Insight Focus

- PTA and MEG Futures prices softened as COVID controls weakened polyester demand.

- PET resin export premiums moved up as logistics disruption tightened short-term availability.

- Loss of export volume to Russia and Ukraine expected to be felt beyond April/May.

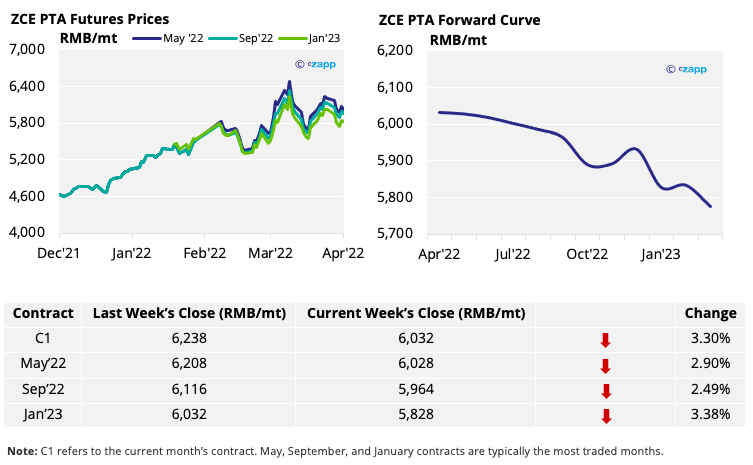

PTA Futures and Forward Curve

- The PTA futures market closed lower for the week on Friday, driven, in part, by softening crude prices following ceasefire talks in Ukraine and a massive release in US crude reserves.

- Lockdowns and COVID controls in China are also resulting in weaker polyester demand from fibre producers, as apparel orders suffer with restrictions.

- PTA production cuts of 25% have been announced by at least four major producers, which may tighten supply and support prices in the near term.

- The PTA 12-month forward curve remains in backwardation, with future months trading at a discount to the current April contract.

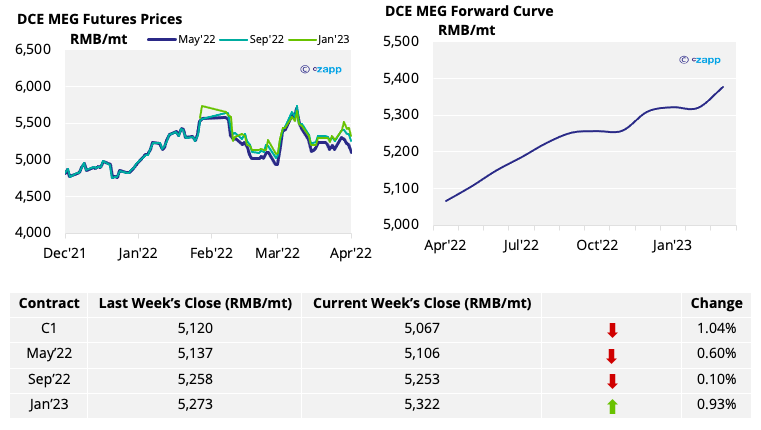

MEG Futures and Forward Curve

- MEG futures drifted lower through the week.

- With margins in negative territory, some producers have either announced production cuts or entered maintenance periods.

- Despite high inventory and weaker polyester demand, the forward curve remains in contango with future contracts, trading at a premium to current levels in the hope of improved supply/demand.

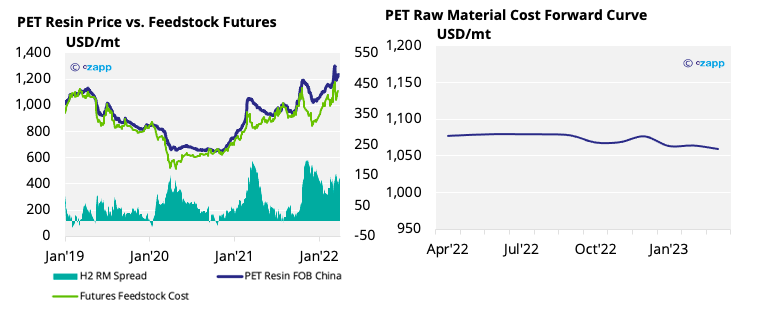

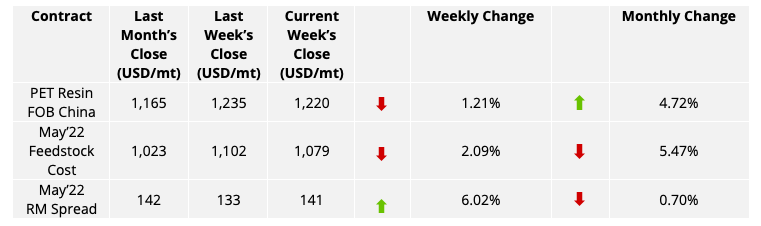

PET Resin Export – Raw Material Spread and Forward Curve

- With China’s PET resin export prices closing the week at 1,220 USD/mt, the current premium over feedstock futures has risen slightly by around 8 USD/tonne to 141 USD/tonne.

- The PET export-raw material forward curve remains flat, with minimal backwardation over the next 12 months.

Concluding Thoughts

- COVID controls within China have not only shaken logistics, but a retrenched consumer base is leading to weaker domestic demand prospects.

- The recent slowdown in deliveries to the main ports of Shanghai and Shenzhen have tightened resin export availability amid already low inventory levels.

- PET resin export premiums should remain firm in the short term as a result.

- Beyond April/May, export demand should soften with lower sales to Russia and Ukraine, as well as fewer European enquires.

- Continued tight availability across the Americas means there’s opportunity to absorb volumes exists elsewhere.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

Chinese PET Industry Faces Biggest COVID Outbreak Since 2020

European PET Market Rocked by War in Ukraine

PET Resin Trade Flows: Europe Awaits Asian Shipments

What the Ukraine Crisis Means for PET

Explainers That May Be of Interest…