- Chinese PET exports have made a strong recovery.

- Production outages and stabilised freight rates have prompted record orders.

- Exports to East Africa and Latin America surged in Q3.

Chinese PET Exports Make Strong Recovery in 2021

Asian exports have faced a myriad of supply chain issues over the last two years, from a general lack of container availability, to severe weather events and port closures.

Despite this, the region’s PET resin exports have recovered in 2021, with sales reaching record high in recent months.

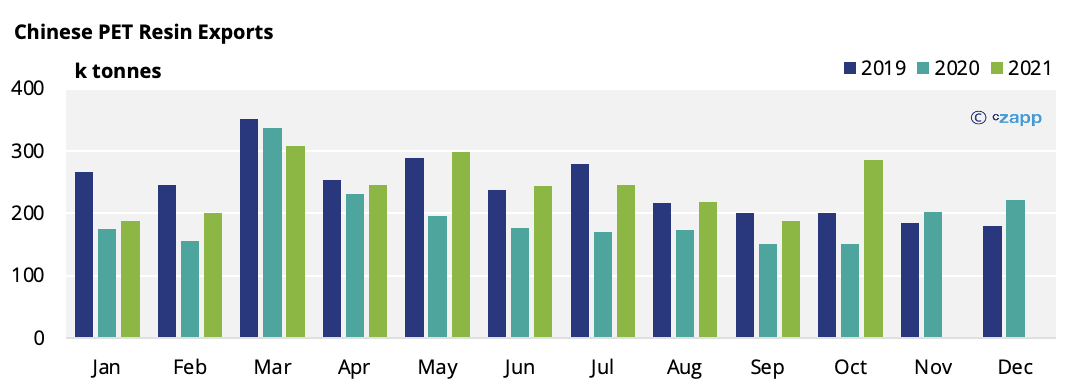

China’s PET resin exports were up 26% year-on-year in the first 10 months of 2021. They were, however, still around 5% below pre-COVID levels.

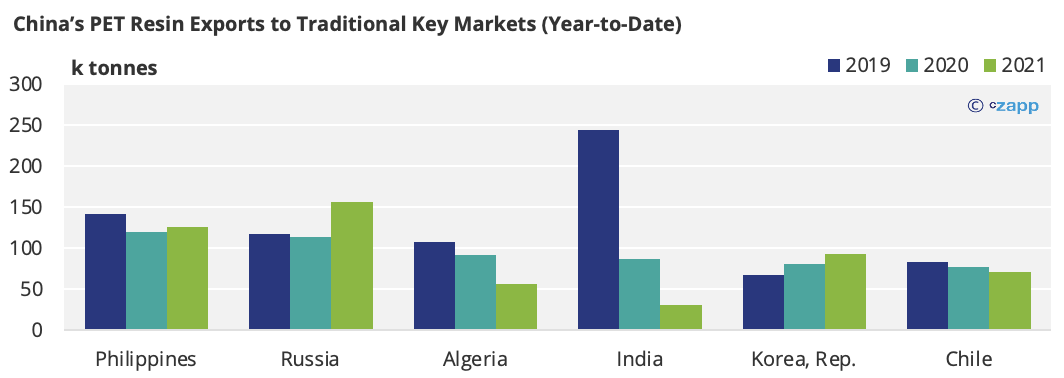

Whilst demand from major markets, like Russia and Philippines, remains firmly in recovery mode, approaching or exceeding pre-COVID levels, shipments to India and Algeria, other traditional sinks for Chinese materials, have plummeted since 2019.

