- 2021 saw record high wheat prices in some regions.

- Equities, energies, metals, and inflation all climbed as well.

- One could be forgiven for assuming that these highs will continue in 2022, but caution is advised.

Wheat Prices in 2021

Every year brings surprises to the marketplace and 2021 was certainly no exception.

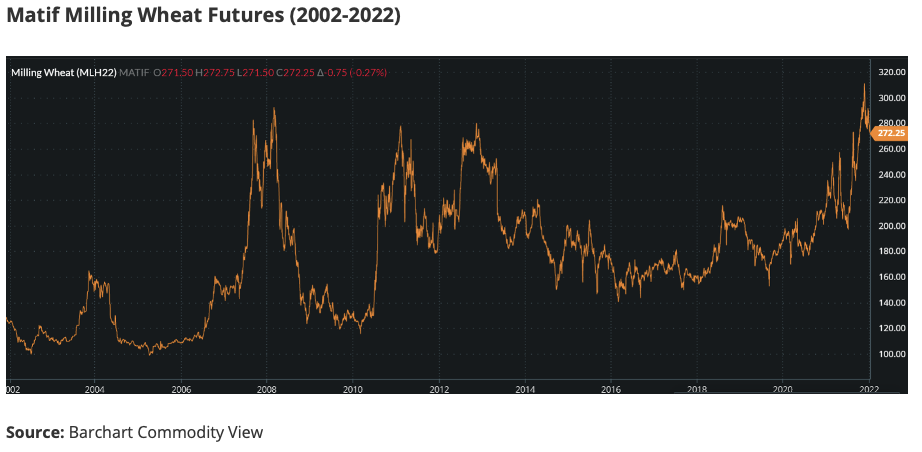

Record wheat prices in Europe, as per the chart below, show the dizzy heights reached, even surpassing those of the globally low wheat stock year of 2007/08.

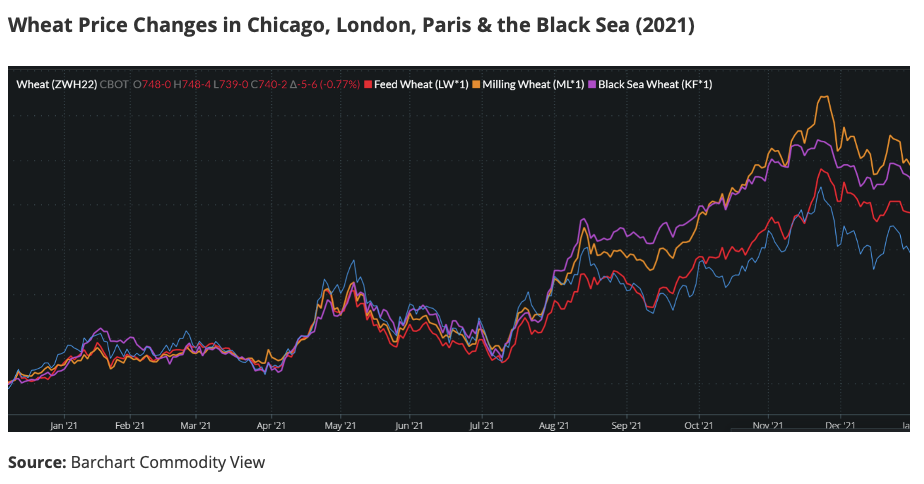

On the world stage, prices also rallied to extraordinary heights, driven by a multitude of factors.

Price Drivers in 2021

Production and Stocks

Reducing global wheat production and stock estimates lent support to the bullish run seen in H2’21.

As production estimates fell, stocks inevitably followed suit. This has led to increased concerns from governments who’ve looked to stabilise domestic prices to ensure food affordability and security.

This has been demonstrated in Russia, where taxes and quotas are common news stories as the country attempts to contain domestic prices by curbing excessive exports as world prices climb.

COVID-19

The turmoil inflicted on all parts of the world during 2020 did not disperse entirely during 2021.

Lockdowns and restrictions have negatively impacted the previously resilient supply chains. This has particularly affected the importers needing to maintain food supply for their populations.

