- The Brazilian sugar and ethanol industry is seeing the highest prices on record.

- Meanwhile, the world needs more sugar.

- Can Brazil help, or are return rates not quite there yet to attract investors?

Global Sugar Production is Barely Growing

Global sugar production has barely grown in the last decade. Meanwhile, consumption has been growing at around 1% per year. The world therefore needs 14m tonnes more sugar than it did 10 years ago. Across this series, we’ll assess the feasibility for cane and beet expansion in some of the world’s largest sugar-producing regions: India, Brazil, Thailand, and Europe.

Can Brazil Help?

The Brazilian cane industry underwent a large phase of expansion around 15 years ago. When ethanol was promised as the alternative fuel, and the then President of Brazil (Luiz Inácio Lula da Silva), dubbed the country as ‘the next Saudi Arabia, but of ethanol’, everyone wanted a piece of the action.

Banks were more than willing to finance capacity expansion; greenfields (aka new projects) and foreign companies wanted to invest as well. Aside from the financial sector, BNDES (The National Bank of Development) credit lines with cheaper long-term rates (under 6%) were also made available.

Another important thing to note is that several companies took short-term credit lines that offered lowered interest rates, believing the market liquidity would enable them to roll the debts in the future. This turned out not to be the case, with several groups finding themselves in financial stress during the Global Financial Crisis (GFC).

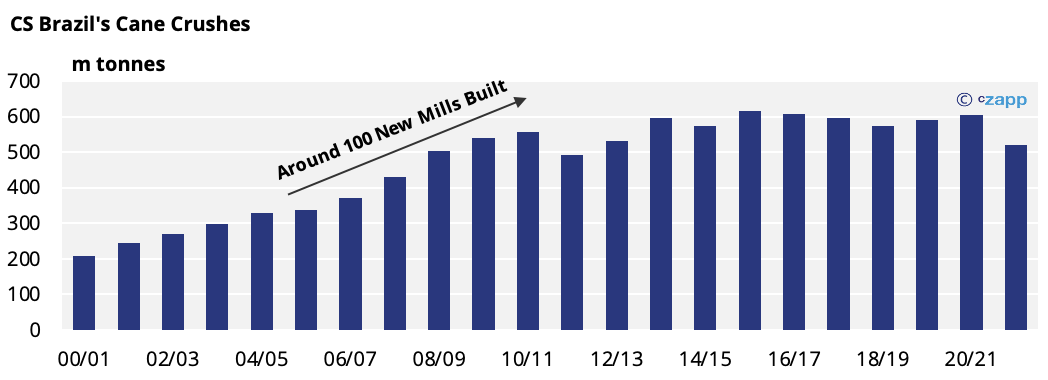

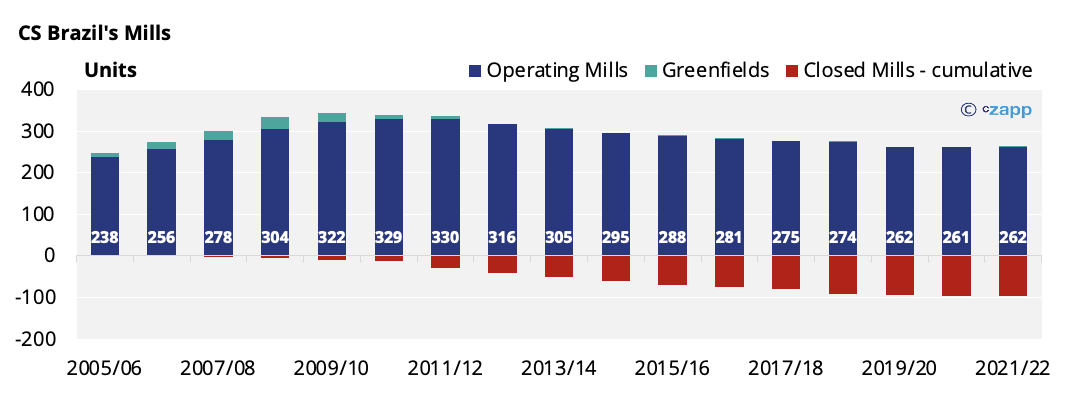

This saw around 100 mills built in Centre-South (CS) Brazil between 2005 and 2010, and the region’s crushing capacity jumped from 370mmt to 550mmt in 2010/11.

