Insight Focus

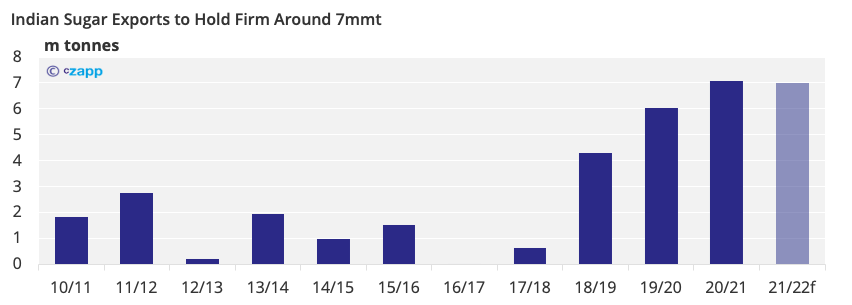

- India could export 7mmt of sugar in 2021/22, up 960kmt tonnes from two seasons ago.

- This week, we discuss the implications these flows might have on the world market.

- If you’d like us to answer one of your questions in an upcoming edition, please email will@czapp.com.

What Does Larger Indian Sugar Production Mean for the World Market?

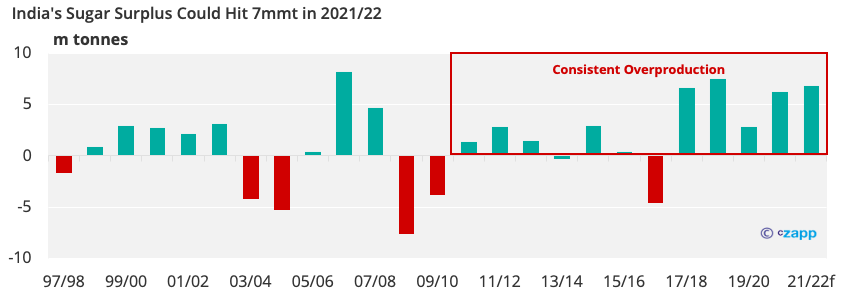

For those not aware, we think India will produce at least 32.5m tonnes of sugar this season, prompting one of its largest surpluses to date.

This 7m tonne surplus should be exported onto the world market. Sugar prices have rallied following Russia’s invasion of Ukraine and so India’s mills have been busy signing export contracts and should continue to do so.

Increased Indian exports could mean CS Brazil’s mills don’t need to maximise their sugar mix this year. Sugar prices shouldn’t need to trade as high either, as raws supply will be stronger.

Thanks to India, there will also be a little more breathing room if Brazilian rainfall is poor between and when its next cane crop is harvested in April/May.

Read Our Latest Trade Flow Insight to Better Understand the Implications of Stronger Indian Exports

Other Insights That May Be of Interest…

Russia & Ukraine Grain Flows Likely to Be Disrupted into H2’22

What the Ukraine Crisis Means for PET