- European buyers are scrambling for PET resin supply as producers sell out.

- As energy prices surge, uncertainty over next year’s costs lead producers to withhold firm 2022 offers.

- Could we see a change in European raw material and PET contract arrangements?

Buyers Scramble for Supply Amid Contract Chaos

The European PET market is on fire.

In what would traditionally be the slowest part of the year, buyers are scrambling for material with most domestic PET producers sold out for at least the next two months (some through to year-end).

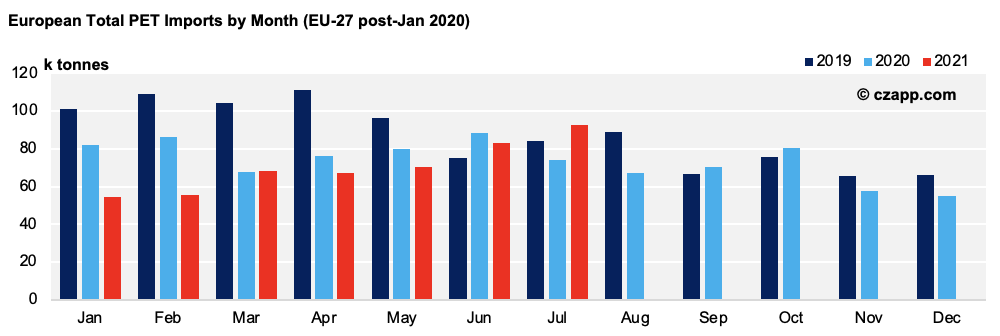

Whilst European end-consumer demand has slowed as seasonality takes effect, the combination of sizable export volumes over the last couple of months and a slowdown in the volume of imported material, means available PET resin is in scant supply.

Contract discussions for next year have also been thrown into chaos, with few producers willing to give firm indications on 2022 contracts or offer fixed prices for Q1.

With Asian and European prices now rising sharply following the Chinese National Holiday, buyers have been left panicked and exposed to a volatile spot market. They are spooked, desperately sourcing available resin, whilst continuing to take maximum contract volumes. Spot buying has been described as intense, with customers building stock and filling warehouses for the early part of next year.

Although most producers are operating at close to full capacity, planned maintenance shutdowns over the next few months will continue to squeeze supply availability.

JBF (432kmt) concluded maintenance in the first week of October, but Spanish producer, Novapet (260kmt), has scheduled a six-week shutdown until the end of November. Indorama (426kmt), the largest European PET producer, will also see scheduled shutdowns in the Netherlands through December and further scheduled maintenance at some of its other plants through Q1’22. Equipolymers in Germany (335kmt) is planning maintenance in December as well.

Note: See this Explainer for more information on global PET resin production.

To put the supply situation into perspective, one producer described having the lowest inventories ever, potentially setting up for very precarious first half of 2022.

PET Spot Prices Surge in Europe

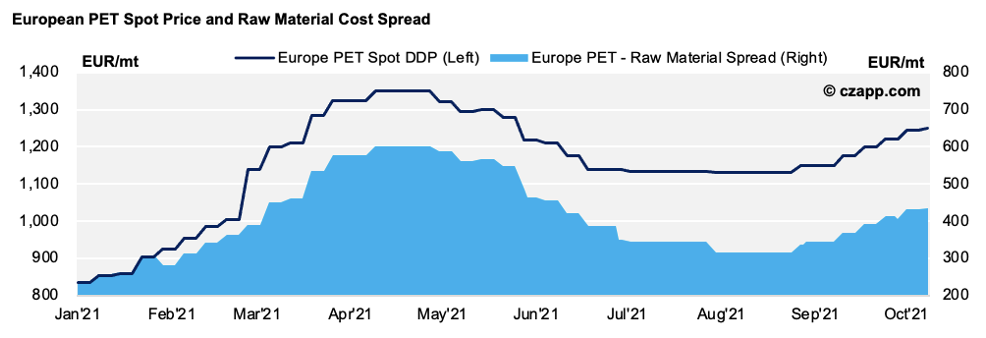

At the time of writing, PET spot prices held their upward trajectory in early October and averaged around 1,250/mt. This is a 100 EUR/mt from the early part of September. Higher prices in excess of 1,300 EUR/mt were heard in some European markets where producers lacked availability and markets continued to see limited imports.

Given the tight market and the rise in Asian export prices, expectations amongst producers are for prices to average at least 1,300 EUR/mt in November.

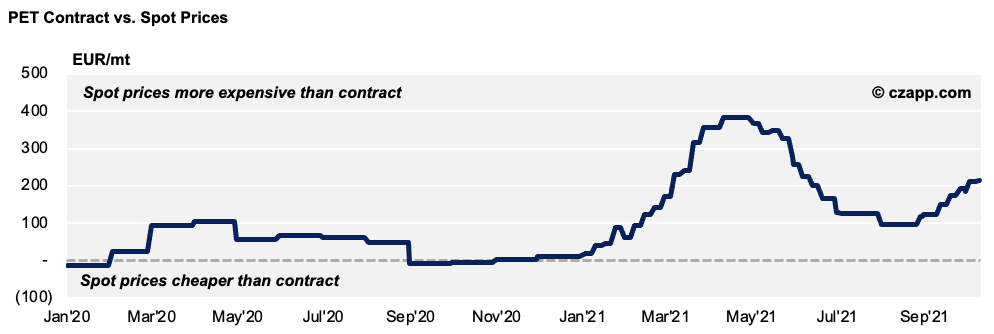

With European spot PET prices rising, the delta between contract and the open market has increased once again. At present, contract prices are trading at around a 210 EUR/mt discount to spot PET prices. However, with energy costs having risen sharply over the last few months, some producers are seeing contract sales below current production costs.