During same crop, there were 330 operational mills, and over the next three years, another nine were set to commence operations.

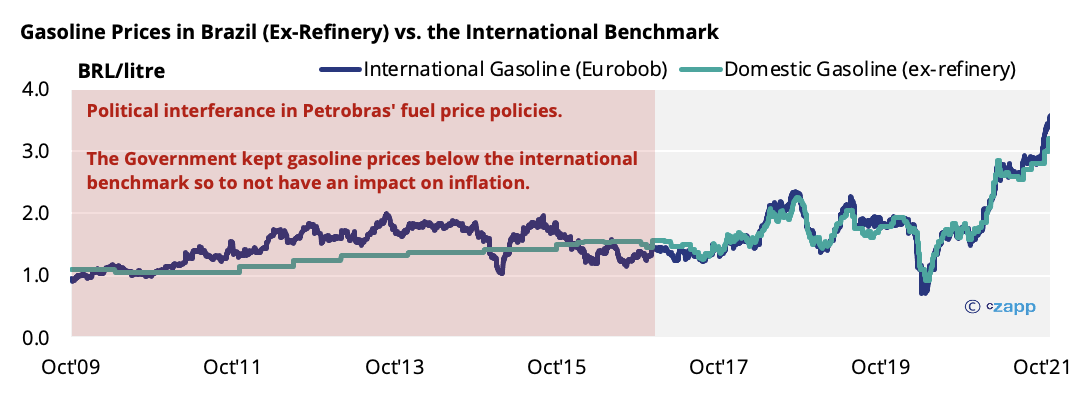

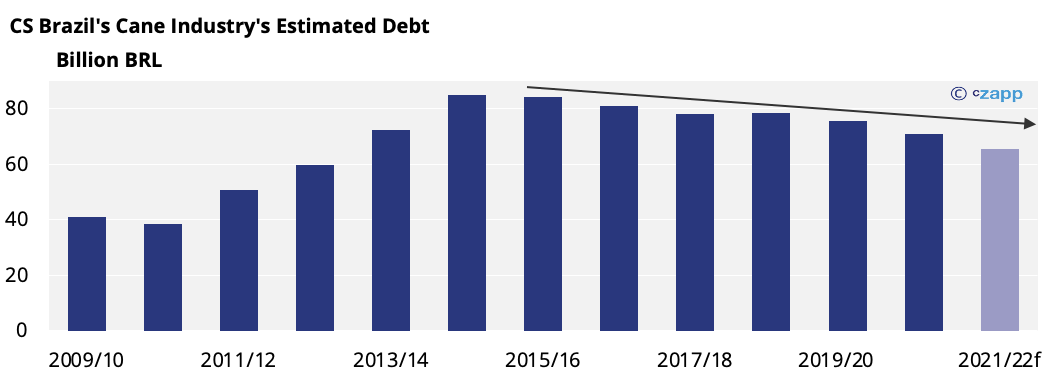

But it wasn’t all smooth sailing. Expansion meant the cane industry’s financial leverage became tricky to balance, with its debt reaching BRL 85 billion in 2015. Between the Global Financial Crisis of 2008, poor crops caused by unfavorable weather, and then Petrobras’ fixed gasoline price policy, many groups were unable to cope and were forced to shut down. From 2007 onwards, almost 100 mills in CS Brazil have closed.