Global Market Strength

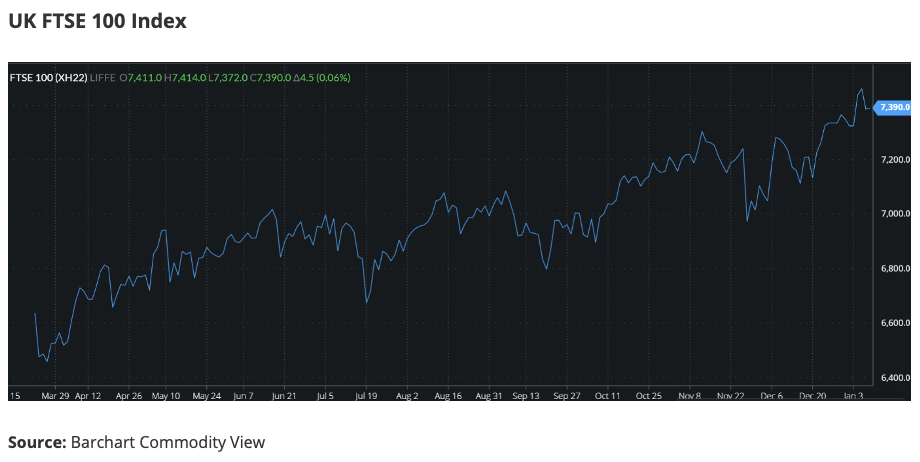

2021 saw the world economies attempt to return to something of a normality, with the past year seeing a surprising rise in a multitude of markets, financial and agricultural.

Economic data has shown remarkable strength from the end of 2020, as has been revealed in recent days by consumer inflation at 5% in the Eurozone.

Rises in equities, as seen below, have also shown an incredible resurgence following the COVID-induced turbulence of 2020.

Other Commodity and Energy Market Rises

In recent articles, we’ve mentioned the impact of fertiliser prices, which more than doubled through 2021.

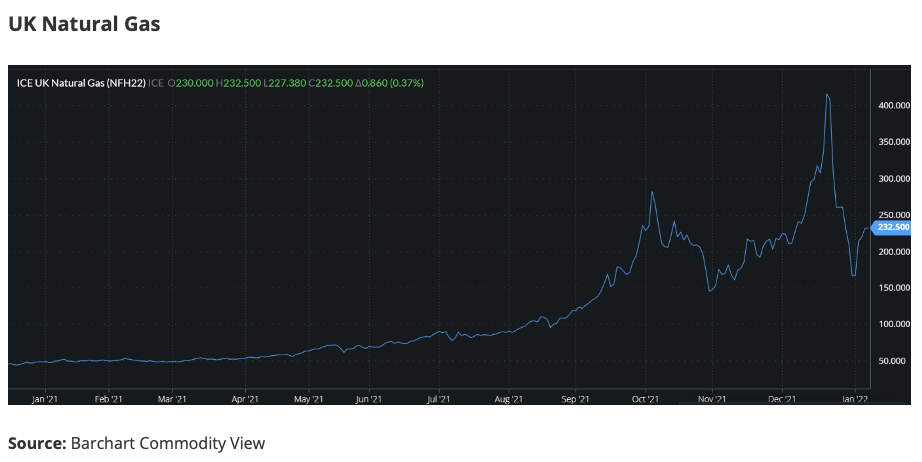

With around 70% of nitrogen fertiliser production costs coming from the gas prices shown below, UK natural gas illustrates perfectly how increasing growing costs are a problem for fertiliser-hungry grain crops, including wheat.

Other markets impacting costs for farmers and the onward processing supply chain have also seen exponential price increases.

