Opinion Focus

- European PET demand has been strengthening since July.

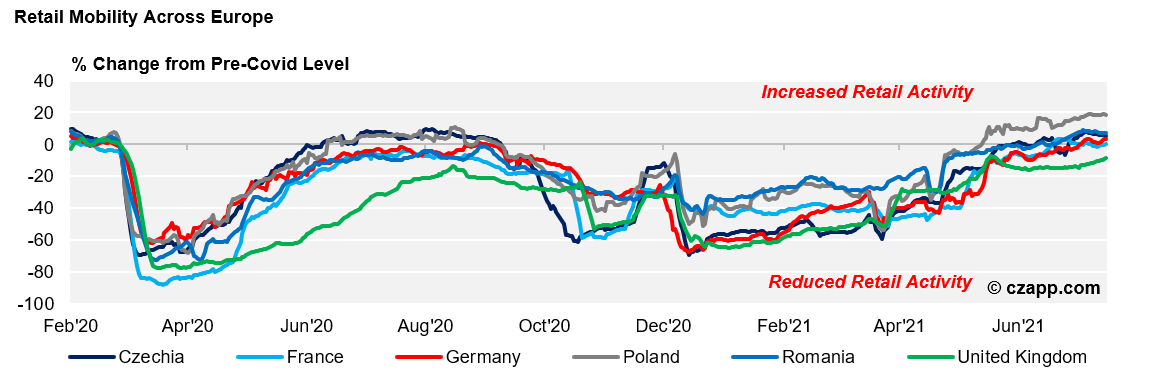

- Warmer weather and loosening COVID restrictions have helped here.

- Flooding in parts of Northwest Europe did cause logistical problems, however, but buyers are still shopping local.

Warm Weather and Loosened COVID Restrictions Boost European PET Demand

- PET producers and preform manufacturers across Europe have reported strong sales for July and August.

- Warmer weather and increased social mobility have boosted resin and preform sales.

- Flooding in parts of Northwest Europe has, however, caused logistical challenges with damage to rail infrastructure and a shortage of trucks and drivers.

- With rPET pellet prices at around 50% above virgin prices, a premium close to 600 EUR/mt, producers are once again seeing increased interest from thermoformers seeking to make the switch back to virgin.

- Disruption to Trans-Siberian shipments coming out of Northern China has also led to a flurry of large enquires from buyers in Russia and Ukraine.

- Nestlé and Danone reported first half sales at the end of July, with progressive improvement through Q2 and growth within their water businesses.

- Increased consumer mobility through the Q2 also prompted a rebound in out-of-home beverage sales, with Danone reporting 60+ per cent growth within the small format water bottle category, a market segment that was amongst the hardest hit by COVID.

- Within Europe, Nestlé reported strong sales performance in Eastern and Central Europe, affirming our previously reported mobility data.

- However, despite the impressive figures, beverage sales were still down versus pre-COVID times, with Danone’s water sales down 8.5% from the same period in 2019.

PET Prices Remain Stable as Buyers Stay Local

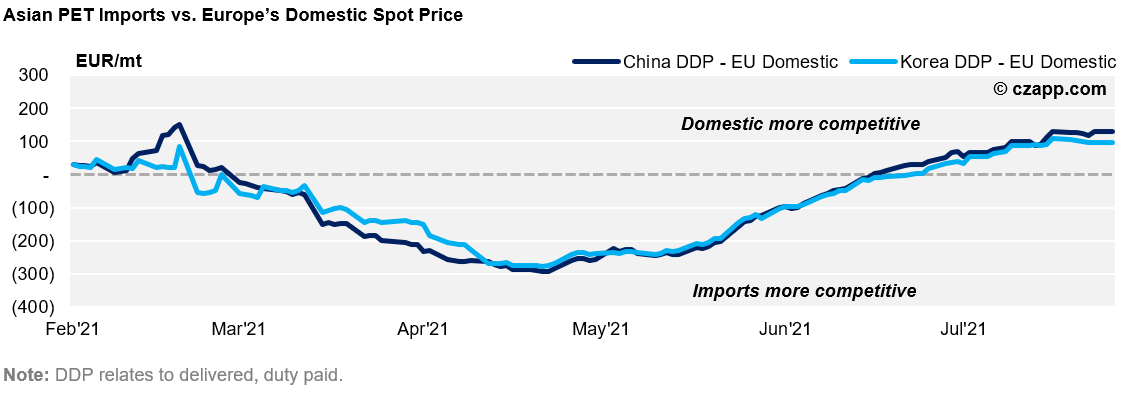

- With Asian imports effectively off the table due to their lack of price competitiveness and poor schedule reliability, European producers have held firm on prices.