The Time (Seems to Be) Now

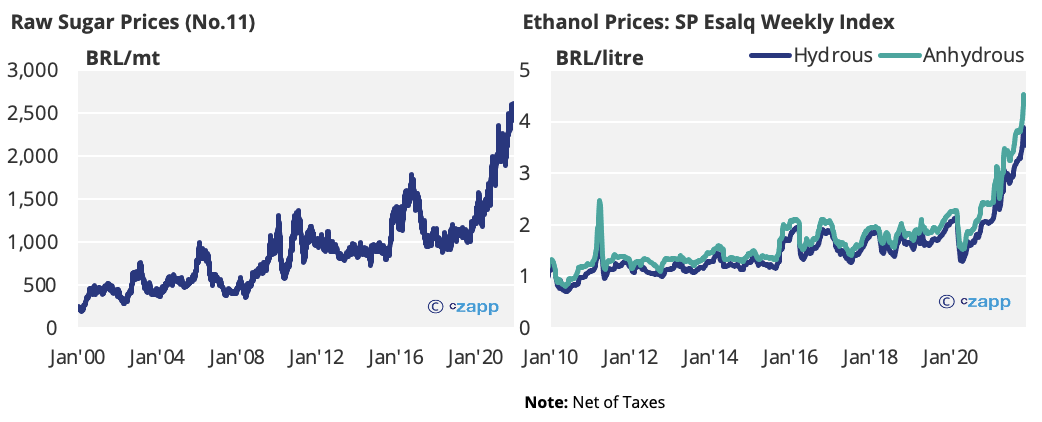

Last year’s sugar hedges, mainly due to the BRL’s weakness, averaged 1,500 BRL/mt, resulting in margins north of 20%, which are excellent. While ethanol, although not capturing the FX effect and initially hit hard by the COVID pandemic, saw margins close to 20% as well. Even with the difficult environment, the mills were able to improve their financial statements and the sector’s debt reduced by around 5 billion BRL in 2020/21.

With prices even higher this season, many have been wondering whether CS Brazil is up for investment in expansion once again. Spot sugar returns have reached record highs of over 2,500 BRL/mt and hydrous ethanol is making it look as though the sky is the limit, climbing each week.

All of this would be great, if not for one detail; inflation is increasing CS Brazil’s cost of sugar production. Yes, CS Brazil’s cost of production has been impacted by the rise of diesel, inputs (especially fertilizers), and a weak BRL, which directly impacts cane prices. Not only that, but this season’s lower agricultural yields result in a loss of economy of scale, affecting overall costs that climbed by at least 35% year-on-year. Sugar margins have dropped below 10% as a result.

However, since ethanol prices have soared, even with a 40% increase in cost of production, margins have been at around 35%. With the projected ethanol prices for the remainder of the season, we think the cane industry’s debt could be slashed by a further 5 billion BRL.

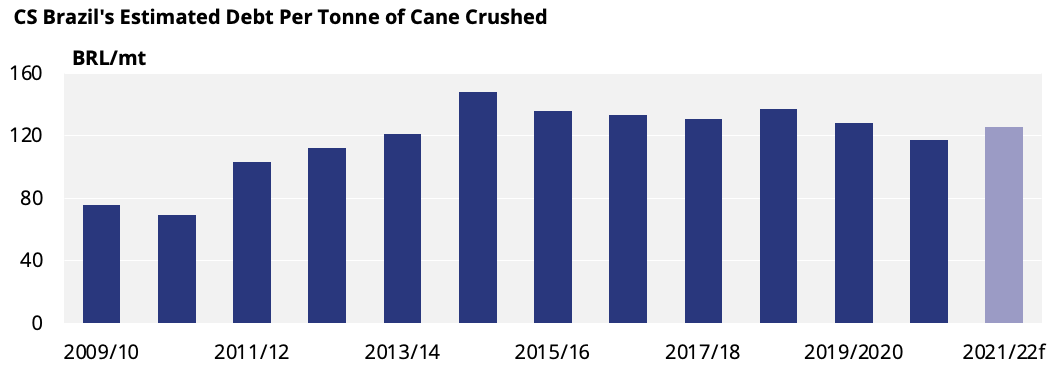

Another way to look at debt is usually in relation to the amount of cane that is crushed. Banks and analysts usually look at the debt/crushing ratio to understand the cane industry’s financial situation. A “good” ratio sits under 110 BRL/mtc (somewhere the cane industry’s not been for at least 10 years).

