- The first ever surcharges on European PET contracts have been introduced to counter high energy costs.

- Resin spot prices are spiralling upwards on the back of low availability and production constraints.

- Will the New Year allow an opportunity to reset the current chaotic market?

Additional Surcharges Send Buyers into a Spin

“Welcome to the mad house”, one trader said, when talking about the PET market earlier this week. “…Everything from energy costs to logistics seems to be faltering”.

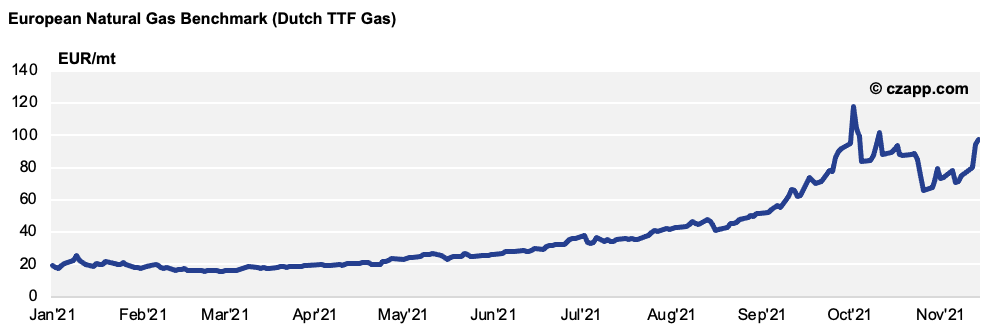

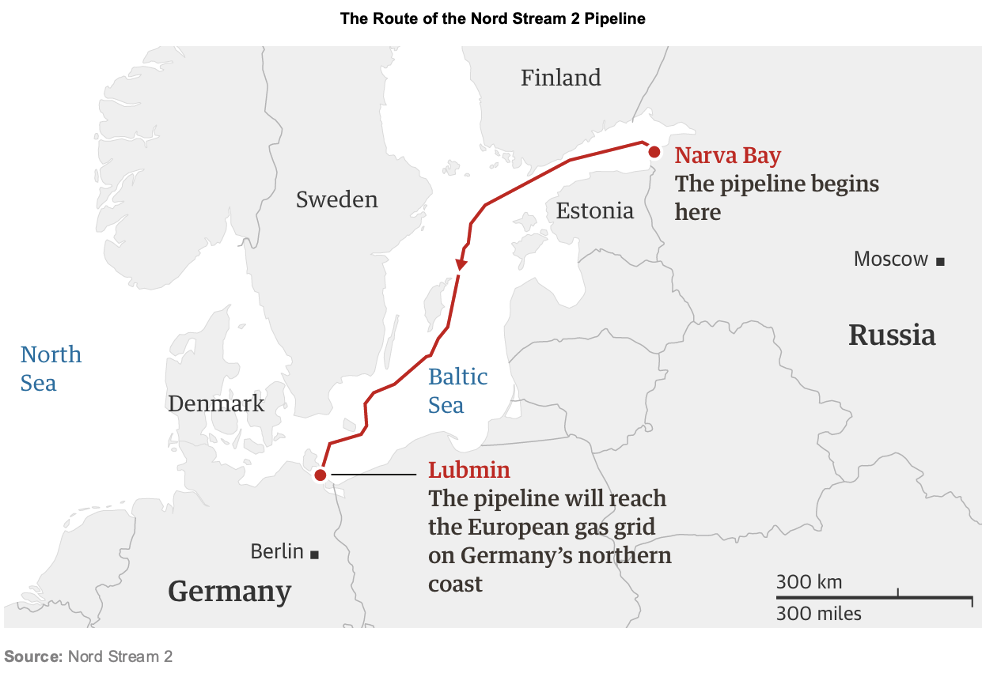

European gas prices have fallen sharply in recent weeks, and increased tensions at the Belarussian and Ukrainian borders, along with the subsequent suspension of the Nord Stream 2 gas pipeline have sent gas prices surging back upwards.

The Dutch Natural Gas contract, a leading European gas benchmark, has jumped over 38% in the last week alone. As a result, energy market experts are anticipating tight supplies and continued high costs, in addition to increased price volatility through the winter.

INEOS, Europe’s second-largest PTA producer behind Indorama Ventures, introduced a 150 EUR/mt energy surcharge on existing PTA contracts at the end of October, with other European PTA producers having followed suit. Alpek UK has also moved to introduce a 170 EUR/mt surcharge on PET resin for customers.

