Insight Focus

- China’s PTA futures closed higher on the week driven by elevated crude prices and logistics disruption.

- COVID controls within China and port closures are cutting domestic and export supplies.

- Short-term PET resin premiums should remain stable on continued tight supply.

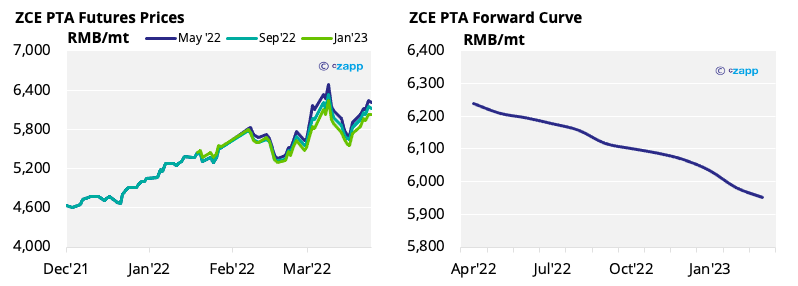

PTA Futures and Forward Curve

- The PTA futures market closed Friday higher for the week after crude oil’s price rebound through the first half of the week.

- PTA’s 12-month forward curve remains backwardated.

- COVID-induced logistics disruption in China has tightened PTA supply.

- Future months are trading at a discount to the current April contract, with tighter supply adding short-term support.

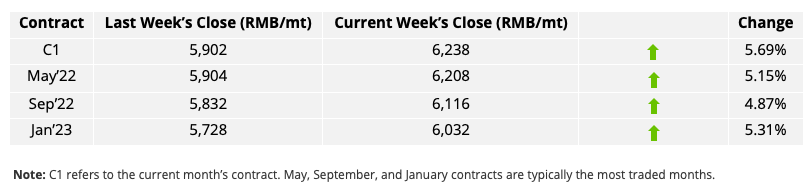

MEG Futures and Forward Curve

- MEG futures drifted lower through the week.

- Several producers have announced output cuts and maintenance periods, but port inventory remains high.

- The current forward curve is in contango with future contracts, trading at a premium to current levels.

- Growing demand from the polyester sector should help drive this recovery.

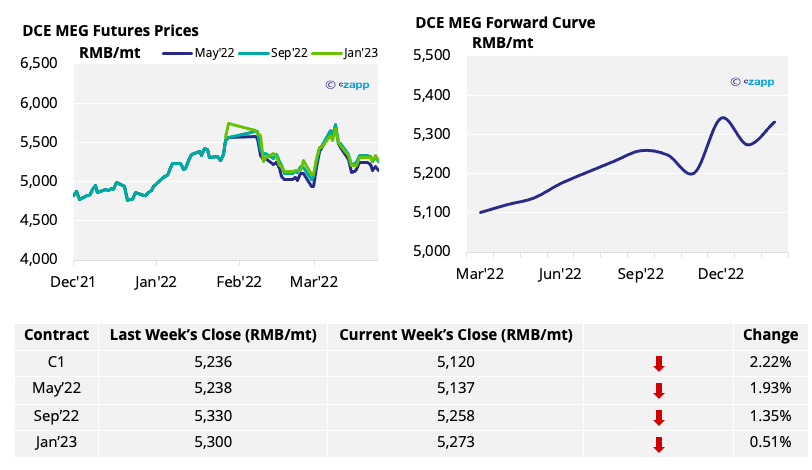

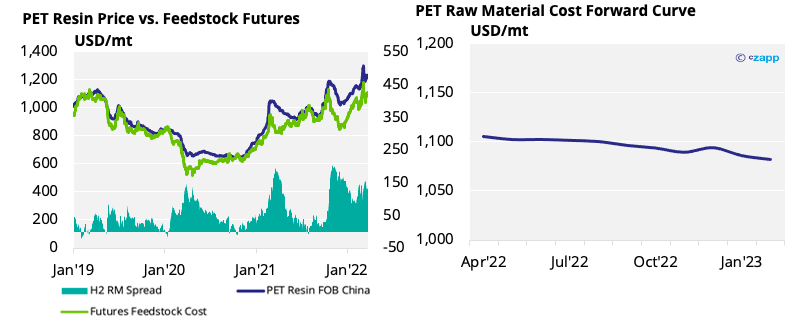

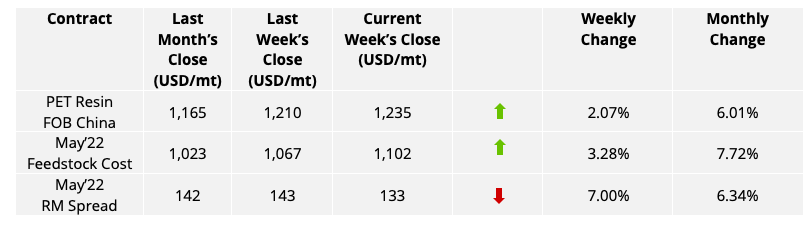

PET Resin Export – Raw Material Spread and Forward Curve

- The current premium over feedstock futures has fallen by around 10 USD/tonne to 133 USD/tonne with China’s PET resin export prices closing the week at 1,235 USD/tonne.

- The PET export raw material forward curve remains flat, slightly backwardated over the next 12 months.

Concluding Thoughts

- COVID controls within China are disrupting logistics, reducing raw material and PET resin supply for domestic use and export.

- PET resin export premiums should remain high in the short-term, supported by low inventory and large order volumes in hand.

- Beyond April/May, export demand may be blunted by the Ukraine crisis and the loss of the summer shipment window to Europe.

- The opportunity to absorb volumes elsewhere exists with availability still tight across the Americas.

- PET export premiums should normalise in the medium-term, though.

For PET hedging enquiries, please contact the risk management desk at mkirby@czarnikow.com.

For research and analysis questions, please get in touch with glamb@czarnikow.com.

Other Insights That May Be of Interest…

European PET Market Rocked by War in Ukraine

PET Resin Trade Flows: Europe Awaits Asian Shipments

What the Ukraine Crisis Means for PET

Explainers That May Be of Interest…