The Steps Towards Cane Expansion

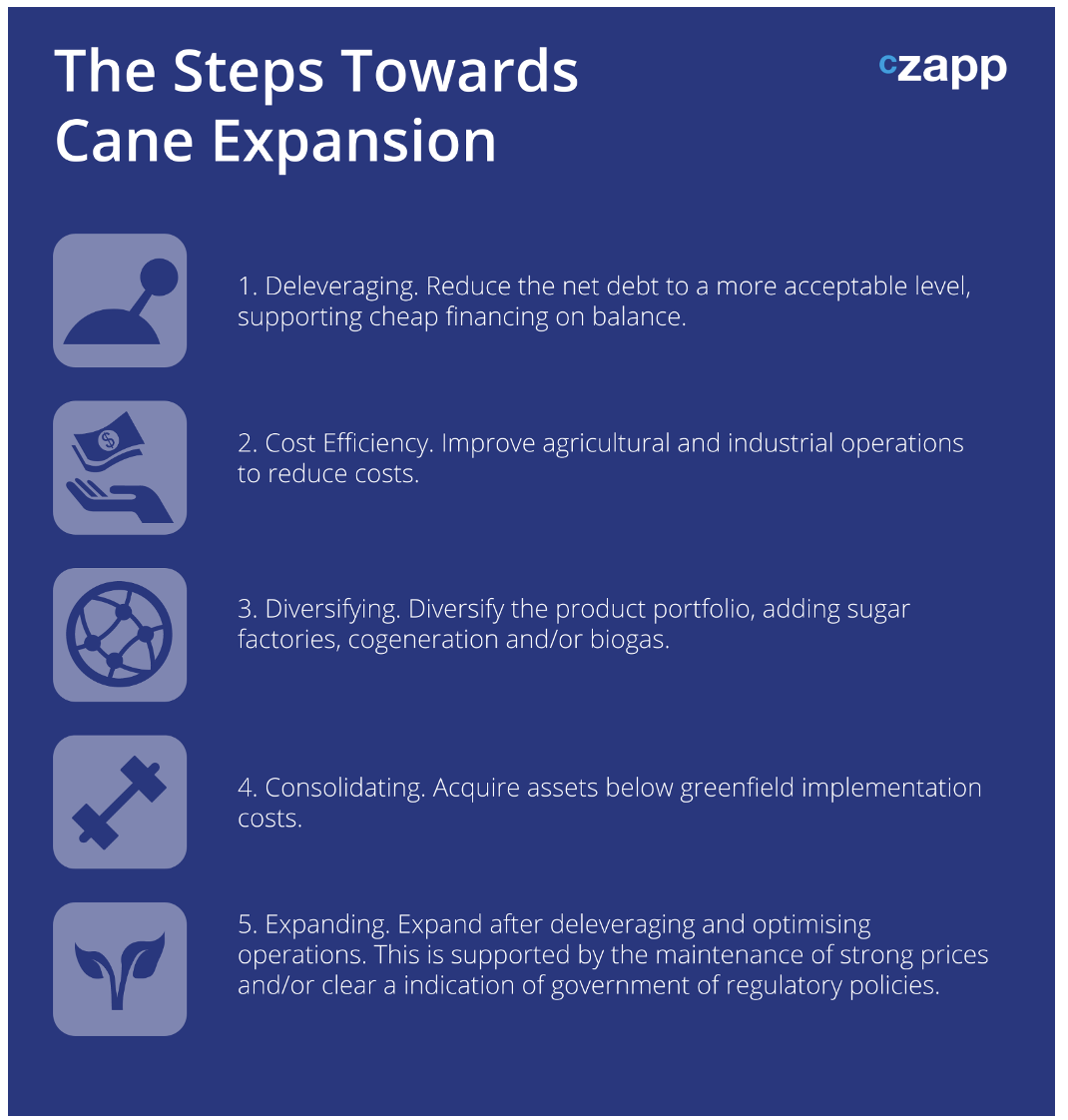

The first step the cane sector needs to take before even considering expansion is deleveraging.

With around 10 billion BRL of deleverage in two seasons, CS Brazil’s cane sector has finally been able to evolve here. The financial statements of many groups have seen an improvement in the past two years, which, in turn, makes it easier to attract fresh financing or roll current loans.

As seen above, there are more steps that must be taken before we see greenfields popping up across CS Brazil.

The second and third steps have been carried out as well in the past few years. CS Brazil’s cane fields’ health has improved, as agricultural practices, such as proper field maintenance and better planting practices, were listed as one of the priorities.

Marginal investments were made simultaneously to increase some of the mills’ crushing capacities, while others invested in adding sugar factories (distilleries), cogeneration and improvement of distillation processes.

Do bear in mind that CS Brazil’s cane industry is very diverse, so these investments highly depend on the profile of the mill/group.

