Insight Focus

- No.11 prices are still trading sideways.

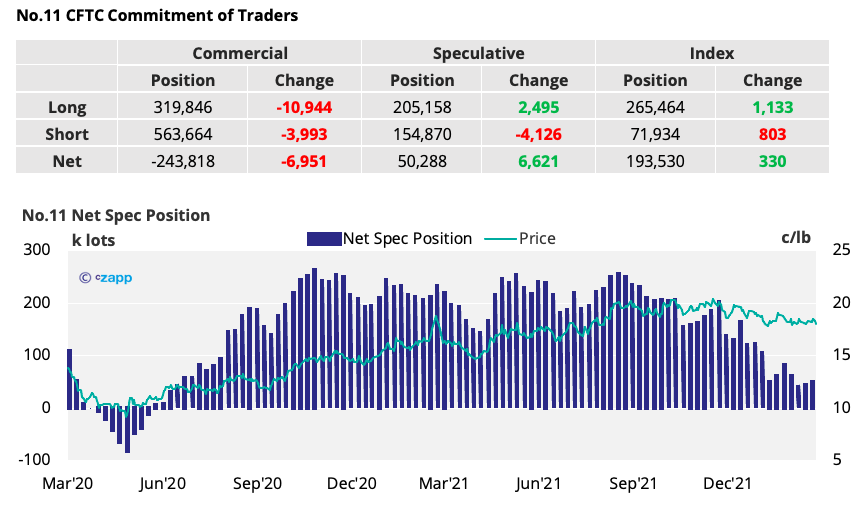

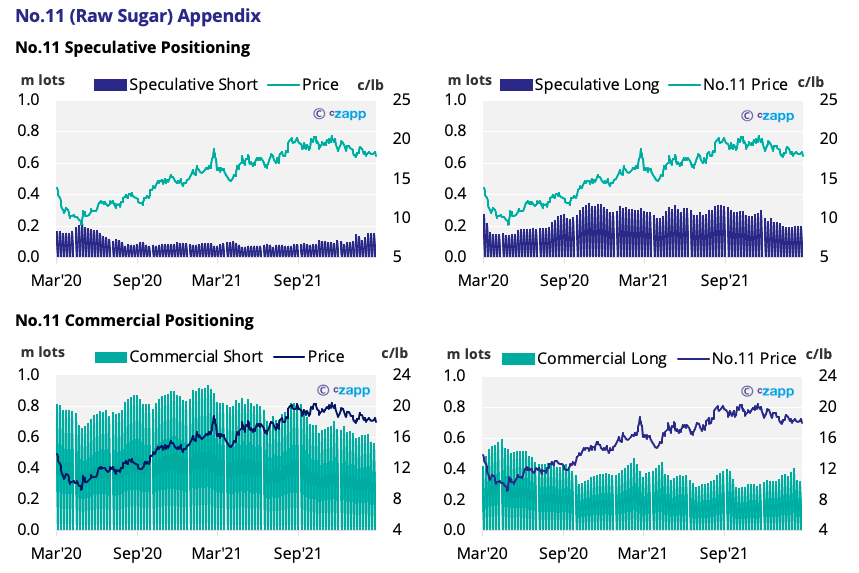

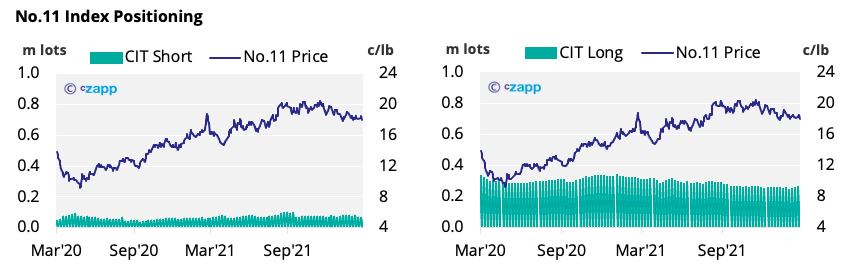

- The No.11 net spec position has increased slightly as the spec short reduces.