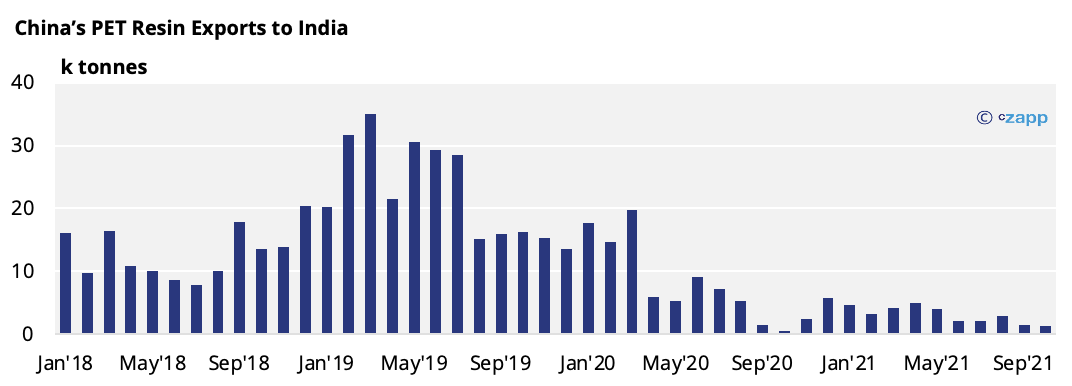

After a year-long investigation, India imposed antidumping duties (ADD) on PET resin imports from China in March 2021. These will be in place for five years, with duties ranging from $60.92 to $200.66.

Having risen by around 76% year-on-year in 2019 (to around 273kmt), Chinese PET resin exports have slumped in 2020/21. Exports to India alone are down 87% from pre-COVID levels year-to-date.

Chinese producers have also lost market share in Algeria, with volumes down 47% from 2019 levels. Expensive freight to North Africa has hindered China’s exports, with material from other sources more favourable. India, for instance, has been able to deliver at a more competitive cost.

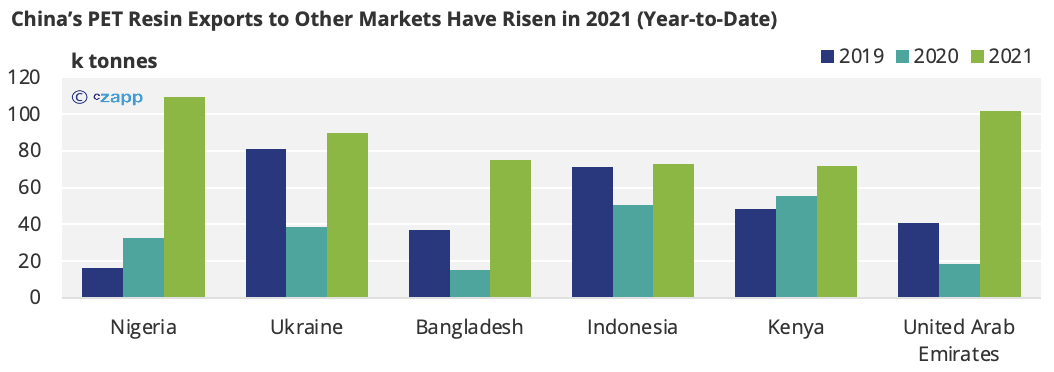

Although Chinese exporters may have lost ground in several key markets, sizeable advances have been made in others, including Nigeria and Bangladesh.

New Markets Offset Export Losses from Indian Anti-Dumping Duties

Nigeria has imported 110k tonnes of Chinese PET resin so far this year, up 94k tonnes from 2019. With this, it’s currently the third-largest buyer of Chinese PET resin in 2021.

Chinese exports to the UAE have also increased. Although volumes crashed to just 18.5k tonnes in 2020, they’ve reached a record high this year (over 100kmt).

Bangladesh has imported more Chinese PET resin too this year, with volumes more than doubling from pre-COVID levels to over 75k tonnes through the first 10 months.

China’s Export Orders Jumped in October

Despite moving into the traditional low season for PET resin exports, where demand from most major markets is typically at its weakest point for the year, shipments and new orders have spiked.