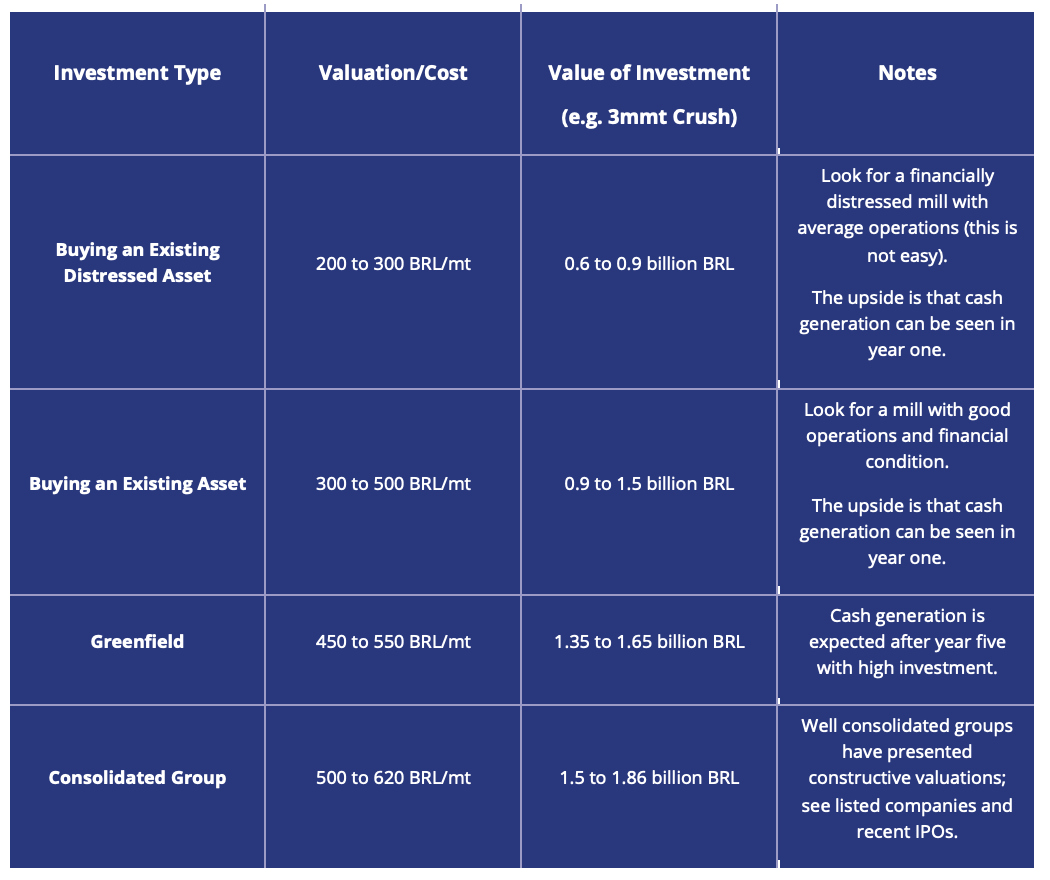

Step 4 has been the most interesting. At the start of the year, Raizen bought Biosev and had acquired the mills from Tonon group in 2017 as well. Buying distressed assets is still cheaper and faster than starting a new greenfield project.

Another possibility we’ve been hearing about is the reactivation of closed mills. Earlier in the piece, we mentioned that around 100 of CS Brazil’s mills closed in recent years. Some of them could reopen.

The Environment is Becoming Challenging

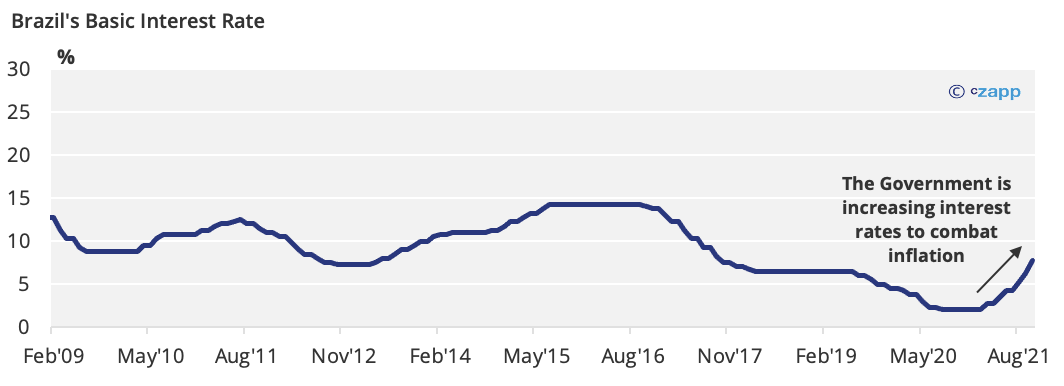

Although prices are offering excellent returns for mills, when looking into the environment for attracting fresh financing, things are becoming more challenging. Inflation is causing basic interest rates to increase, which makes financing more expensive.

