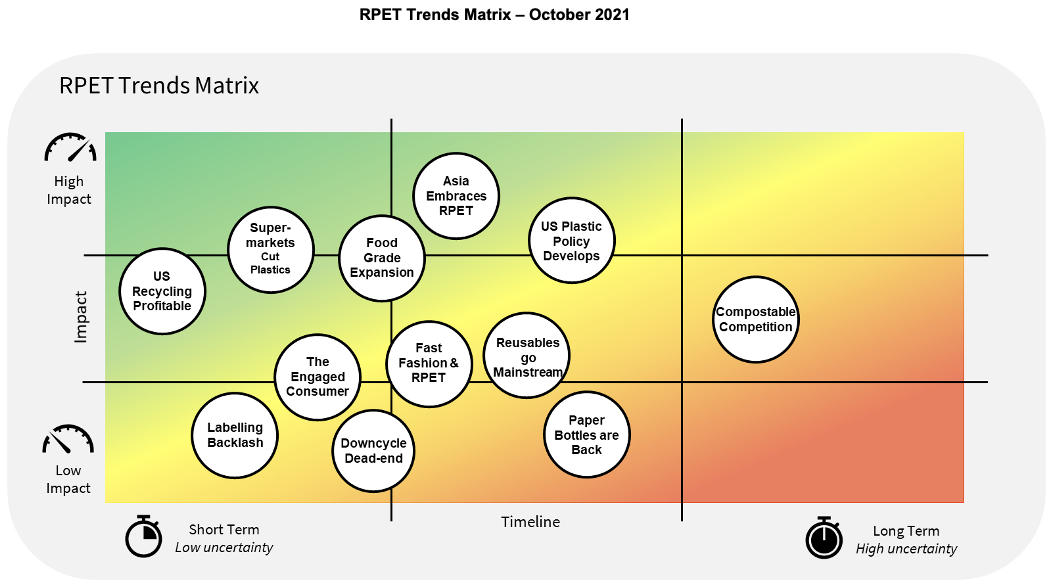

Scanning for Trends: Filter, Identify, Prepare

- Confronted with a chaotic world overloaded with data and information, it’s often difficult to cut through the noise and identify relevant industry trends. More so, to identify those trends early on.

- The RPET Trends process allows readers to identify potential disruptions, or opportunities, ahead of time; to anticipate and prepare for potential future shifts in industry dynamics.

- Every month, we’ll filter and analyse the latest recycling market information (see Czapp’s PET News Feed) and identify interesting and relevant market trends and patterns.

The Trends Matrix below shows those market changes that we believe deserve greater attention. Full articles covering each of the key trends will follow through the month.

This Month’s Top Trends

Asia Embraces Recycled Packaging for Food Contact

- More Asian countries are revising their stance on the acceptance of recycled plastics into food contact applications.

- India and Korea have both amended food packaging standards and the use of food-grade RPET is a hot topic within China.

- Asia is the largest and fastest growing consumer of commodity plastics like PET.

- Growing acceptance of food-grade recycled plastics within Asia would be revolutionary for demand as well as investment into food-grade RPET production.

Click here to read the related article >>>

Reusable Packaging Goes Mainstream

- Reusable PET beverage bottles have seen increased use within Latin America and African markets in recent years.

- The use of refillable containers within more mature markets, such as Europe and North America, is still very limited.

- Large supermarket chains, from the UK to Australia, are now expanding trials of reusable containers across a broad set of products.

- Could we see PET demand destruction, or will consumers refuse reusables due to lack of confidence on health and safety?

Click here to read the related article >>>

Supermarkets Bid to Ditch Plastics

- European households spend 13% of total expenditure (on average) on food and non-alcoholic beverages, with large supermarket chains and grocery stores being the primary outlets.

- Carrefour, Morrisons, and Lidl, have all recently taken affirmative steps to reduce plastic packaging.

- In addition, Spain will ban the sale of fruit and vegetables in plastic containers from 2023.

- Changes in material choices within supermarkets will have a large say in shaping the future of the packaging market.

Click here to read the related article >>>

US Recycling Profitability Returns

- Recycling revenues are roaring back across the US with strong demand for plastics and other packaging materials.

- US recyclers have faced a lack of profitability in recent times, with collection rates stalling due to COVID and an increase in recyclable waste sent to landfill; many have faced bankruptcy.

- Increased investment into recycling infrastructure, from sorting to processing, is now returning revenue as a post-COVID sustainability boom takes off.

Click here to read the related article >>>

Compostable Competition

- With on-the-go food outlets gearing up for an increase in post-COVID commerce, sustainability and compostable packaging is back on the agenda.

- Despite a lack of regulatory support within Europe, recent consumer surveys point to large public support for composable packaging over traditional plastics.

- Whilst in the US, proposed legislation across several states is targeting a switch to compostable or recyclable within single-use items.

- Do compostables really represent a challenge to future PET demand growth?

Click here to read the related article >>>

Other Opinions You Might Be Interested In…

- RPET Trends: Tackling Hard-to-Recycle Plastics

- RPET Trends: US Plastics Regulations Gain Momentum

Explainers You Might Be Interested In…