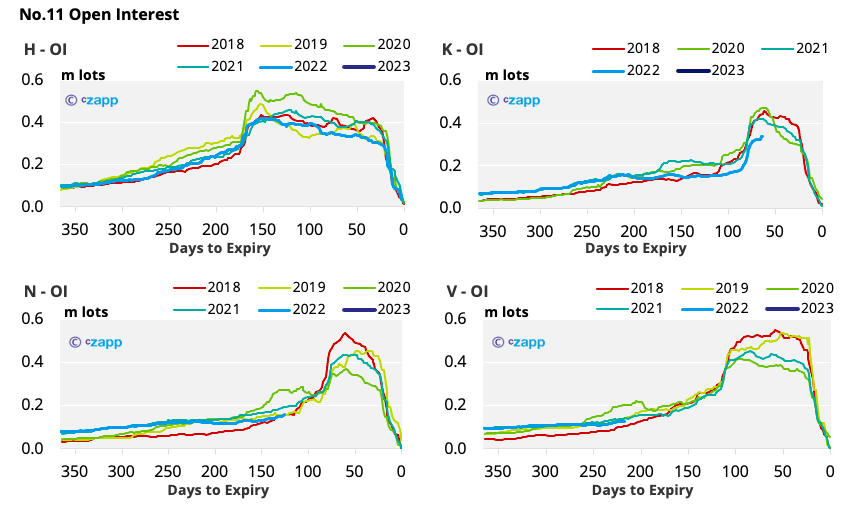

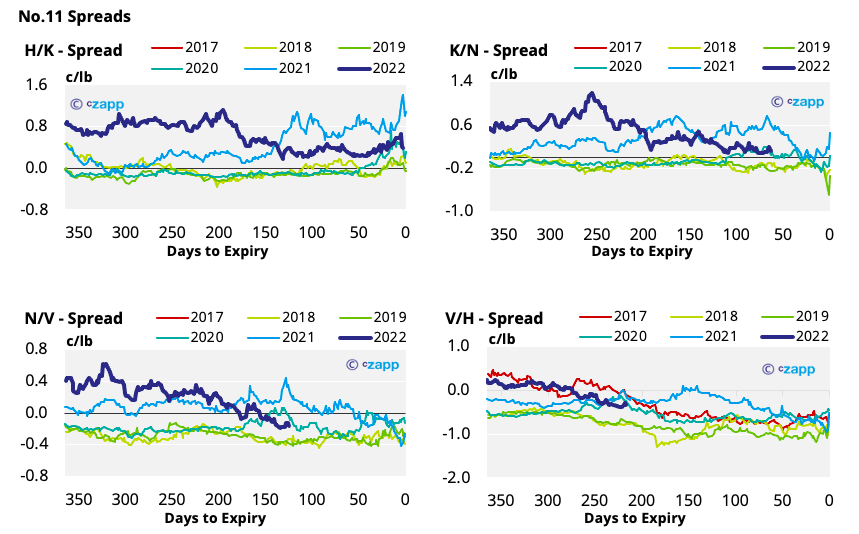

- Commercial positions continue to lift as the H’22 expiry draws closer.

New York No.11 (Raw Sugar)

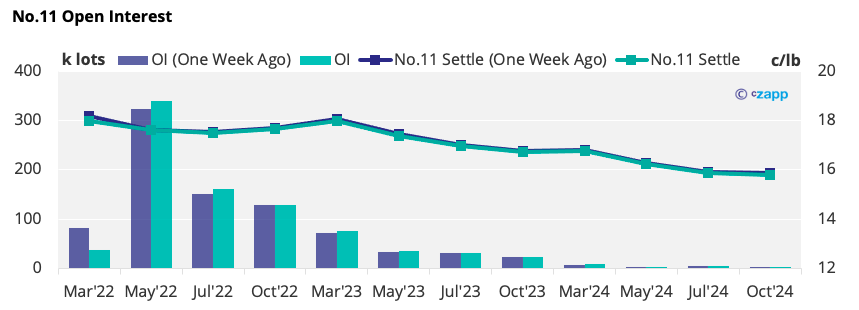

- Raw sugar prices continue to trade at around 18 c/lb, as they’ve been doing since the end of January.

