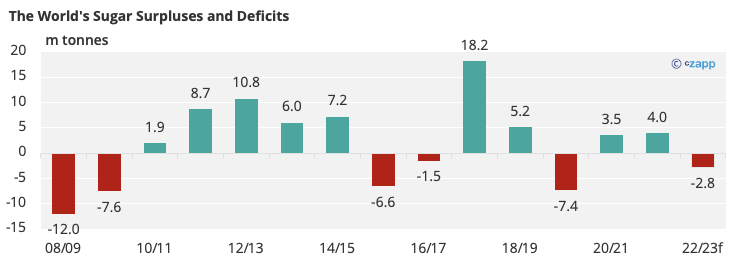

- The global sugar surplus for 2021/22 has increased to 4m tonnes.

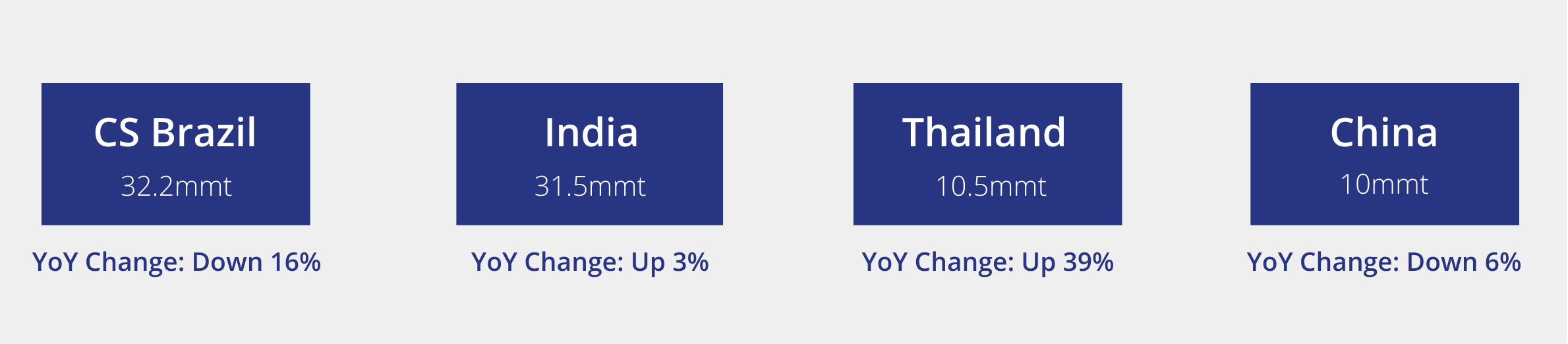

- India’s stronger-than-expected cane crop has driven this increase.

- 2022/23, however, will see almost a 3m tonne deficit.

Global Sugar Supply

We now think the world will produce 4m tonnes more sugar than it needs to satisfy demand in 2021/22, up 1m tonnes from our January update.

This will not be the case in 2022/23, as production should fall 2.8m tonnes short of consumption instead.

Global Sugar Production

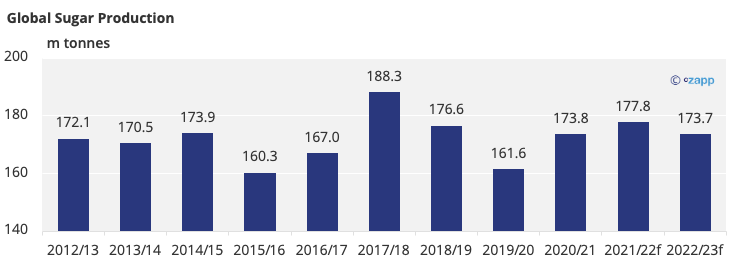

The world should produce 177.8m tonnes of sugar in 2021/22, up 900k tonnes from our previous estimate as our Indian production forecast has increased.

If this materialises, it’ll be the world’s second-highest production on record, though well short of the 188m tonnes produced in 2017/18.

Global Sugar Consumption

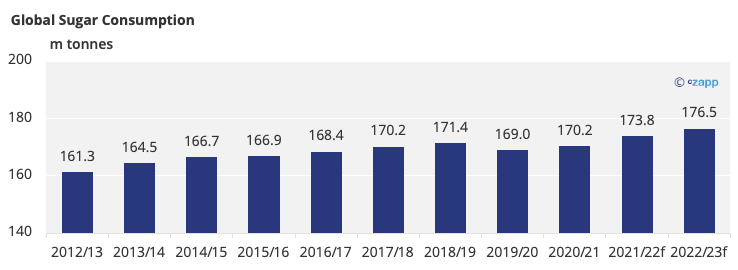

We think the world will consume 173.7m tonnes of sugar in 2021/22, down 100k tonnes from our January update, widening the surplus further.

Regional Production

Regional Updates

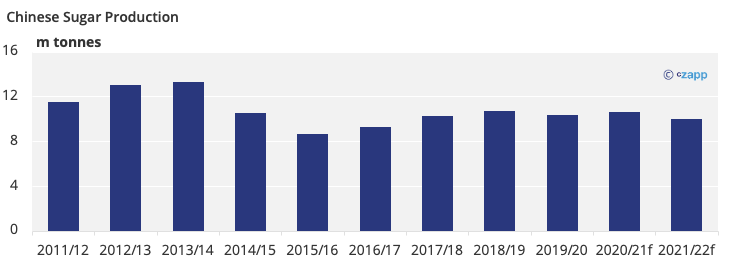

China should produce 10m tonnes of sugar in 2021/22, down nearly 700k tonnes year-on-year.

In the north, beet area has dropped as competition from corn and potato has intensified. Meanwhile, in the south, a cold and wet harvest prompted disappointing sucrose yields, and hindered cane development and harvesting.

If you have any questions, please get in touch with us at will@czapp.com

Other Insights That May Be of Interest…

Sugar Statshot: Behind the Data

Market View: Negative Sentiment Grows as Specs Add to Short

Explainers That May Be of Interest…