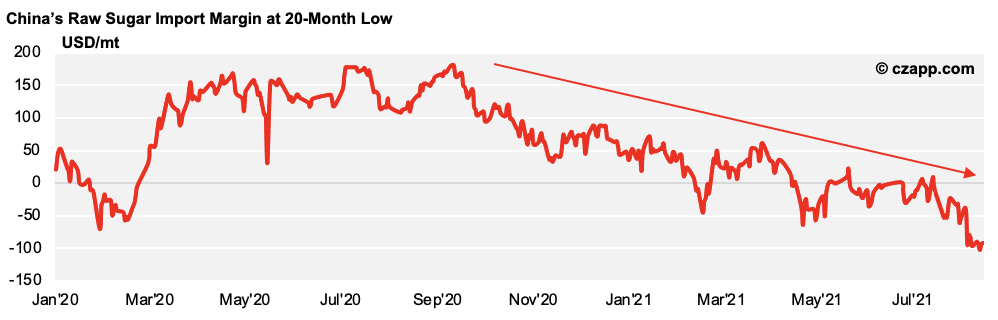

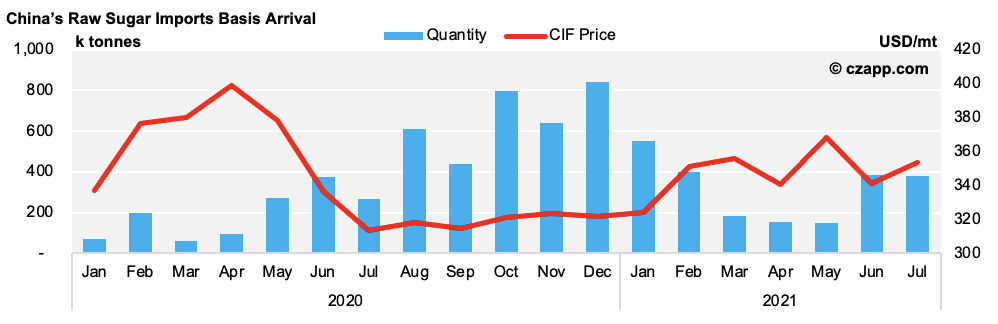

- China’s raw sugar import margin is the poorest it’s been since December 2019.

- High raws prices and costly freight have weakened refiner returns.

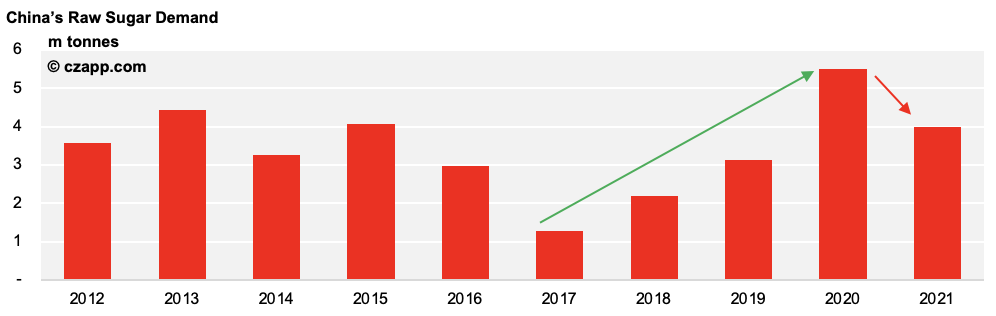

- China could therefore import 1.5m tonnes less sugar than it did in 2020.

China’s Raw Sugar Import Margin Hits 20-Month Low

- It’s unprofitable for Chinese buyers to import raw sugar at today’s prices.

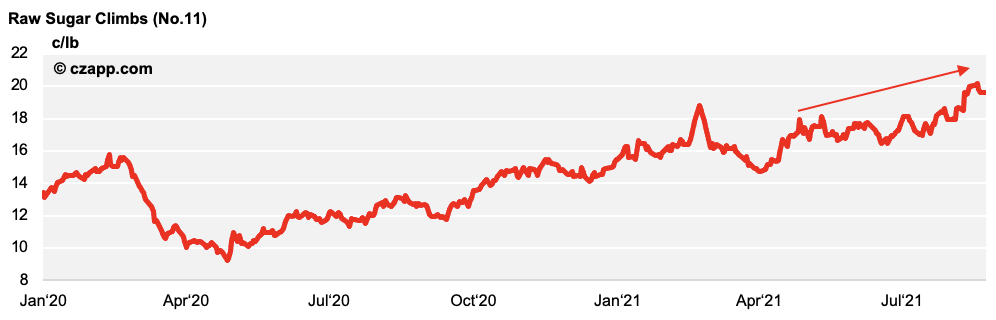

- The climbing No.11 and expensive freight have weakened returns.