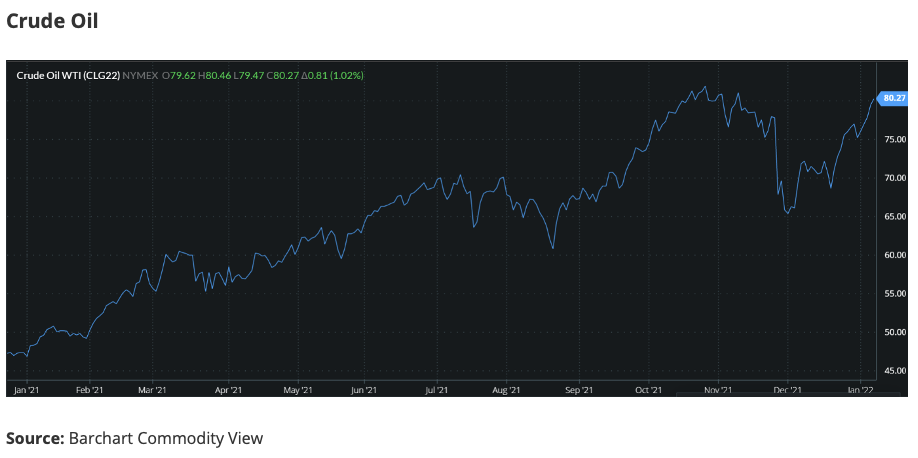

Oil, the fuel for planting, growing, and moving wheat climbed significantly in 2021.

The upturn in economic outlook has seen strong demand and price increases for metals and raw materials impacting labour, tractors, machinery, buildings, and most essentials associated with wheat production and distribution.

Supply and demand numbers for wheat are fundamental to price movements but this mass of market movement across broad sectors of the global economy has helped sweep wheat along for the ride.

Looking at Prospects for 2022

Reading and listening to various commentaries, one could be forgiven for believing that 2022 will be a continuation of highs, but caution is well advised.

As we’ve mentioned before, high prices tend to be short lived, as the first chart in this piece shows. The increased values either discourage demand by pricing commodities out of certain markets or encourage greater areas of cropping, with supply therefore ramping up to ultimately dampen values down.

Also discussed previously, the fertiliser highs are showing lower gas prices from the middle of 2022, theoretically leading to lower input prices going forwards.

Logistics have been a headache for many industries due to COVID lockdowns, with labour absences and general disruption on a global scale. As we move through 2022, assuming a calming of waters on the COVID front, these logistical issues should dissipate with time.

Supply, demand, and the weather have caused many issues over the last year. As we start 2022, there are good looking crops on the horizon for Europe and others, but weather records are being broken faster than the 2021 market recorded. Much will depend upon the kind or unkind actions of the weather.

The political situation around the world is always a big unknown as we begin a new calendar year. The large wheat exporters of Russia and the Ukraine could spark a price rally if tensions rise further. Any antagonising relations between the US and China have the potential to influence prices and trade flows.

Regional politics are inevitably on the minds of those impacted. Here in the UK, Brexit has spurred a raft of unknowns for agriculture as trade agreements take shape. This, combined with the national stance on farmer support, with the likes of the Environmental Land Management Scheme (ELMS) and others, created a raft of unanswered questions.

The climate and environment are close to many hearts with COP26 in November 2021 leaving much to ponder in 2022. Influences here will likely be limited this coming year, but there will be changes ahead. Assessing your own situation sooner rather than later may well be a wise move.

Conclusions and Managing an Uncertain 2022

As always, the future is unknown. Wheat prices are currently high, but they’re easing off as the year turns.

Every business’ needs are different but the volatility in such a horde of markets makes price risk management as important as it has ever been.

Risk management can often be aided by thinking outside of the box.

Careful business planning and subsequent discipline in execution will typically reward in turbulent times. Knowing what you’re aiming to achieve and how to get there gives a strong footing to start the year.

As a physical grain trader for many years, I was regularly disappointed in farmer sellers’ and user buyers’ disinterest in discussing contracts or ideas that were not the norm. Those that embraced the idea, as history has proven, were winners, time and again.

Locking in margins with a profit, wherever your business sits in the chain, can never be wrong. The use of minimum or maximum price contracts for raw materials, inputs or outputs can help enhance margins.

Communication with trusted trading partners is key to building solid relationships and decision making.

Whatever 2022 holds for your business, the opportunities in these extraordinary times are out there. Find them, embrace them and we wish you all a very happy and prosperous 2022!

Other Insights That May Be of Interest…

The Future of the Wheat Industry

Wheat Production Alongside the Climate Drive