Insight Focus

- Hedging for the 22/23 crop advanced very little between in the last few months

- In this week’s Ask the Analyst, we discuss what this might mean;

- If you’d like us to answer one of your questions in an upcoming edition, please email will@czapp.com.

Why Are CS Brazil’s Mills Hedging So Slowly?

CS Brazil’s mills had priced just under 60% of their 2022/23 cane by the end of January, down 15% year-on-year.

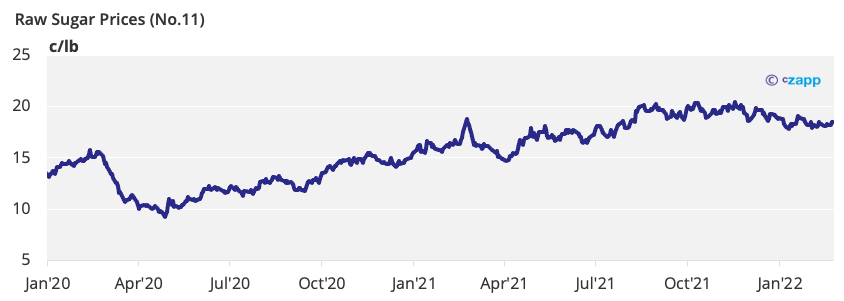

Whilst it may look like the mills are currently under-hedged compared to previous years, we shouldn’t forget that the No.11 rally in the wake of COVID led to unusually high levels of hedging in 2020 and 2021 as prices strengthened.

Looking at the current rate of hedging through this lens, Brazilian mills are actually reasonably well covered.

Equally, consensus within the industry is still for max sugar production (as opposed to ethanol) in the upcoming season. This puts the idea that mills may significantly change their sugar ethanol production split this season to rest.

It’s also likely that the mills are less hedged this year as sugar futures in BRL term have stopped rallying in recent weeks, leaving the mills to exercise patience and hope these highs return, rather than sell at a lower level.

The question marks surrounding Q1 rains are also making the mills less sure of their cane production estimates, with rainfall during this period key for crop

development. Leaving a buffer volume unhedged will help protect mills in the case of a poor crop.

However, it’s worth noting that oil prices are still rallying as the situation in Ukraine intensifies; they’ve now broken the 100 USD barrier for the first time in seven years.

If Petrobras responds in kind and raises fuel prices, this would be positive for Brazilian ethanol, and we may see some sugar hedges unwound if the premium over sugar is big enough. However, as fuel prices in Brazil are a hot topic in the run-up to Brazil’s Presidential elections in October, there’s no guarantee that we’ll see the scale of this rally reflected at the pump in Brazil.

This all means that, at first glance, Brazilian mills holding their hedges could indicate a risk to sugar supply in 2022 with production being diverted to ethanol. In actuality, mills are committed to max sugar production and even sharply rallying oil prices don’t yet pose a real risk to this.

Other Insights That May Be of Interest…

Ask the Analyst: Brazilian Fuel Prices Alongside Brent Crude’s Rally