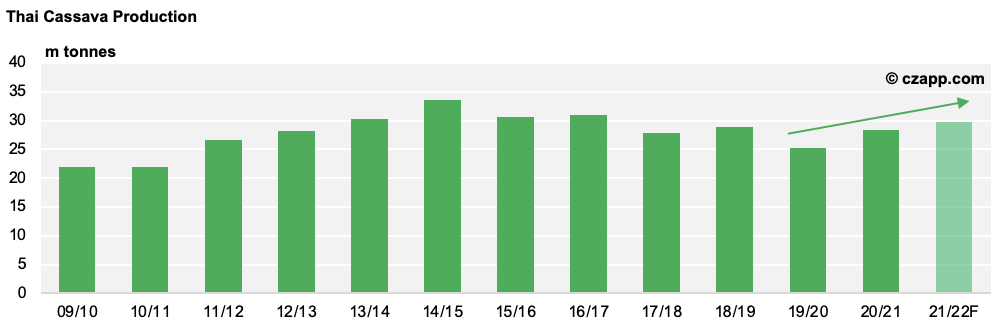

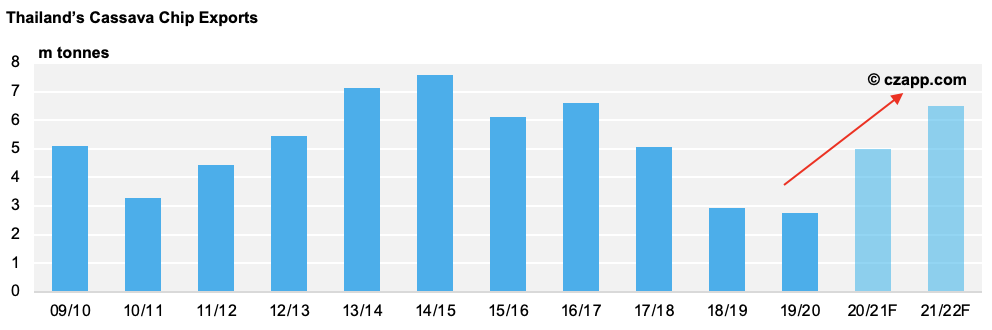

- Thailand should produce 29.7m tonnes of cassava in 2021/22, up 5% year-on-year.

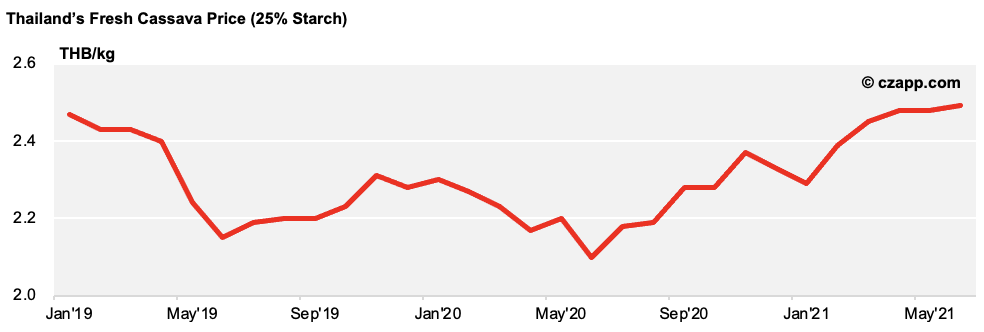

- Hefty demand from China’s ethanol producers has driven the price up.

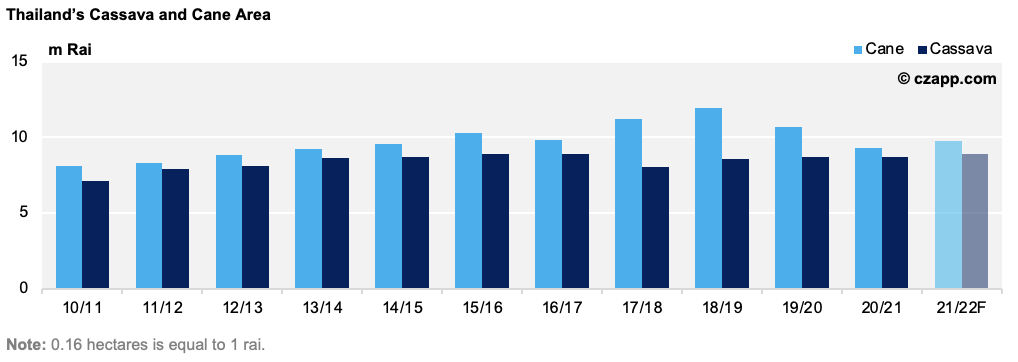

- This could strain logistics, however, with cane production set to rebound.