This year has laid bare the faults in a pricing system many have deemed to be broken for a long time, potentially creating a catalyst for change in European PET pricing.

2022 Contract and Production Cost Uncertainty

With a lack of understanding around the future cost base, and with producers unwilling to risk offers on a formula or fixed price basis, the market finds itself at a fork in the road.

Traditional raw-material contract formulae have been on a rocky road for several years but there’s been little coherent strategy around alternatives. Next year’s looking a little different; INEOS, a major European raw material supplier, is reportedly considering an announced monthly PTA contract price for Europe, something that would enable producers an easy switch in PET contract formulae. However, change takes time, and a PTA ACP won’t likely be ready for a 2022 start.

For the first part of next year, much of the volume that would have traditionally been contracted on an annual basis will likely be settled through monthly free negotiations. The idea of a separate European PET ACP has also been floated through the industry over the summer months.

Cost of Production Breakdown

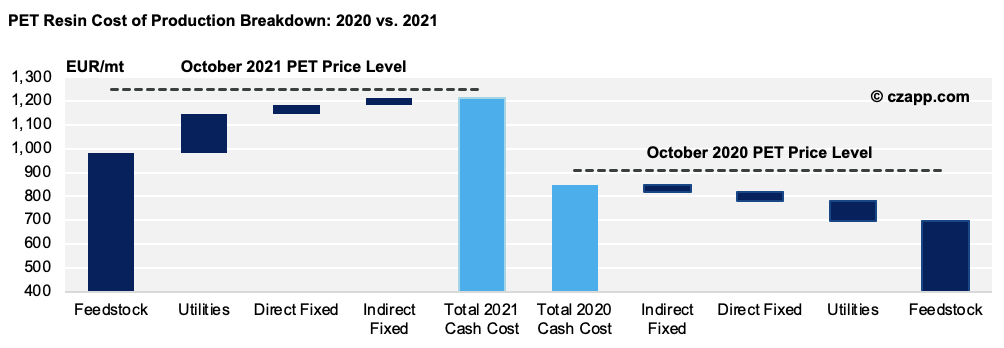

Whilst raw materials represent just over 80% of the total cost of production for PET, utilities and other variable costs are an important contributor to overall process cost. Over the last 12-months, estimated utility costs have doubled, increasing by around 80 EUR/mt based on a 300k tonne plant.

Although the spread between raw material cost and the PET spot price has widened, the increase in energy cost has shrunk spot margins considerably.

Smaller capacity plants and those lacking backward integration into raw materials will be most exposed to the energy price squeeze and narrower margins. As such, it’s unsurprising that few producers are willing to offer for 2022 without getting a clearer understanding of next year’s cost base.

Will Buyers Load Up On Imports?

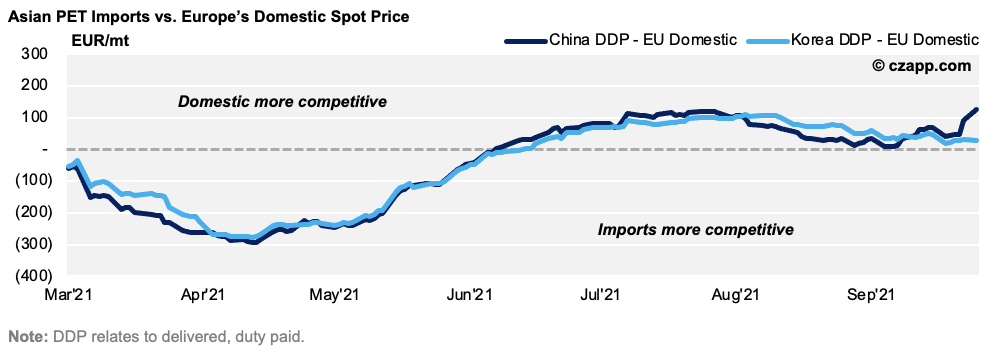

Faced with difficult and uncertain supply decisions within Europe, some buyers are pushing to secure greater imports from Asia. With the recent energy price rises in Europe, some have even questioned whether European material can remain competitive versus Asian resin.

However, based on spot container freight, European resin is still more competitive than imports on a delivered basis, despite the strength in domestic PET prices.

Availability and reliable scheduling of imports is also a risk, as Europe is not the only region to be experiencing a supply crunch. Across China and the rest of Asia, stocks are also low.

Large export volumes to the Americas, as well as shutdowns and production constraints have limited supply, with some of China’s largest producers already close to sold-out for the year.

Although interest in bulk shipments has also peaked, few operators can provide such a service and successfully deliver to a fragmented European customer base. As such, bulk shipments are unlikely to move the market in Europe. However, break-bulk is playing a much greater role in transpacific supply, and currently contributing to a lack of supply within Asia.

Will Today’s PET Supply Crunch Create a More Volatile 2022?

Expectations are for major European producers to seek alternatives to the traditional cost-plus contract, with H1’22 seeing more monthly free negotiations.

Due to the supply crunch, buyer panic may be difficult to manage ahead of the new year and Q1 could be painful adjustment period given the many uncertainties.

With producers with record low stocks, Q1’22 supply will continue to be scarce with little chance for an inventory build.

Improved post-COVID demand next year amid a lack of supply could create a volatile H1’22 spot price environment as buying pressure builds from March. Spot prices could be unforgiving in the event of any future unplanned outage.

Other Opinions You Might Be Interested In…

Explainers You Might Be Interested In…