- This lack of meaningful change has prompted a small reversal in the spec short, which had been slowly growing in recent weeks.

- Despite this, the net spec position remains near its lowest point of the last two years, at 50k lots.

- The upcoming H’22 expiry means commercial positions have continued to close out or roll.

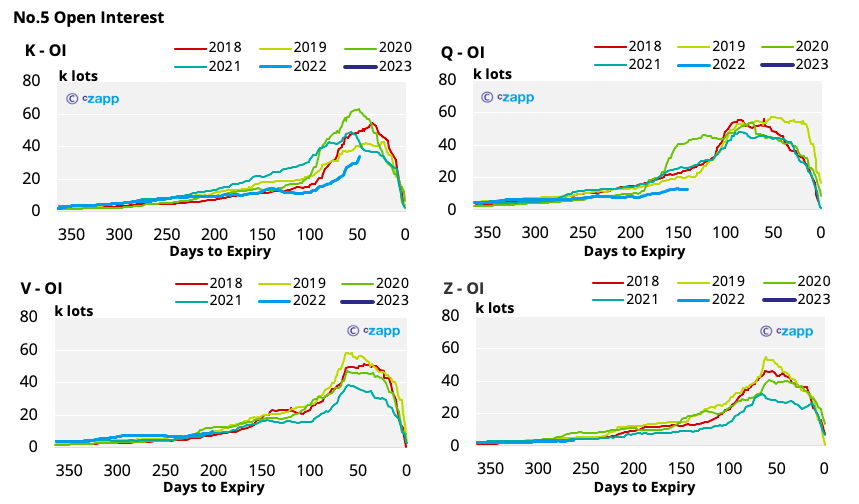

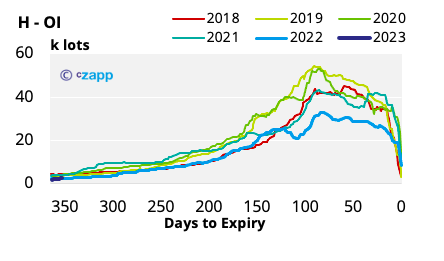

London No.5 (White Sugar)

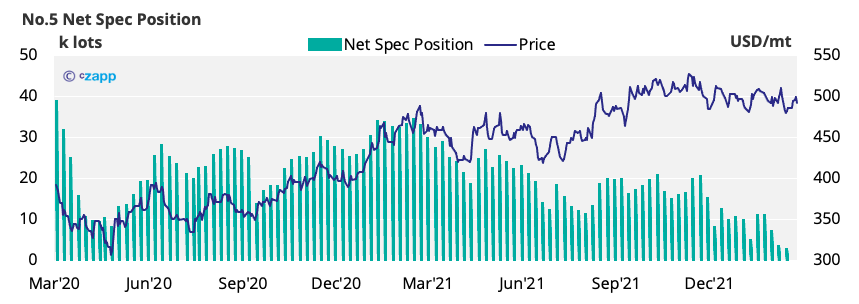

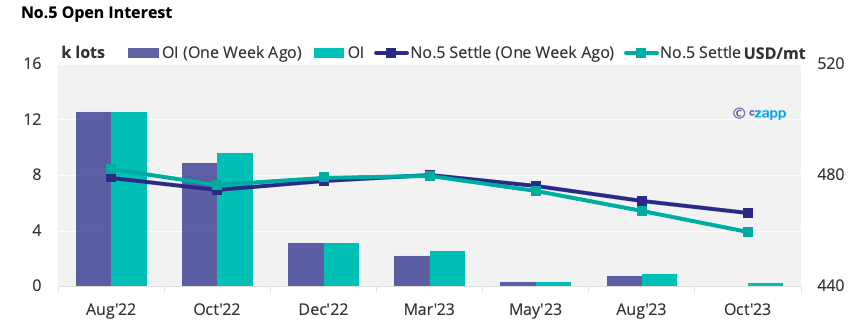

- K’22 sugar prices have strengthened to above 490USD, over the last week.