Thai Cassava Production to Increase in 2021/22

- We think Thailand will produce 29.7m tonnes of cassava in 2021/22, up 1.4m tonnes (5%) year-on-year.

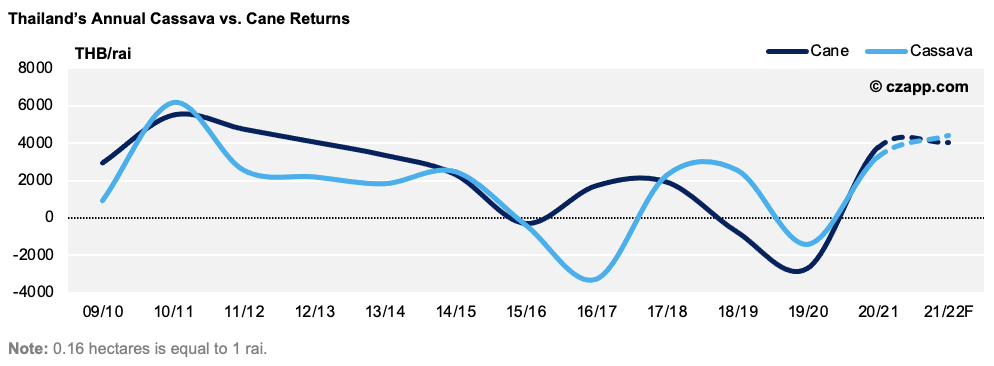

- This is because the annual returns for both crops are extremely similar (4,410 THB/rai for cassava vs. 4,047 THB/rai for cane).

- The cassava price is also increasing on the back of strong Chinese demand.

- China’s ethanol producers plan to use cassava chip as a feedstock, with corn being used to feed its growing pig herd.

- We currently think China will import 6.5m tonnes of Thai cassava chip in 2021/22, up 1.5m tonnes year-on-year.

Can Thai Logistics Handle This?

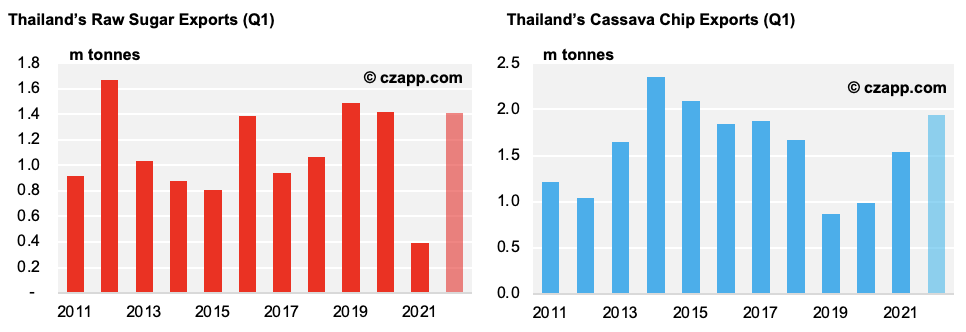

- We think Thailand will export a large volume of cassava chip (1.9mmt) and raw sugar (1.4mmt) in Q1’22.

- The two products could therefore face heavy competition in a logistical sense as well, as they’re both moved from A (mill/factory) to B (warehouse/port) using the same trucks and barges.

- This means producers must be well-organized in 2021/22, especially in the Northeast, the key production region for both.

- If they’re not, shipments could be delayed as truck and barge wait times lengthen.

Other Opinions You Might Be Interested In…

Explainers You Might Be Interested In…