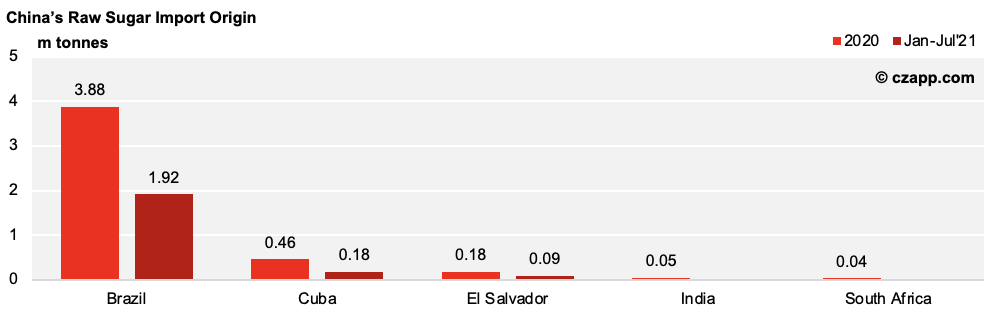

- We therefore think China will import just 4m tonnes of raw sugar in 2021, down 1.5m tonnes year-on-year.

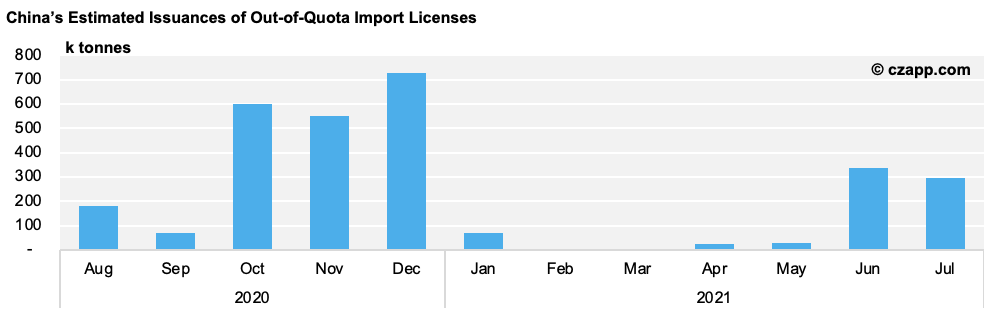

- This drop is largely fueled by the poor margins on offer, but also comes as the Ministry of Commerce refused to issue out-of-quota import licenses until May.

- It was worried cheap imports during the crush (December to May) would weaken the mills’ sales; China’s mills produce low-quality whites from domestic cane and beet, whilst the refineries import and refine raw sugar.

- By the end of July, the refineries had imported just 760k tonnes of out-of-quota sugar, down 240k tonnes year-on-year.

Could China’s Demand Improve?

- If the No.11 drops below 18c/lb and the import margin re-enters positive territory, China could import up to 500k tonnes of raws.

- This is because the refineries will want to fully utilise their out-of-quota import licenses.

- Having said that, the 2.2m tonnes of raws they bought between January and July was purchased when prices sat below 14c/lb (vs. 19.58c/lb today), so it’ll still be expensive.

Where Will the Sugar Come From?

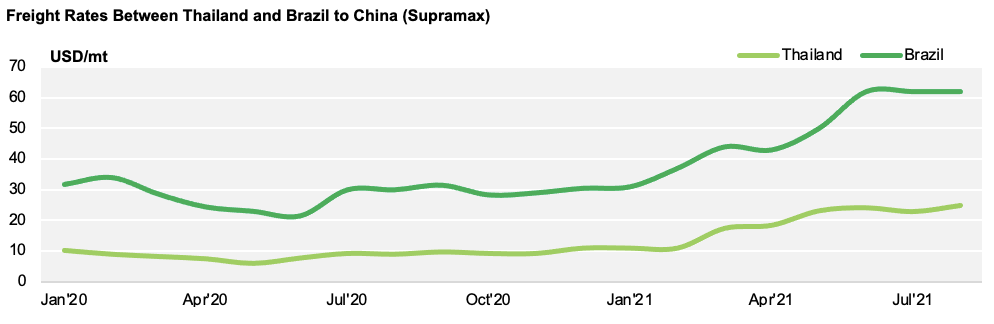

- 87% of China’s raw sugar has come from Brazil this year, even though freight costs for that route surged from 30 USD/mt in January to 69 USD/mt in July.

- We think Brazil will remain a key supplier as it is still a cheaper option than Thailand.

- Thai freight rates have more than doubled since Jan’20 (now at 25 USD/mt), and the physical values for Thai raws are also 200 points over the No.11, whilst Brazil’s are 30 points under.

Other Opinions You May Be Interested In…

Explainers You May Be Interested In…