Insight Focus

- Russian invasion throws PET supply chain and procurement planning into chaos.

- European PET prices leap higher, averaging 160 EUR/mt in March, driven by surging feedstock costs.

- Uncertain production costs are a challenge for European producers.

Short-Term Planning in Disarray

Whilst COVID has dropped off the current news cycle, any presumption of a return to normal in the European PET market has been abandoned following Russia’s invasion of Ukraine.

Major beverage brands have exited Russia and Ukraine, with vessels rerouted and short-term planning in disarray.

With companies avoiding business with Russia, the Russian market lacks both PET resin and raw material imports. Whilst PET resin imports originally destined for Russia and Ukraine are offloaded elsewhere.

In some regions, such as the Balkans, PET buyers are now receiving an additional quarter’s supply, whilst Russian PET producer, AlcoNaptha, has announced force majeure.

Despite supply chain disruption, European PET resin demand remains robust. Resin sales have accelerated over the past month, with European producers reporting more enquires for April.

Increased supply chain risk means buyers are building safety stocks ahead of peak season, with many seeking greater than maximum contract volumes from producers.

Buyers are also increasingly willing to pay high spot prices to secure material, with many small/mid-sized converters not yet fully covered for the summer months.

Ukraine Exodus Prompts Short-Term Demand Increase

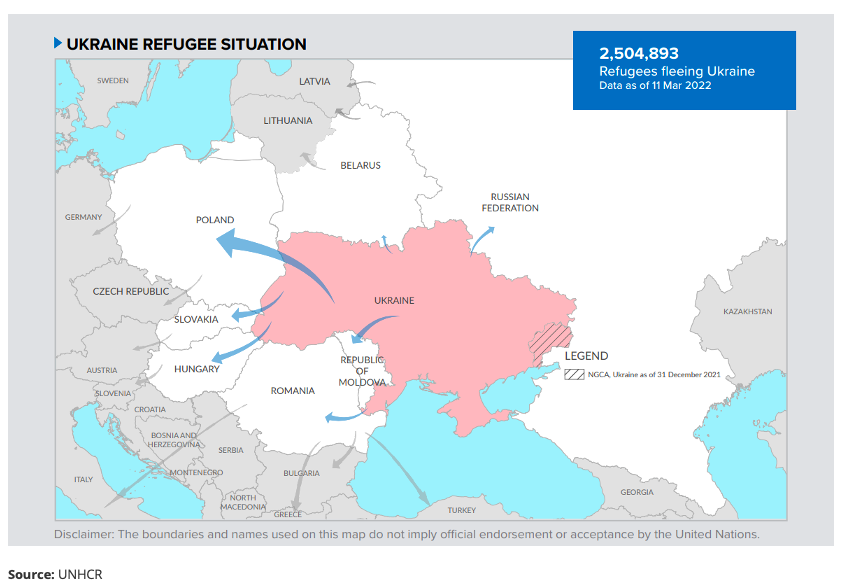

Over the last three weeks, more than 2.5 million people have fled Ukraine, with most going to Poland.

As a result, food and beverage manufacturers have requested additional resin to meet the projected short-term demand increase. Europe’s largest glass factory in Ukraine has also been damaged and is now out of action. This is causing major supply issues for several large beverage brands, which may lead to a temporary increase in the use of PET bottles in Eastern Europe.

Supply routes to feed any increased demand within Eastern Europe are limited, though. Many shipping companies are avoiding passage through the Black Sea, and Russia continues to blockade Ukraine’s sea ports.

Any increased demand will therefore be reliant on European production, primarily from Lithuania, Poland, and Germany.

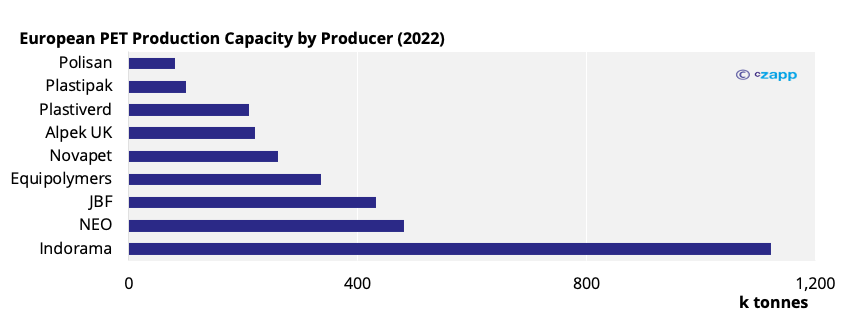

Lithuania has the largest concentration of PET capacity in Europe, home to two PET resin producers, NEO Group (480 k tonnes/year) and Indorama (263 k tonnes/year), both in Klaipeda. Indorama also has an additional 230 k tonnes/year in Poland.

INEOS PTA Shutdown for Month

Crucial to this regional supply, NEO Group is ramping up PET production after cuts due to engineering and feedstock supply problems over the past couple of months. Production rates at its Lithuanian plant should now ramp up quickly with a potential return to the spot market in the coming weeks, after around four months absence.

Further West, nerves are heightened as INEOS carries out maintenance on PTA at Geel, Belgium, scheduled until 8th April. Whilst PET producers reliant on PTA supply from INEOS can run full in March, supported by inventory, their ability to do so in April depends on a successful return of PTA production. Given last year’s prolonged outage that crippled European production, all fingers will be crossed in hope of avoiding any engineering complications this time around.

