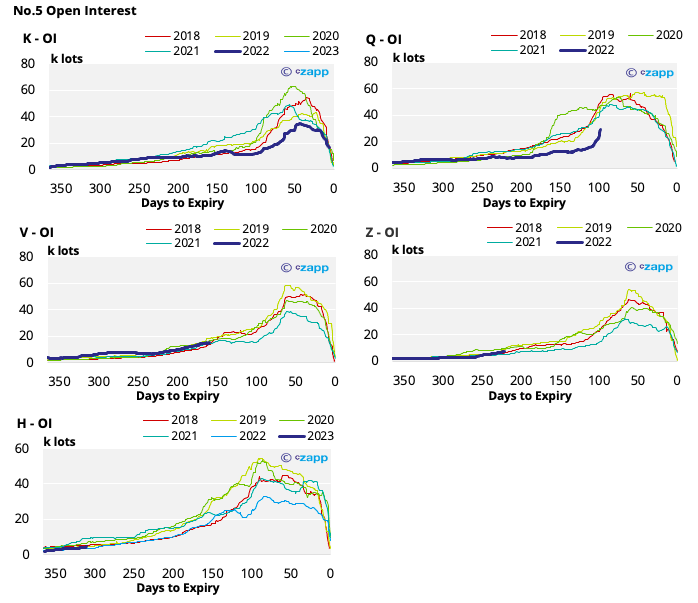

- With the K’22 set to expire soon, open interest in the Q’22 has ticked upwards.

- Prices have rallied across the board, so the white sugar futures curve remains backwardated through till the end of 2023.

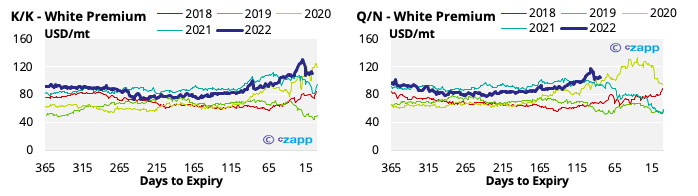

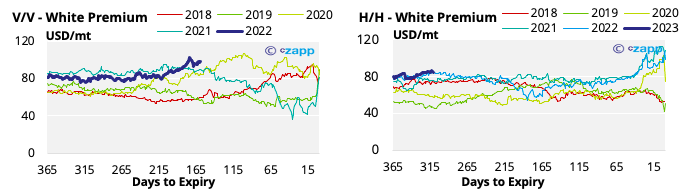

White Premium (Arbitrage)

- The white premium has stabilised at around 110 USD/mt.

- After accounting for increased energy prices, we think re-export refiners can still operate profitably above this level.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix

Other Insights That May Be of Interest…