Insight Focus

- Mexico could export around 500k tonnes of sugar onto the world market until 2030.

- Its production should rise despite lower domestic demand.

- Reduced High Fructose Corn Syrup consumption could dent exports to world market.

Mexican sugar consumption has been falling for the past five seasons. Its production, on the other hand, has held largely firm. With Mexico unable to export its entire surplus to the US, we think it’ll become a more significant world market supplier going forward. Of course, if its HFCS consumption drops as corn rallies, its export availability could weaken with more of the surplus being snapped up by the industrial consumers.

Mexican Sugar Demand Falls Whilst Production Increases

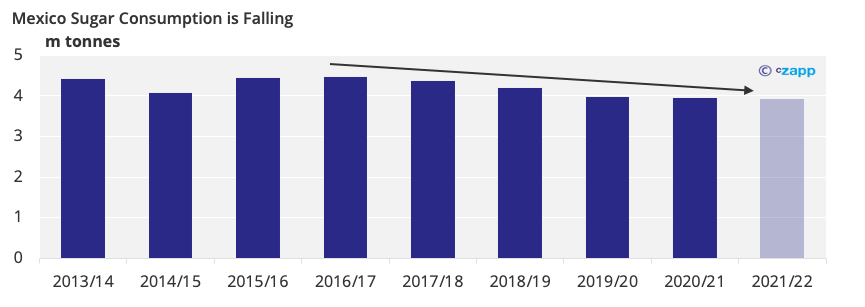

Mexican sugar consumption has been falling since the 2016/17 season.

Often, when consumption decreases, production follows suit. This has not proven to be the case in Mexico, though.

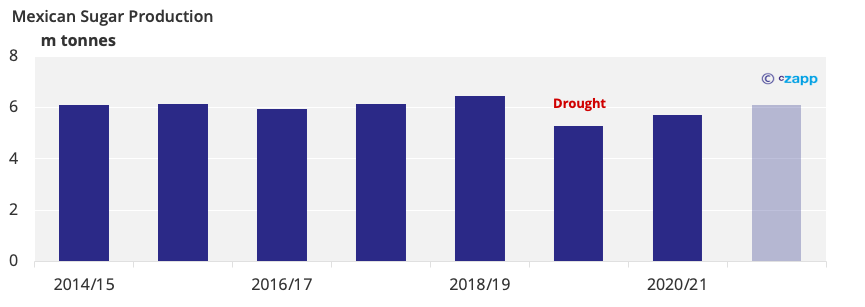

Since 2019, Mexico’s cane farmers have been demanding a higher sales price, which is used to calculate how much the mills pay for their cane. Eventually, they were successful and domestic prices strengthened as a result.

Strong domestic prices have enabled production to hold firm at around 6m tonnes, minus the drops seen in the drought-hit 2019/20 and 2020/21 seasons.

What Happens with the Excess Sugar?

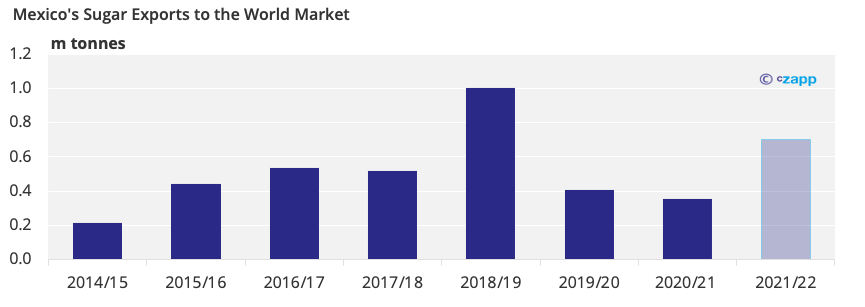

As the gap between production and consumption widens, there’s a surplus of sugar Mexico must place. This is often exported to the USA and, if necessary, the world market.