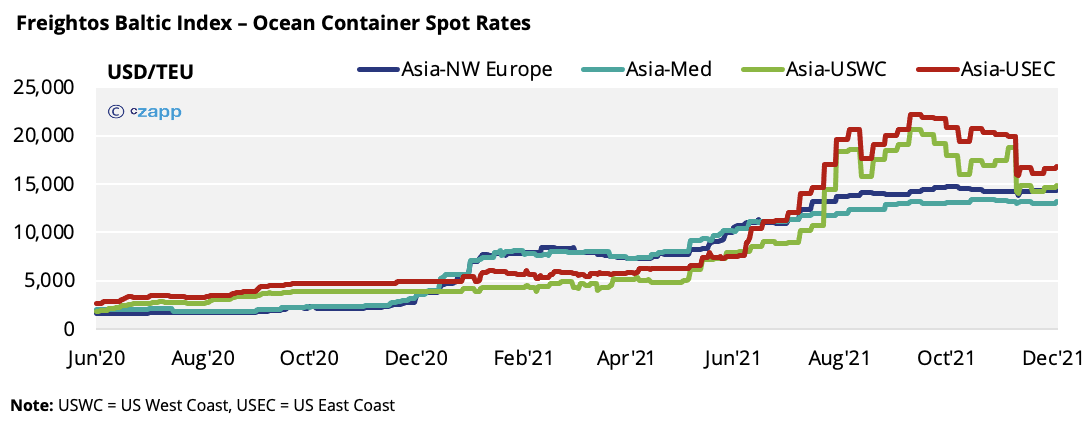

A combination of global production outages and a stabilisation in ocean freight rates have driven this new wave of demand, fed by necessity and a greater risk appetite for container shipments.

Chinese PET resin exports surged to around 285k tonnes in October, up 52% month-on-month and 89% year-on-year.

Export sales for September/October are estimated at around 800k tonnes per month, up more than 100% year-on-year.

Although orders were more modest in November, sales totalled around 1.1m tonnes over the combined three-month period.

As 470k tonnes of PET resin shipped in September/October, a further 630k tonnes of sales from this period alone is awaiting shipment, in addition to earlier delayed orders.

As a result, exports should remain above typical seasonal levels through November and into the New Year.

Where Did China’s Recent Q3 PET Exports Go?

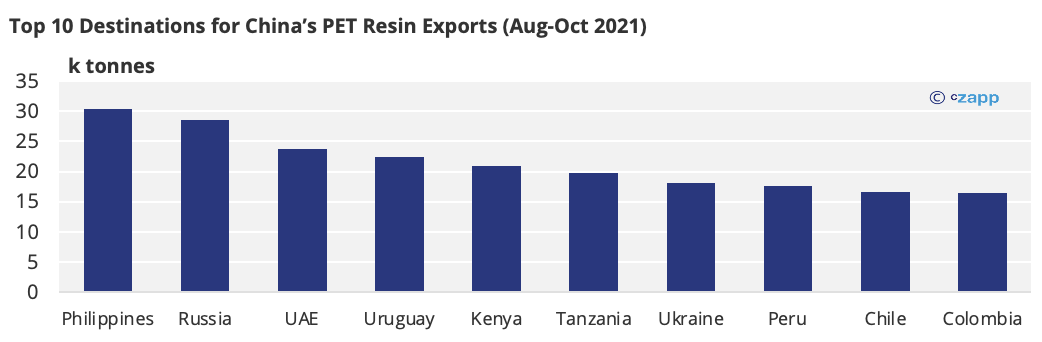

Outside of this year’s major markets (the Philippines, Russia, UAE), large volumes went to both East Africa and Latin America in Q3.

Shipments to Kenya and Tanzania rose sharply in Q3, with volumes in the third quarter alone equivalent to 47% and 107% of their total 2020 volumes respectively.

Chinese exporters have benefitted from competitive rates to many of the East African markets, as well as bulk deliveries to regional hubs.

With production outages across the Americas and a shortage of domestic material, the food and beverage packaging sector has been forced to bring in greater volumes of resin from Asia, particularly as we approach peak summer demand in the Southern Hemisphere.

Exports to Peru, Colombia, and Uruguay have surged in Q3, supported by the delivery of large breakbulk orders to several destinations. Exports to Colombia and Uruguay in the three-month period alone surpassed 2020 levels.

Many of the traditional European importers were absent from the list of major destinations in Q3. However, since mid-summer, numerous European buyers have placed large forward orders with Chinese suppliers for Q1 delivery.

Evidence of such orders may become apparent in the trade data over the course of December/January as shipments are made, targeting delivery the pre-season period.

An Update on the Brazilian Anti-Dumping Duties

In our recent article, we mentioned the recent discussions around Brazilian ADDs on Chinese PET resin.

According to the official announcement on the 26th November, a review of the 2016 anti-dumping duty has been initiated.

The existing ADD is applied to Brazilian PET resin imports, with intrinsic viscosity between 0.7 and 0.88 dl/g originating from China, Taiwan, India, and Indonesia.

Current anti-dumping measures will remain in effect during this review, which should last several months.

Indorama has now restarted operations in Brazil (500kmt) having been down since mid-August following a major fire at the facility.

Other Insights That May Be of Interest…

What’s Really Happening in the Container Market?