Insight Focus

- Wheat production looks a mountainous task in Ukraine this year.

- Shipping in the Black Sea will remain difficult at best, impossible at worst.

- Oil, gas, and fertiliser will be expensive and for many wheat producers.

Everything changed on the 24th February. Russia invaded Ukraine and we saw a phenomenal rise in global wheat prices.

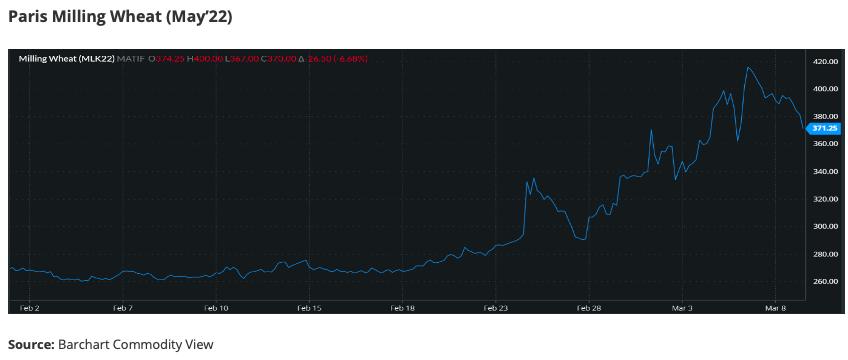

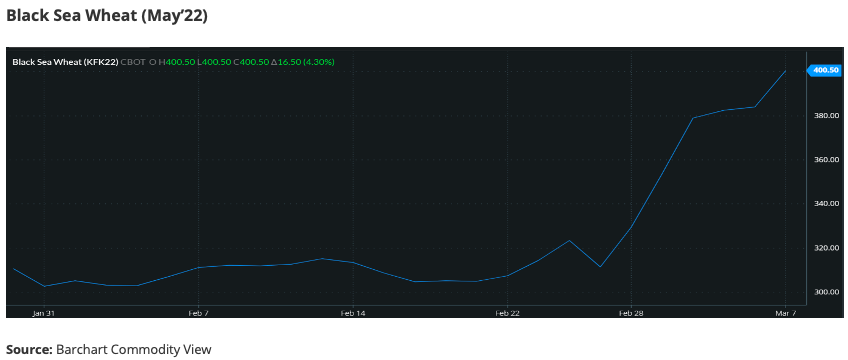

Since my last article, we’ve seen price volatility on a truly astounding level, day by day and even minute by minute.

The below charts depict the crazy ups and downs seen in recent days for wheat prices in Europe and the United States.

The Major Concerns

Ports and Logistics

With Russia wreaking havoc in the southern coastal towns and cities of the Ukraine, it’s clear to see that it’s attempting to achieve dominance over these strategic ports, thereby gaining control of all trade in or out of the country via the Black Sea.

Bombing and fighting around these critical ports have made shipping in the region a no-go for most, though.

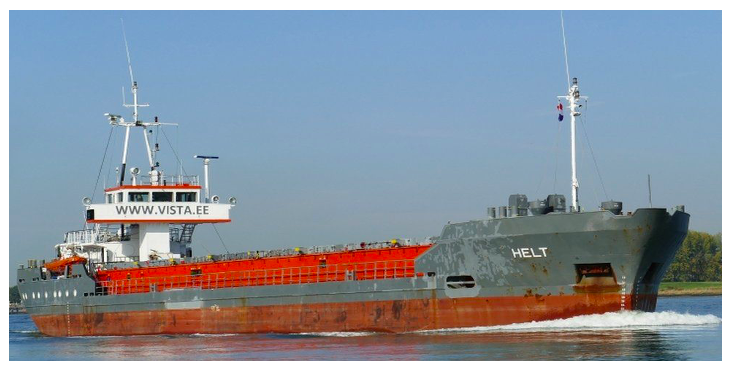

On 3rd March, reports emerged of an Estonian cargo vessel (Helt) sinking off the Ukrainian Black Sea port of Odesa following an explosion. On the same day, news reported an explosion involving a Bangladeshi-owned ship (Banglar Samriddhi) in the Ukrainian Black Sea port of Olvia.

With no movement of either Ukrainian or Russian wheat through the Black Sea, nearby prices have soared as buyers and traders struggle to obtain spot wheat cargoes from elsewhere.

Farming Disruption in Ukraine

It’s no surprise to hear that not all Ukrainian farmers are working their land.

Although the winter wheat is planted, fertiliser needs applying, spring planting is due to start, and fuel is either in short supply or being contaminated to avoid aiding the Russian military advance.

Labourers and farmers joining the war effort to defend their land will impact the 2022 harvest, due to commence in the summer.

Oil and Gas

The cost of wheat production is soaring with each day that passes. More sanctions have pushed oil and gas prices higher and higher.

While oil is the fuel for machinery, fertiliser is the fuel for wheat and is heavily reliant upon gas. Russia and Ukraine are large producers and exporters of phosphates and potash for fertiliser.

In addition, the gas pipelines from Russia to Europe have been well documented recently. There’s much apprehension across Europe in relation to the supply of all in the coming months for this year’s wheat production.

The Poorer Importing Nations

We’ve previously mentioned major concerns for the wheat importers, especially in North Africa. Hugely dependent upon exports from the Black Sea, there are serious doubts as to whether the poorest can afford wheat at the current prices, double this time last year, and three times higher than those seen in 2019.

Thinking Ahead

Vladimir Putin is not one for backing down and thus, unless his people wish to find a way to pressure him, war in Ukraine should continue for the coming months as the Ukrainians stand in resolute defiance.

Wheat production therefore looks a mountainous task in Ukraine this year. Shipping in the Black Sea will remain difficult at best, impossible at worst. Oil, gas and fertiliser will add to costs, or be limited in availability for large swathes of the wheat-growing world.

Wheat prices will likely continue their rollercoaster of volatility, remaining high and potentially unaffordable for many. Consequently, political stability may once again be questioned in North Africa.

I am ever hopeful that peace and stability is on the horizon for all people and their wheat.

Other Insights That May Be of Interest…

What the Conflict Between Russia & Ukraine Means for Wheat

High Fertiliser Prices and the Wheat Industry

Explainers That May Be of Interest…