- Further down the board in 2023, the futures curve has become increasingly backwardated.

- The Z’22/H’22 spread has strengthened of late and now trades around neutral.

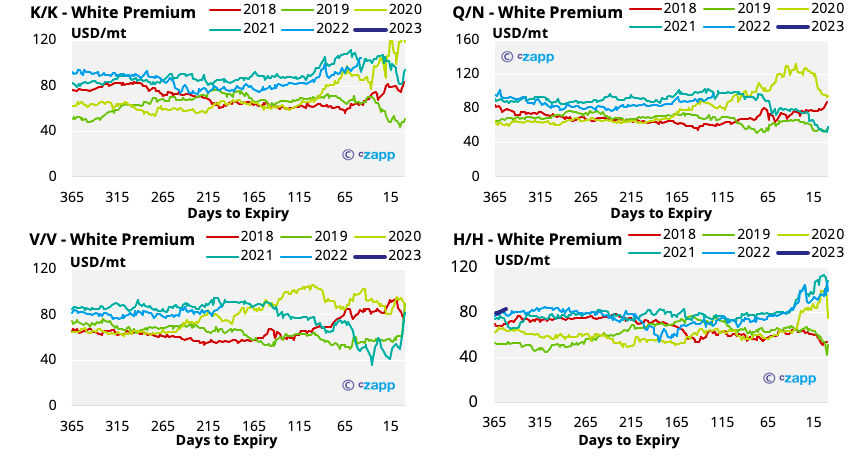

White Premium (Arbitrage)

- A strengthening No.5 has supported the white premium, putting it back at around 100 USD/mt.

- This means smaller cash values will be required for re-export refiners to operate profitably.

- With the No.5 futures curve becoming more backwardated in 2023, the white premium could weaken through that year, all else equal.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

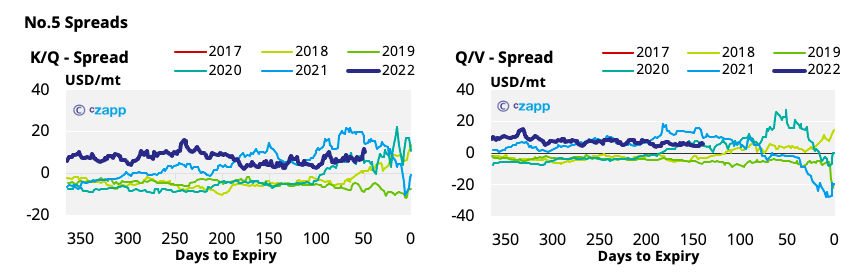

No.5 (White Sugar) Appendix

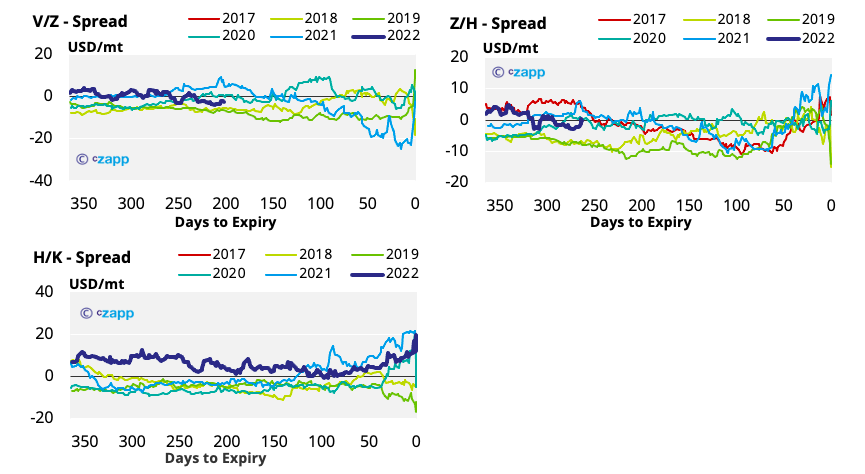

White Premium Appendix

Other Insights That May Be of Interest…

Market View: What the Ukraine Crisis Means for Sugar