Insight Focus

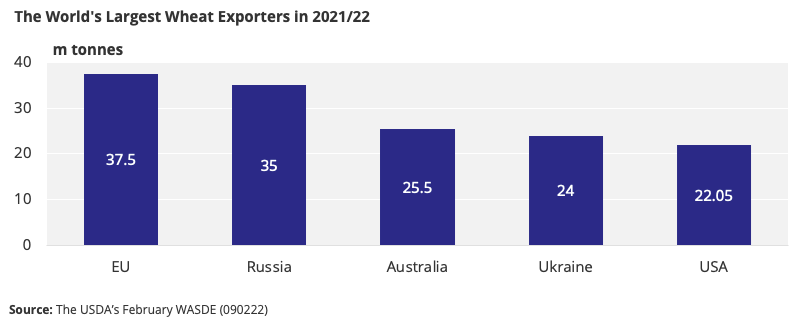

- Russia and Ukraine are significant players in the world wheat market.

- Here, we consider how a Russian invasion could impact the world of wheat.

- Increased tension should encourage buying, while any de-escalation would likely be bearish.

The Conflict Between Russia and Ukraine

Concerns around the world of a Russian invasion into Ukraine are high on the diplomatic agenda.

As a number of countries withdraw their diplomatic staff and advise their remaining nationals to leave, suggestions from some leaders in the Western Democracies that an invasion is imminent are clearly not dispersing.

Russia’s annexation of the Crimean Peninsula in February and March 2014 was a clear statement of intent to prevent continued undesired Western influence over former Soviet States, which, in turn, would lead to further security unease within the Russian Motherland.

Russia continues to dismiss suggestions that it is planning an invasion, stating that any increase in military activity near their borders is not indicative of any hostile intent. They have, nonetheless, made firm demands for certain military assurances, including guarantees that neither Ukraine, nor any other former Soviet State, be allowed to join the NATO Security Alliance, in order to safeguard the national security of Russia.

Influencing the Wheat Market

Current global wheat prices are relatively high, supported recently, in part, by the ongoing tensions and uncertainty surrounding the two major Black Sea wheat exporters, Russia and Ukraine.

In the event that a Russian invasion were to take place, the issue would be what disruption might result to grain movements out of the Black Sea ports from either or both countries.

We have regularly commented in past pieces on the world’s largest exporters, and it is not difficult to comprehend the alarm that may potentially ensue if exports from the Black Sea were disrupted or worryingly brought to a near stop, given the importance of both on the world trading stage.

What If?

In the unlikely event of an invasion of Ukraine by Russia, how much would shipments from the Black Sea region be impacted?

Firstly, it seems unlikely that the buyers of Russian wheat would halt purchases. The biggest buyers of Russian wheat are Turkey, North African nations, and the Middle East. These countries either have cordial relationships with the Russians or just want to buy the cheapest wheat to feed their populations.

Secondly, a significant reduction in shipments of wheat through the Black Sea would require some form of military action by the likes of NATO countries to prevent ship movements. A Russian naval escort of cargoes would most probably nullify any attempts to forcibly stop vessels. Thus, shipments would be anticipated to continue without serious hinderance.

A possible complication would be reluctance of ship owners to enter Black Sea ports causing a hike in shipping rates, given the security and insurance problems associated with entering waters in an area of conflict.

Port facilities within Ukraine could face logistical issues as free movement of grain to them could see major disruption in pockets where fighting was taking place. However, material impact on Russian grain exports in this way is doubtful.

The world of financing and banking could theoretically prevent some payments in the event of sanctions on Russia. It would nonetheless seem plausible that such problems could be circumnavigated by Russia and the aforementioned purchasers.

Conclusions

Russia and Ukraine are significant players in the world wheat market. An invasion of Ukraine by Russia will have horrific ramifications on a human level. In relation to the wheat market, any issue is anticipated to be short lived or limited.

Neither will want to see any major turmoil to wheat shipments and nor will their respective buyers. Any financing or physical blockading issues should be dealt with swiftly.

Limited complications resulting from land movement to port and ship-owners reluctance to ship from a warzone are credible but should be insufficient to have any major overall impact.

Looking at probable price scenarios for wheat will be news dependent in the short term. Reports of increasing tension will encourage buying, while any de-escalation should be bearish to the markets.

In the long-term, wheat prices will almost inevitably be barely affected as supply and demand will ultimately prevail while any logistical hurdles will be resolved.

I continue to hope for a peaceful diplomatic resolution to the tensions as soon as possible so we can focus on supply and demand in place of war or peace.

Other Insights That May Be of Interest…

Conflict Continues Between Key Grain Suppliers

Explainers That May Be of Interest…