Although contract surcharges have become a common occurrence in the US market over the last couple of years, surcharges are far from normal in the European PET market and have never been applied in the past.

Other PET producers have already informed clients that they’ll be passing on these surcharges onto PET contracts for the remainder of 2021. However, this move is far from uniform and every producer is taking a different view and approach.

With high spot prices, customers have sought refuge from the open market by taking maximum contract volumes over recent months at lower prices compared to the spot market.

Additional surcharges on existing contracts that were negotiated at the start of the year have rattled the market at time when buyers are already concerned around 2022 supply security.

However, for buyers, dipping into the spot market now to avoid surcharges would be akin to leaping out of the frying pan and into the fire.

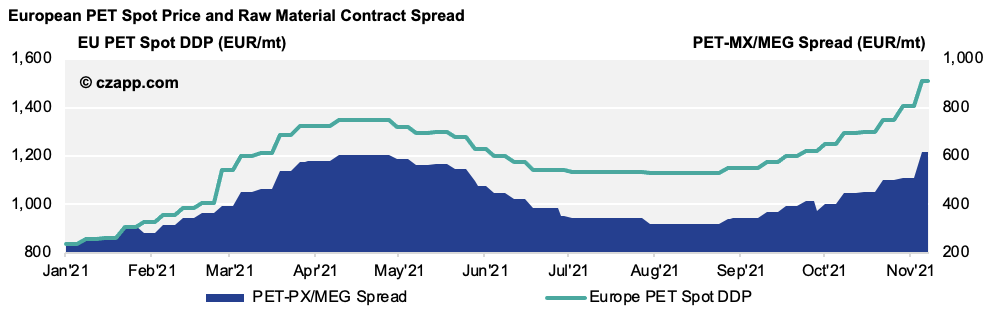

Even with a 150-170 EUR/mt surcharge, the difference between contract and spot prices continues to swell, although raw material costs for November are yet to fully settle.

PET spot prices continued to rally in early November and averaged around 1,535 EUR/mt, a massive 285 EUR/mt increase from just a month earlier, and 10-year high for the market.

Given the pace of change, and the different inventory position of producers, there’s a large spread between prices.

Some free negotiated prices, agreed right at the beginning of the month, were at lows of 1,450 EUR/mt, whilst by the 12th November, deals at 1,600 EUR/mt were becoming the norm.

Target prices for new bookings from some producers were higher still at 1,650 EUR/mt, indicating continued upward momentum in the near-term.

At the time of writing, the PX European Contract Price (ECP) for November was yet to settle; MEG ECP reached a final settlement for November at 990 EUR/mt, an increase of 45 EUR/mt from October.

Resin Availability Squeezed by PET Production Constraints

Whilst buyers continue to scramble for material, supply and availability is also being restricted by raw material supply constraints.

Most PET producers are close to sold out for the year, with availability at record lows. At this time of year, producers would traditionally have a full inventory ready for the new year.

However, availability for January deliveries already looks limited for some producers.

Alongside a continued lack of reliability and high freight costs associated with PTA imports, domestic supply has also been hit by an unplanned outage at PKN Orlen’s PTA unit in Poland.

As a result, Indorama Poland subsequently declared a force majeure on PET resin, shrinking regional resin supply further still.

It’s understood that the aim is to have both plants up and running by the end of November.

Will We See a Future Wave of Imports, Like in 2019?

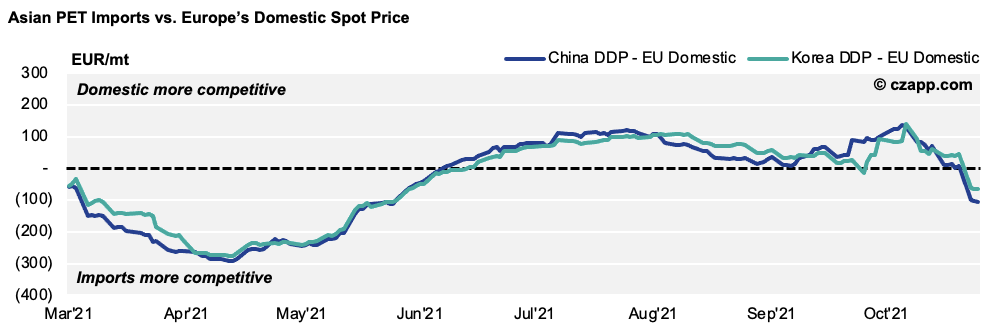

In normal times, with such a sharp rise in domestic prices, European PET producers may find themselves at risk of customers bringing in greater import volumes.