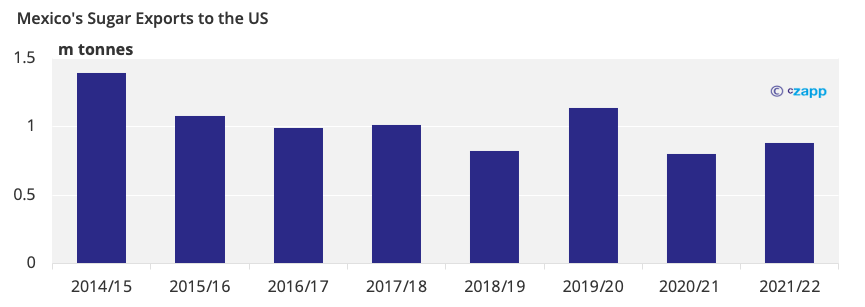

As Mexican and US sugar prices are protected, and way above the world market, the mills are reluctant to sell outside of the US, Mexico, and Canada. This became more in 2014 when the Suspension Agreement allowed the US control of Mexican import volumes.

Since this point, Mexico’s exports to the US have steadied to average 1m tonnes each year, and it has become a more significant world market supplier.

Mexico has the capacity to increase world market volumes too. We think it’ll export around 700k tonnes to the world market this season, with this figure climbing to around 1m tonnes by 2030. If this materialises, Mexico will be exporting close 2m tonnes of sugar a year (inc. US volumes), making it the fifth-largest exporter in the world.

HFCS Imports Take a Hit as Corn Prices Increase

Mexico’s sugar exports may be smaller than we’re forecasting if its High Fructose Corn Syrup (HFCS) imports drop, though.

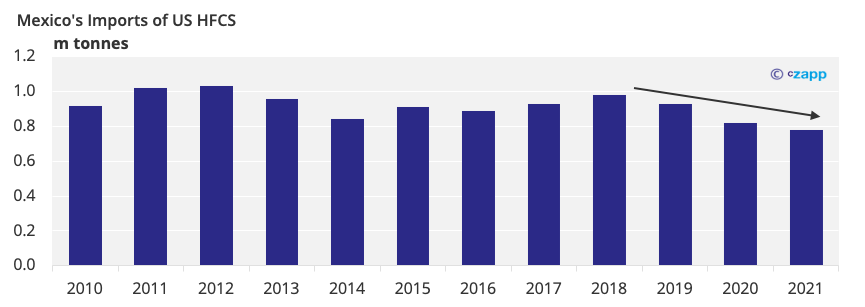

Most of its HFCS has traditionally come from the United States, but these flows dropped through COVID as US producers battled with increasing costs of production and labour shortages.

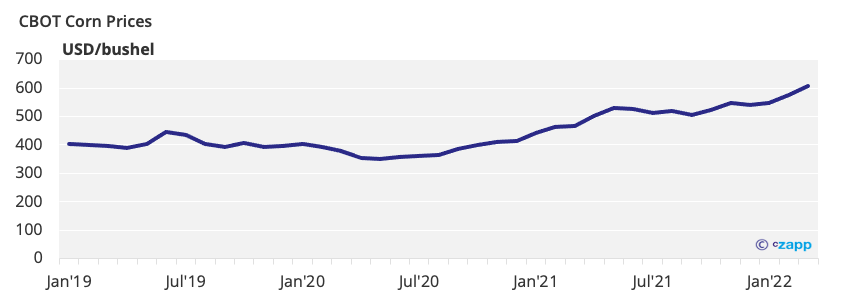

And now, global grains prices have gone berserk following Russia’s invasion of Ukraine, making HFCS more expensive. HFCS demand is price sensitive meaning, if prices increase, Mexico’s food and beverage producers will decrease HFCS imports and use cheaper domestic sugar instead.

As it stands, Mexico still has enough sugar to become a world market exporter, but if more of this is consumed but the country’s industrial consumers, its export availability will weaken.

Other Insights That May Be of Interest…

The Mexican Sugar Decline: Taxes, COVID or Something Else?

Explainers That May Be of Interest…