Gone are the days when BNDES (National Bank of Development) had cheaper credit lines too. The institution is now offering the same rates as the private market; we saw finance for the sector being offered at yearly rates of IPCA (Inflation) +7%. So, this year, it would mean your debt has a yearly interest rate of over 17%.

Furthermore, when looking at new projects, the model requires a positive price outlook for the next five years. Remember from launching a greenfield project to turning a profit, there’s often a 5-to-6-year gap, depending on the market conditions.

Although we can see a constructive environment for sugar, can we affirm the same for ethanol? While RenovaBio brought a more defined role for sustainable fuels in the Brazilian energy matrix, some uncertainties lurk on the horizon.

At the moment, these uncertainties revolve around fuel distributors asking to alter the RenovaBio program, high fuel prices leading to discussions in creating a formula for Petrobras price readjustments, and even discussions in lowering the ethanol blend in gasoline.

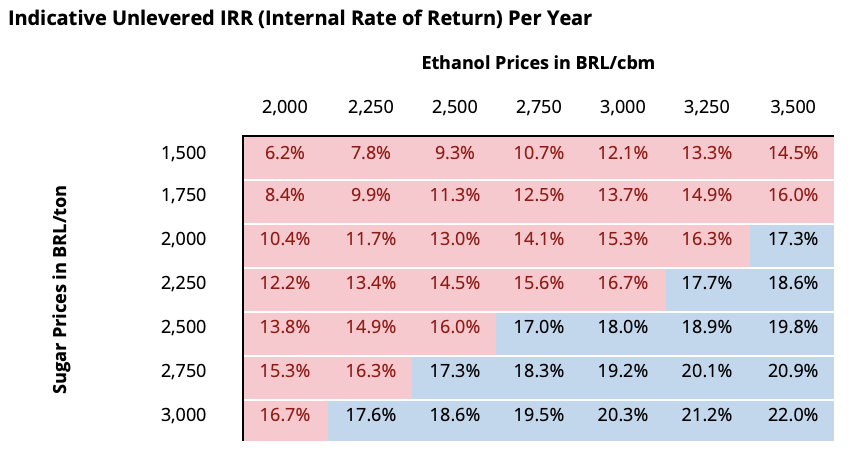

The table below shows a combination of sugar and ethanol prices that would yield a return attractive for investors. The blue area is where the attractive returns and price combination are.

Above, we demonstrate an indicative return analysis for a hypothetical greenfield investment in Brazil with a 3m tonne cane crushing capacity.

Our view is that potential investors would be willing to invest in projects that can deliver 17% plus unlevered IRR (Internal Rate of Return) per year, which requires sugar and ethanol prices to rise and sustain in the medium to long term.

Are we there yet? Theoretically, yes, but we’re only there when considering spot prices. The longer-term view for sugar is constructive and, assuming sugar returns remain above 2,600 BRL/mt, ethanol prices would need to be above 2,500 BRL/cbm. This is quite a stretch if we consider the uncertainties mentioned before, and the fact that this year marks the first time ethanol prices have surpassed this level as a yearly average.

Projects Are Under Way

The recent high prices have had an impact on projects that were long dormant.

Let’s firstly focus on Aporé Distillery, a project from Nardini Group, located in Goiás state. This project started in 2008 with the issuing of environmental licenses, formation of the cane field and 60% building of industry part (where the cane is crushed, and the product is made). However, the project was halted in 2012 and has been on hold ever since. Although construction was interrupted, they managed to keep the agricultural side running and have planted 10k ha of cane, which has since been supplying other mills in the region.

The project was restarted last month, and construction could begin again soon. The distillery should be operational in 2023. This greenfield project will start off as a distillery, and a sugar factory could be added in the future.

There’s another project that could be revived as well, located in Mato Grosso do Sul state. It began in 2009 and, although part of the cane field had been planted and 40% of the industry part was built, the company decided to stop work on the project in 2010 due to unfavorable market conditions. We’ve heard talk that the group intends to restart the project soon, though it will be resumed as a distillery initially and a sugar factory could be added later.

Other Insights That May Be of Interest…

The World Needs More Sugar…Who Can Help?

The World Needs More Sugar…Can India Help?

Explainers That May Be of Interest…