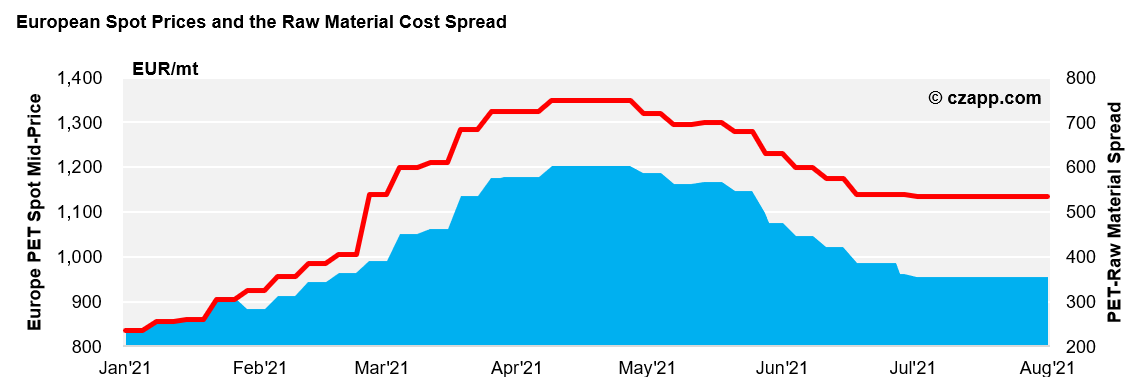

- At the start of August, domestic spot prices averaged between 1,120-1,170 EUR/mt, rolling over from the previous month.

- Even with domestic prices running at a discount to import parity, many producers are wary of forcing price rises that may catalyse a future spike in imports, as was seen in 2019.

- Given the many challenges the industry has faced over the past 18 months, market share retention is a clear priority for European producers going into the off-season.

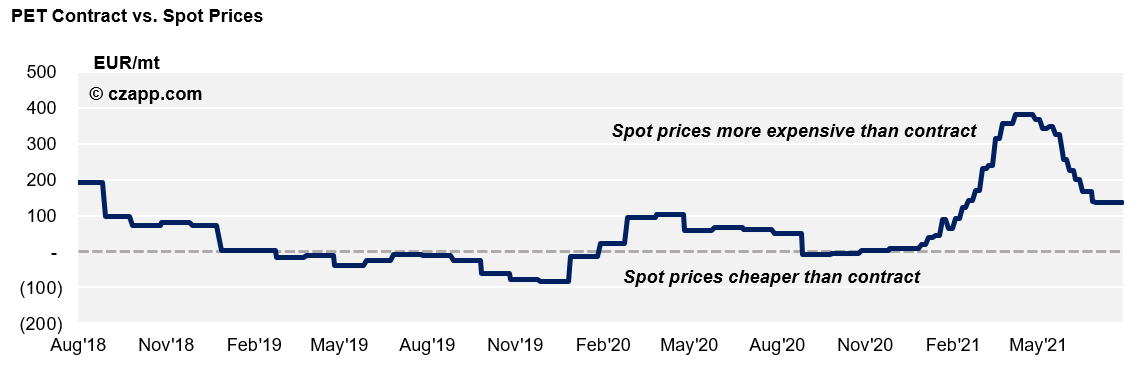

- Despite much of the drama surrounding spot market volatility, spot sales represent only around a third of the total market, with most production sold on an annual contract basis.

- Contracts are typically based on a raw materials formula, market index, or combination of both.

- Over the last year, the market has experienced a major deviation between the raw material cost position and spot market prices.

- Therefore, despite the surge in spot prices and associated margins, most customers have been able to benefit from substantially lower contract prices on a large proportion of their overall requirements.

2022 Contract Discussions

- Although 2022 contract discussions will not begin in earnest until October time, suppliers and buyers are once again looking to their future positions.

- Given the large spread between contract and spot prices, some producers are already discussing significant increases on next year’s formula adder.

- On the other side of the negotiating table, multinational beverage brands have already secured substantial forward volumes at very large discounts to current Asian FOB pricing as Chinese export demand comes under pressure.

- With Europe being a net importer of PET resin, and the many challenges with import reliability and price competitiveness, momentum seems European sellers’ side at this stage of the year.

- As a result, it’s possible we’ll see buyers decide to lock-in greater domestic contract volumes in 2022 versus previous years.

European Producers Are Well Positioned if Future Lockdowns Are Avoided

- Going into September demand should be slow, following typical seasonal patterns, and without the levels of tourism needed to sustain a longer peak season.

- Even in the absence of imports, European producers could well face increased competition in a shrinking spot market.

- However, scheduled maintenance through September-November will reduce output and help balance the market.

- Increased pre-buying in Q4 could also help compensate weaker demand in the off-season.

- Further lockdowns in Q4 are still a major risk factor that’s far from off-the-table.

Other Opinions You Might Be Interested In…

Explainers You Might Be Interested In…