Insight Focus

- Crude oil prices hit record highs following Russia’s invasion of Ukraine.

- This week’s Ask the Analyst addresses why Indian sugar prices have been seemingly unscathed by this.

- If you’d like us to answer one of your questions in an upcoming edition, please email will@czapp.com.

Why Have Indian Sugar Prices Been Unscathed by Crude Oil’s Drastic Rally?

World market sugar prices often move with crude oil prices, largely due to the link between gasoline, ethanol, and sugar in Brazil. Petrobras generally aligns Brazil’s gasoline prices with global oil movements, most recently increasing prices by 18% after crude oil’s rally.

In India, though, the relationship is different. Its energy and agricultural markets are heavily regulated, meaning crude oil movements barely impact its sugar and ethanol prices.

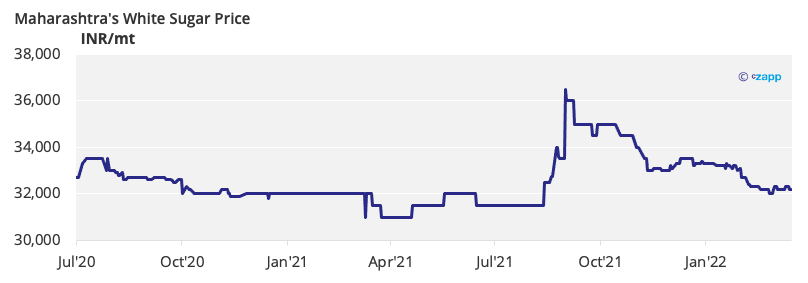

Domestic sugar prices are regulated by the government-set minimum support price, meaning they have little to no relation with world market prices. The minimum support price dictates the lowest price sugar can be sold at, giving prices a floor when stocks are high, plus the flexibility to increase when supply tightens during the off crop.

Ethanol prices are also regulated, this time to ensure profitability for that derived from B molasses, C molasses and cane juice, regardless of supply and demand. This has been the case since 2018, when the government renewed its ethanol ambitions and set a 20% fuel blend target.

As India’s ethanol is only intended for domestic use, and imports can only be used for non-fuel purposes, there’s also limited interaction between the domestic and global ethanol markets.

The Indian vehicle fleet contains very few flex-fuel vehicles compared to Brazil too, further weakening the link between oil, gasoline prices and ethanol prices.

Even without regulation, higher gasoline prices are unlikely to impact India’s ethanol and sugar markets the same way they do in Brazil.