Elsewhere, Equipolymers has delayed planned maintenance until Q4, whilst Indorama’s plants in Spain and Turkey will undergo scheduled maintenance in April.

PET Resin Prices Leap Following Feedstock Price Surge

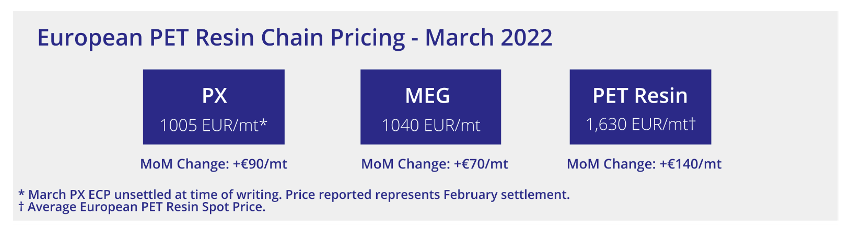

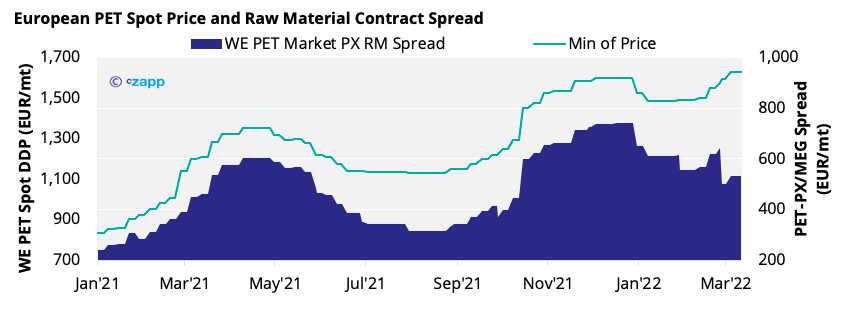

European PET resin spot prices have followed upstream costs higher in March, averaging around 1,630 EUR/mt, up 140 EUR/tonne from February.

Lower prices of around 1,580 EUR/mt were heard for local delivery in Northwest Europe, whilst other producers reported bids as well as free-negotiated prices at 1,650 EUR/mt. With buyers no longer experiencing a preferential rate for free-negotiated monthly prices over the open spot market.

Import prices are currently in the range of 1,620-1650 EUR/mt CIF, broadly on par with European delivered prices.

Production Cost Uncertainty the Main Challenge for European Producers

Although spot prices have jumped, March’s paraxylene European Contract Price (PX ECP) is yet to be agreed, creating a large degree of uncertainty around producer costs in March. However, based on projections, the spread between the PET spot price has narrowed over the last month.

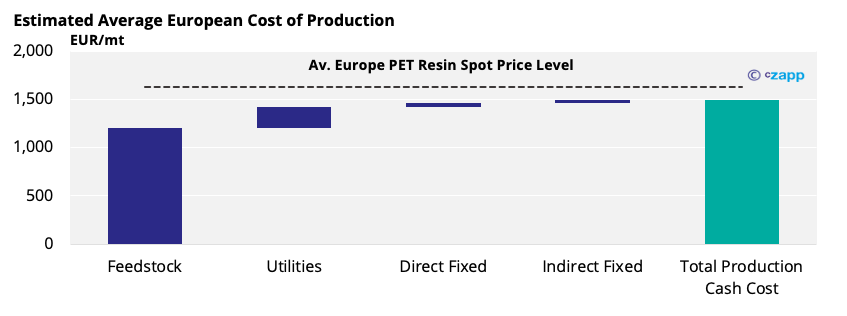

Whilst raw materials account for around 80% of PET’s total production costs, producers are also being squeezed by increased utility and logistics costs.

Extraordinary increases in gas and electricity prices over the last month have added an average of 100 EUR/mt to utility costs for PET producers and the average European cost of production is now around 1,490 EUR/mt.

However, Europe’s asset base is not only diverse in terms of capacity and feedstock integration but also on energy costs, with a large and volatile disparity between individual countries.

European electricity forward prices have fallen in recent days, though, with the April contract now down 15% on March. Forward gas prices have also weakened, indicating a potential reprieve for producers next month.

Market Outlook & Concluding Thoughts

- Whilst producers seek a premium on import parity and, in some cases, hold back stock, the speculated level of 1,700 EUR/mt for April is far from a done deal.

- Forward feedstock costs seem to be stabilising, with crude dropping by as much as 25% in recent days.

- Much is now dependant on where the March PX ECP is agreed.

- Demand pressure will also dictate future price direction; Russia’s invasion of Ukraine is resulting in some short-term increases in PET resin demand.

- With inventory levels through the supply chain remaining relatively low, any additional demand could support higher producer

margins in the near-term. - However, the conflict and resulting inflation’s impact on future discretionary consumer spending within the wider European context will be a major consideration for buyers over the next month.

Other Insights That May Be of Interest…

NEW! PET Resin Trade Flows: Europe Awaits Asian Shipments

What the Ukraine Crisis Means for PET

European Port Delays and Heavy Snow Tighten PET Supply

Europe’s PET Supply Worries Ease as Omicron Hits Consumer Demand