Insight Focus

- Chinese PTA and MEG closed lower for the week, dragged down by crude’s collapse.

- Whilst Chinese PET resin export prices have eased, the premium over feedstock futures has widened.

- PET raw material costs should remain rangebound in near term.

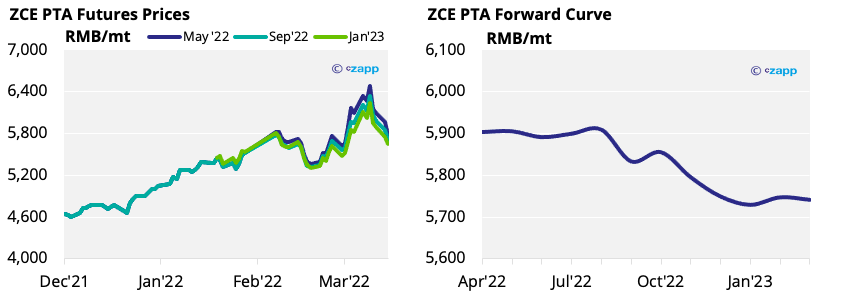

PTA Futures and Forward Curve

- The PTA futures market closed lower for the week on Friday.

- This was primarily driven by crude oil’s sharp drop.

- The PTA 12-month forward curve is backwardated, once again, with future months trading at a discount to the April contract.

- Improved supply and demand may add support inthe short term.

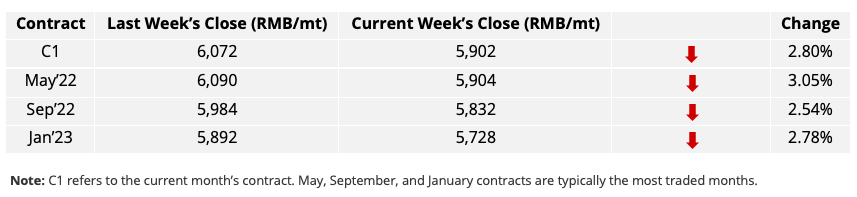

MEG Futures and Forward Curve

- MEG futures receded, tracking the fall in crude oil.

- The forward curve is now in contango with future contracts trading at a premium to April levels.

- High inventory levels may limit upward pressure in short-term.

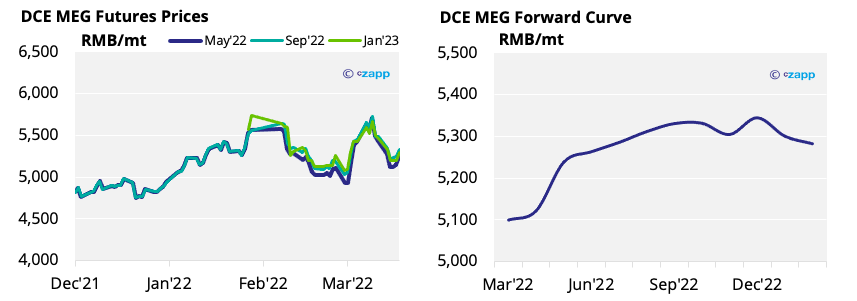

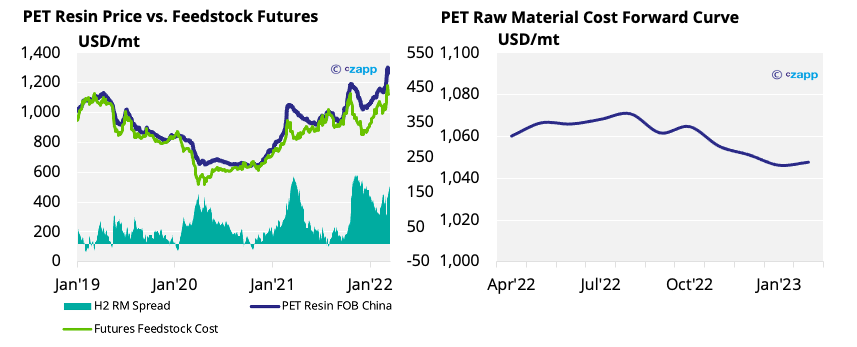

PET Resin Export – Raw Material Spread and Forward Curve

- With China’s PET resin export prices closing the week at 1,210 USD/tonne, the current premium over feedstock futures has widened to 143 USD/tonne.

- The PET export-raw material forward curve is flat.

- Current spot offers for June shipment are around 1,230 USD/tonne FOB, having dipped to 1,200 USD/tonne mid-week.

Concluding Thoughts

- Crude oil should remain volatile in the near term, with PTA and MEG futures reacting accordingly.

- Record orders for Chinese PET resin over the last six months will continue to support the high premiums over feedstock for the reminder of H1’22 due to lack of availability.

- Premiums may even widen slightly with peak demand in April/May, lending support to current indications for June shipment.

For PET hedging enquiries, please contact the Risk Management team, MKirby@czarnikow.com.

And for Research and Analysis, please contact GLamb@czarnikow.com.

Other Insights That May Be of Interest…

European PET Market Rocked by War in Ukraine

PET Resin Trade Flows: Europe Awaits Asian Shipments

What the Ukraine Crisis Means for PET

Explainers That May Be of Interest…