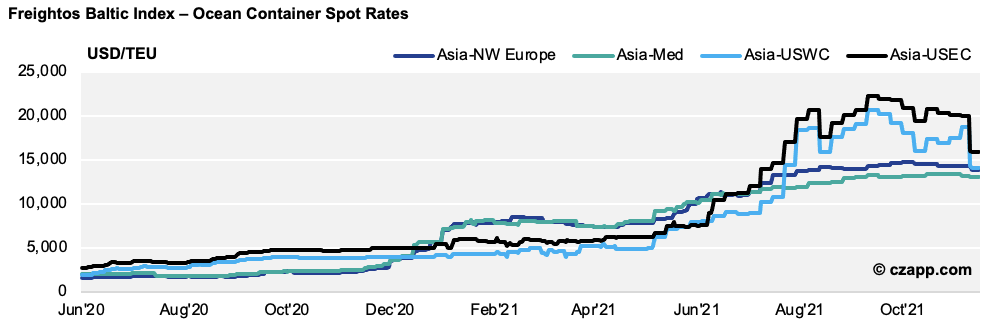

With Asian export prices having lost ground over the last 14 days, current FOB levels of 1,140 EUR/mt for China are increasingly competitive against European spot prices.

A repeat of the difference seen back in April this year between import and domestic PET resin, on a delivered basis, looks a likely scenario.

However, with many of the major brands now seemingly content with coverage and with some expressing a somewhat bearish sentiment on future freight rates, there seems to be some reluctance to purchase additional imports at present.

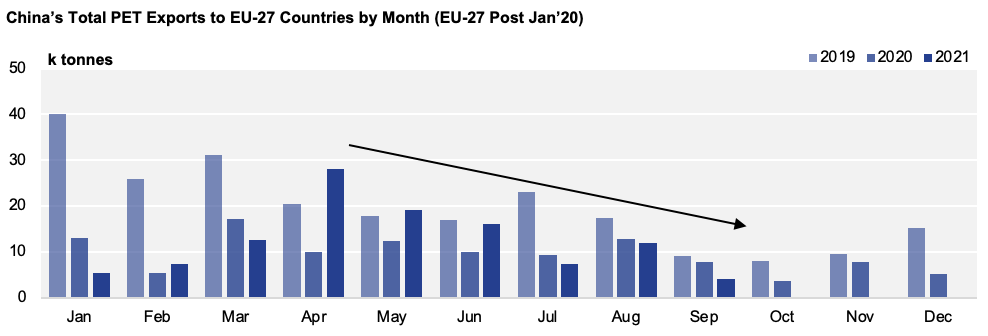

EU-27 import volumes during the three months to August were broadly on par with pre-pandemic levels, up 0.8% compared with the same period in 2019.

Chinese export volumes to EU-27 countries have slumped, down 52% over the last three-month period versus same period in 2019 (pre-COVID).

Although Chinese PET producers are seeing good export demand, availability is also constrained following the impact of the ‘duel control’ energy curbs, with many producers lacking additional material for 2021 shipments.

Therefore, despite increasing competitiveness of imports, there’s little evidence to suggest large volumes of imports are heading to Europe.

Will 2022 Offer the PET Market a Chance to Reset?

Many of the recent surcharges should be short-term. With contracts expiring at the end of the year, buyers hope they’ll be shed, offering a much-needed reset.

Contract volumes on the traditional annual ‘cost-plus’ formulae in 2022 should be significantly reduced. Most producers have indicated that they’ll move almost entirely to a freely negotiated market, settled on a monthly or quarterly basis (as reported last month).

Over the last three years, spot prices have averaged just 60 EUR/mt higher than contract prices.

So, although a free market may add additional monthly volatility for buyers, averaged costs over the mid-term will likely show little difference.

Unlike the current raw material formulae, based around monthly settlements of PX and MEG, a freely negotiated price would enable producers to factor in all costs.

Buyers could face increased near-term pain though with an escalation in domestic PET resin spot prices over the next couple of months.

Other Opinions You Might Be Interested In…

- Europe’s Energy Crunch Causes Chaos for PET

- Production Outages Harm Americas’ PET Supply

- European PET Market Set for Major Price Correction

Explainers You Might Be Interested In…